The FOMC Minutes for February will be released today. It will show how many members bet on a significant increase in interest rates at the latest meeting and whether they foresaw the need to raise rates higher than previously planned to contain persistent inflation.

Still, it is important to understand that the meeting was held in early February. A pile of fundamental statistics revealing strong economic growth and labor market came afterward. In fact, the labor market is still overheated, which creates unnecessary inflationary pressure in the country. Yesterday's business activity data for the service sector became another proof of the expansion of the US economy at the beginning of this year.

Anyway, the US central bank will deliver the Minutes tonight. As a reminder, at the February meeting, the officials unanimously voted for raising rates by only a quarter of a percentage point. It was a modest rise from their half-point advance in December after four successive 75 basis point increases. So, the Fed's key interest rate was lifted to the 4.5%-4.75% range after the announcement.

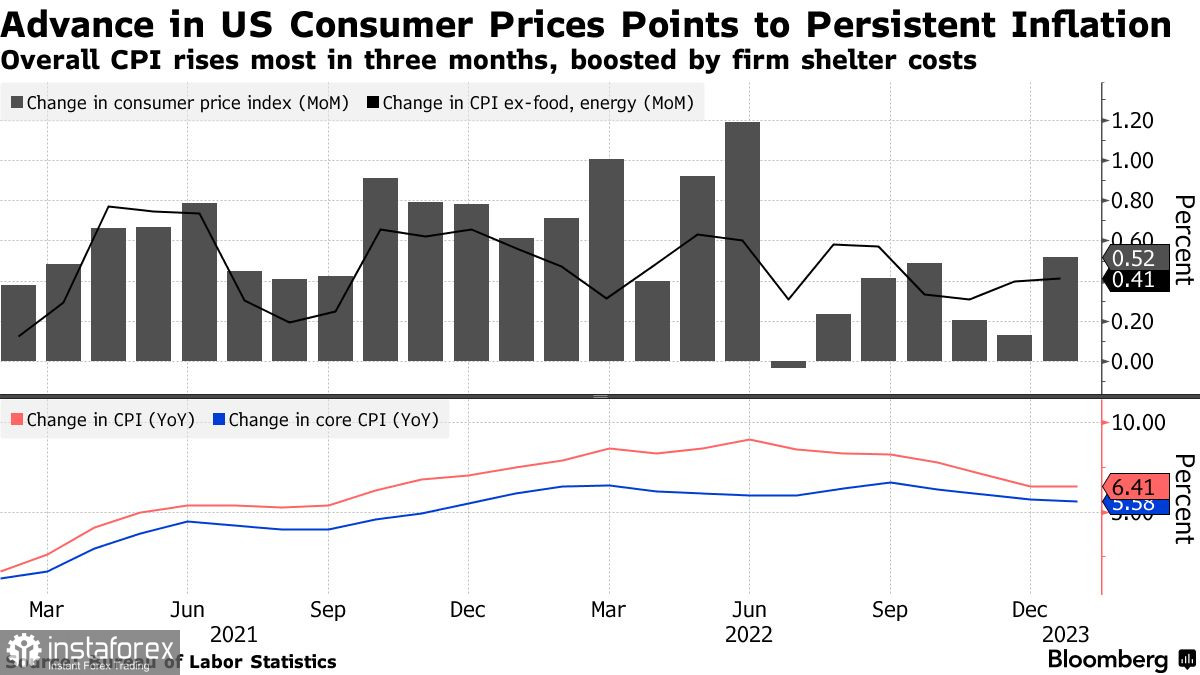

The pace of future rate hikes will depend on a number of factors, including the state of the labor market, the overall health of the economy, and inflation. In fact, consumer prices keep slowing down faster than expected. However, should the Fed pause or end tightening earlier than expected, which would certainly help avoid a more serious blow to GDP in the future, forecasting inflation could become difficult. Its acceleration will be more damaging to the economy than short-term increases in interest rates by the central bank.

Last week, two hawks – Cleveland Fed President Loretta Mester and St. Louis Fed President James Bullard – said they saw grounds for another 50 basis point hike at the next meeting and that such larger moves should still be considered.

Today's Minutes will provide insight into whether these two policymakers, who do not vote on monetary policy decisions this year, were the only hawks. More recently, Richmond Fed President Thomas Barkin opposed the possibility of bigger hikes, saying a 25 basis point hike would give officials more flexibility.

If today's Minutes show a more aggressive stance, the US dollar will highly likely continue to grow in the short term, and the pressure on risk assets will increase again. Consequently, we will see EUR/USD and GBP/USD reach new lows.

The EUR/USD pair is still feeling the pressure. The bear market will stop once the quote breaks above 1.0660, targeting 1.0720, 1.0760, and 1.0800. If the price goes down, the bullish activity may increase near 1.0615. Otherwise, it will become possible to open long positions after the pair reaches the 1.0565 low.

The bear market on GBP/USD ended. The bulls should go above 1.2140 in order to consolidate. In case of a breakout through resistance, the price may rise to 1.2215, targeting 1.2265. If the bears take the 1.2065 level under control, the pressure on the pair may return. A breakout through the range will push the GBP/USD pair back to 1.1980, with the target at 1.1920.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română