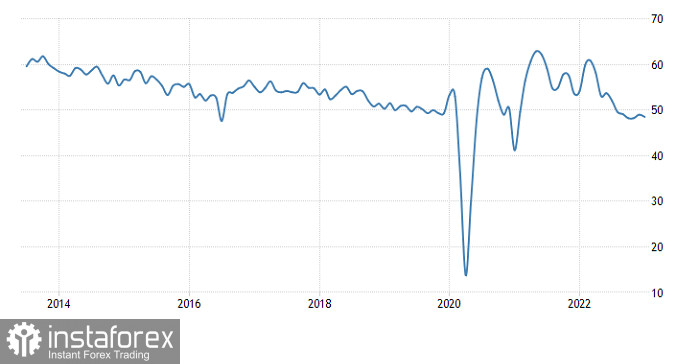

The market is likely to fluctuate today, particularly during the European session. Euro will rise due to business activity indices as estimates are an increase from 50.8 to 51.5 points in the service sector and a rise from 48.8 to 49.5 points in the manufacturing sector. The composite index is also expected to climb from 50.3 to 51.0 points.

Composite Business Activity Index (Europe)

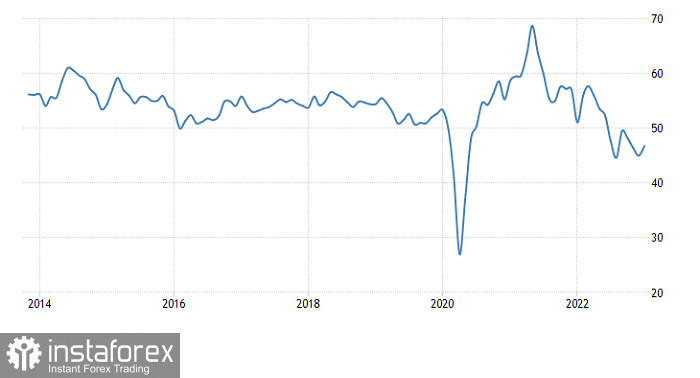

Pound is also expected to turn up as the UK's manufacturing index is projected to rise from 47.0 to 47.5 points and the service index to hike from 48.7 to 49.3 points. The composite index will be up from 48.5 to 49.2 points.

Composite Business Activity Index (UK):

However, neither the euro nor the pound will consolidate as all business indices in the US are also forecast to rise without exception. In particular, the ISM manufacturing index is set to rise from 46.9 to 49.0 points, while the service index will be up from 46.8 to 48.9 points. The composite index will also climb from 46.8 points to 48.9 points.

All this will be the reason for a return to the early trading day values, so no changes will take place at the end of the day.

Composite Business Activity Index (United States):

Despite a slight pullback, EUR/USD is still in a downward trend. Support is around the area of 1.0650, so staying under it will prolong the bear market. Price will increase if the downward cycle loses strength.

GBP/USD consolidated around the upper area of 1.2000/1.2050. This could be a catalyst for trading forces and will be seen by traders as leverage in new market speculation.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română