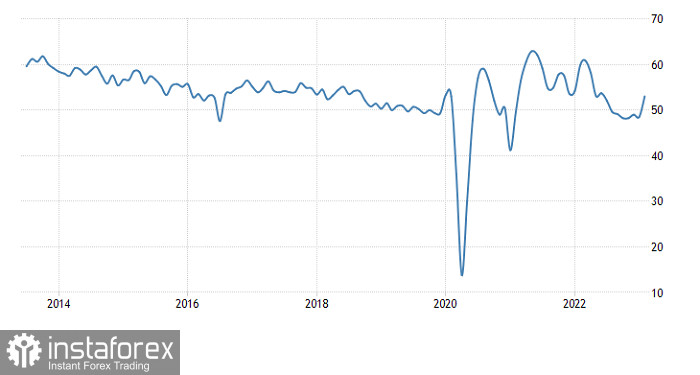

GBP/USD showed strength yesterday after the release of preliminary PMI reports, which by the way came better than expected. Thus, the manufacturing PMI rose to 49.2 from 47.0, beating market expectations of 47.5. The services PMI surged to 53.3 versus 48.7, well above forecasts of 49.3. Meanwhile, the composite reading advanced to 53.0 from 48.5, above the projected 49.2. Clearly, the pair grew afterward although with some delay. Investors seemed astounded by the results at first, so it took their reaction some time to follow.

United Kingdom Composite PMI:

In fact, the pair stayed firm despite better-than-expected business activity statistics in the United States, except for the one in the manufacturing sector. Although the manufacturing PMI was estimated to surge to 49.0 from 46.9, it actually increased to 47.8. The services PMI surged to 50.5 from 46.8, beating market forecasts of 48.9. The composite index grew to 50.2 versus 46.8, well above the expected 48.9. It is highly unlikely that a somewhat weaker increase in the manufacturing PMI could have had such a strong impact on the situation. However, if we take into account a 0.7% fall in existing home sales instead of a 1.4% rise, the picture gets clearer. In the United Kingdom, all the indices came higher, while in the United States, they came mixed.

United States Existing Home Sales:

In addition, the greenback is still overbought. On the back of an empty macroeconomic calendar, that could serve as a restraining factor for the dollar. In fact, the currency may even go down in price. In other words, GBP/USD is likely to consolidate near the current levels today.

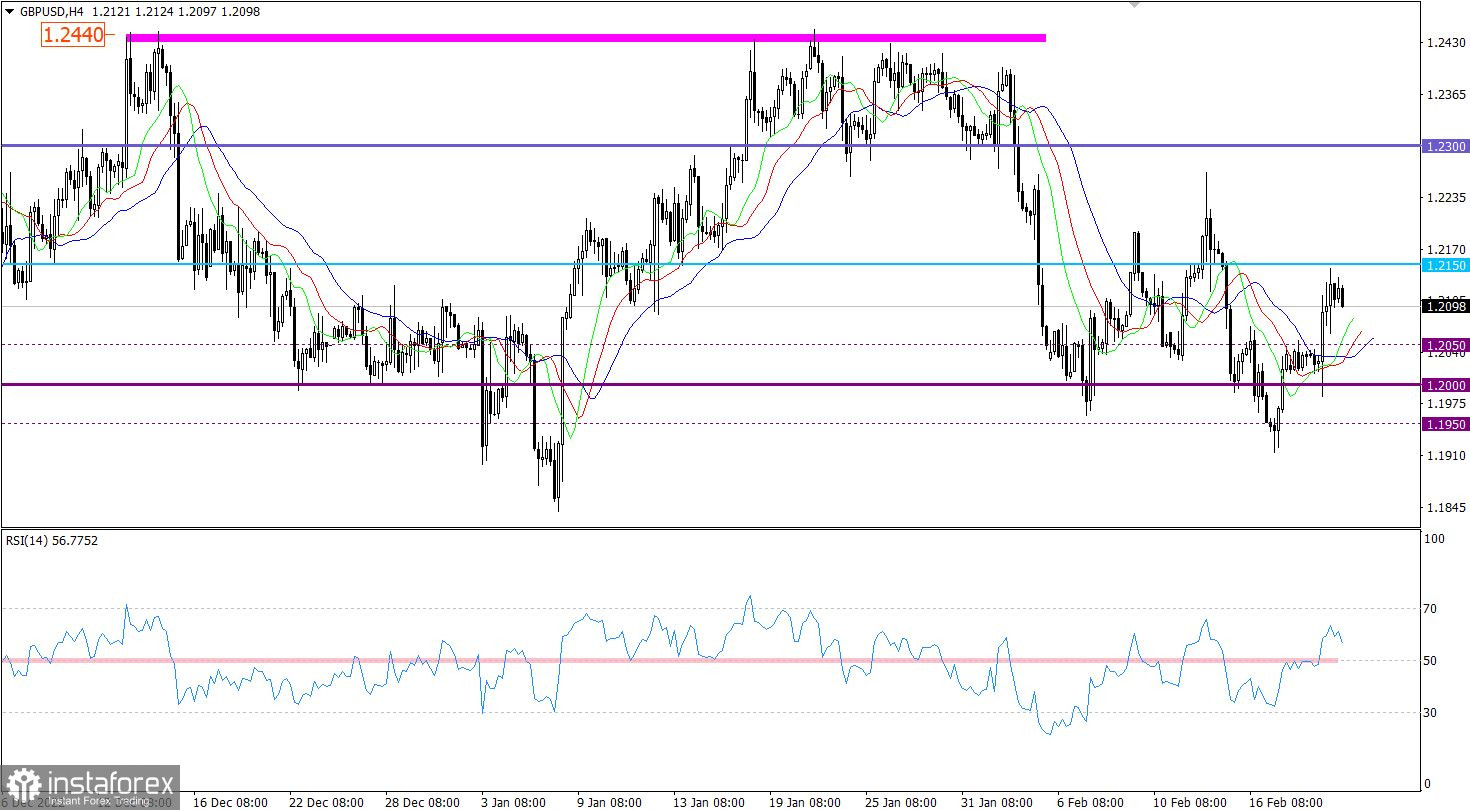

The sideways trend on GBP/USD ended near the upper limit of the 1.2000/1.2050 psychologically-important range with a rebound. As a result, buying volumes increased, and the price rose to 1.2150.

The RSI technical indicator settled in the upper area of the 50/70 range in the 4-hour time frame, confirming an increase in buying volumes.

The Alligator's MAs are headed upward in the 4-hour time frame, in line with the recent price impulse.

Outlook

The bulls are feeling pressure from resistance at 1.2150, which has led to a decrease in buying volumes, followed by a flat market and a rebound. The uptrend will extend if the quote consolidates above 1.2150 in the 4-hour time frame.

Alternatively, the price may plunge to support at 1.2000 after a bounce off 1.2150.

Speaking of complex indicator analysis, there is a mixed signal for short-term trading due to the flat market and a buy signal from intraday trading due to the recent impulse.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română