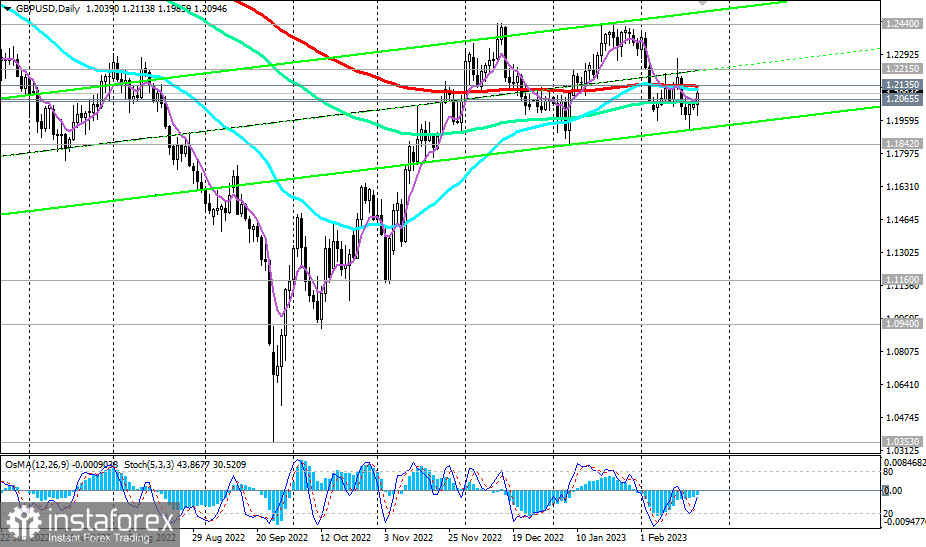

Last month, against the backdrop of the weakness of the U.S. dollar, the GBP/USD pair managed to correct from the local low of 1.1842 and reach 1.2440. Since the beginning of this month, the GBP/USD resumed to decline. The price broke through the important medium-term support levels 1.2135 (200 EMA on the daily chart), 1.2055 (144 EMA on the daily chart) and reached the local intra-month low 1.1915 last Friday.

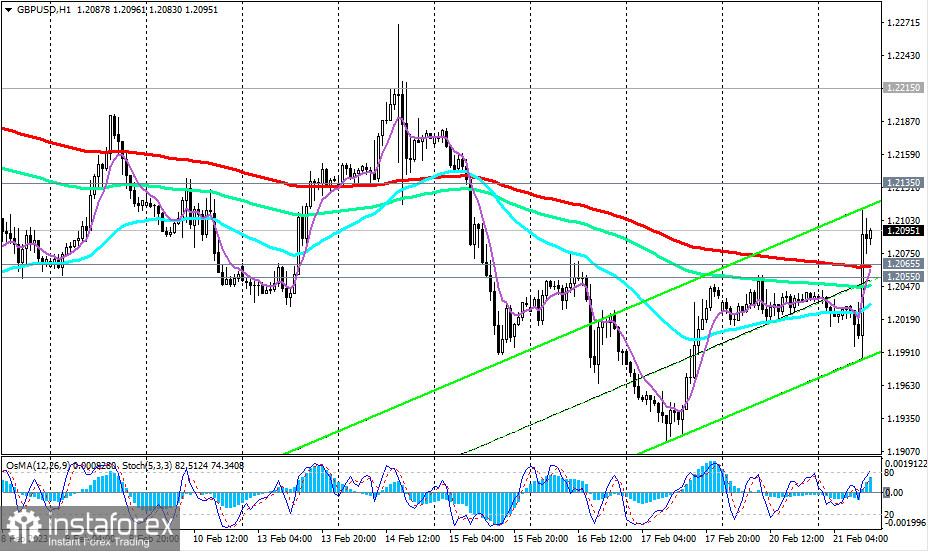

At the same time, the pound strengthened sharply today after the publication of the S&P Global report, including in the GBP/USD pair, which jumped 115 points.

The price broke the important short-term resistance level 1.2065 (200 EMA on the 1-hour chart), and the resulting bullish momentum may push the pair to the 1.2135 resistance level. Above it is unlikely, at least for now. For that the pound needs a new strong positive drivers, which are absent so far, while economists predict an imminent recession in Britain.

A rebound from the current levels and near the 1.2135 resistance level and a resumption of decline are most likely. The breakdown of the support levels 1.2065, 1.2055 will confirm the scenario for the resumption of the global downward trend of GBP/USD.

In an alternative scenario, in case of further growth and after the breakdown of the important resistance level 1.2135, GBP/USD will head towards the 1.2215 resistance level (50 EMA on the weekly chart) and then towards the key resistance levels 1.2710 (144 EMA on the weekly chart), 1.2860 (200 EMA on the weekly chart).

Support levels: 1.2065, 1.2055, 1.2000, 1.1842, 1.1160, 1.0940

Resistance levels: 1.2135, 1.2200, 1.2215, 1.2300, 1.2400, 1.2440, 1.2500, 1.2600, 1.2710, 1.2800, 1.2860

Trading scenarios

Sell Stop 1.2085. Stop-Loss 1.2145. Take-Profit 1.2065, 1.2055, 1.2000, 1.1842, 1.1160, 1.0940

Buy Stop 1.2145. Stop-Loss 1.2085. Take-Profit 1.2200, 1.2215, 1.2300, 1.2400, 1.2440, 1.2500, 1.2600, 1.2710, 1.2800, 1.2860

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română