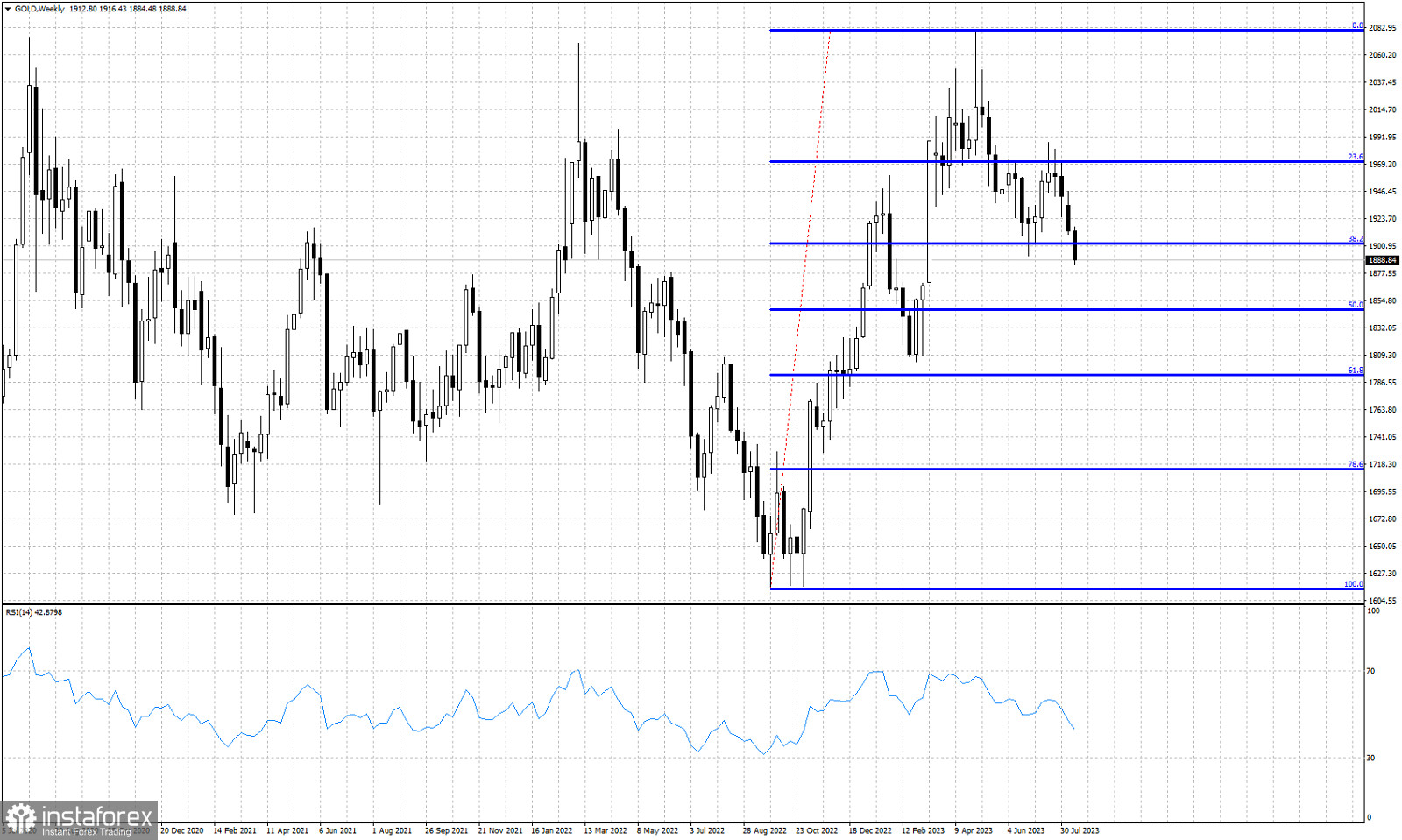

Blue lines- Fibonacci retracement levels

Gold price ended the week at a new lower low around $1,888. Short-term trend remains bearish as price continues making lower lows and lower highs. Recent price action suggests that the entire upward move from $1,614 low from 12 months ago is most probably complete and that a correction has started (bullish scenario). Gold price formed a weekly lower low relative to the past 20 weeks. Price has broken below the 38% Fibonacci retracement providing a fresh sign of weakness. Gold price is vulnerable to a move lower towards the 50% Fibonacci retracement level around $1,846. The bullish scenario suggests that this entire downward movement is a counter trend correction and that Gold price will form eventually a higher low, most probably around the 61.8% Fibonacci retracement. The bearish scenario suggests that Gold price has started a new downward wave that will eventually push price below $1,614. The recent lower high around $1,986 is the most important resistance level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română