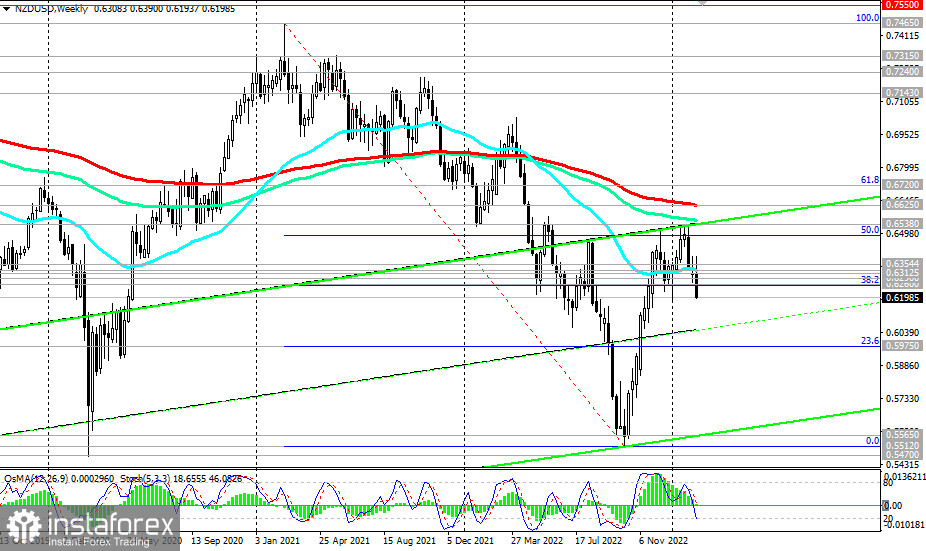

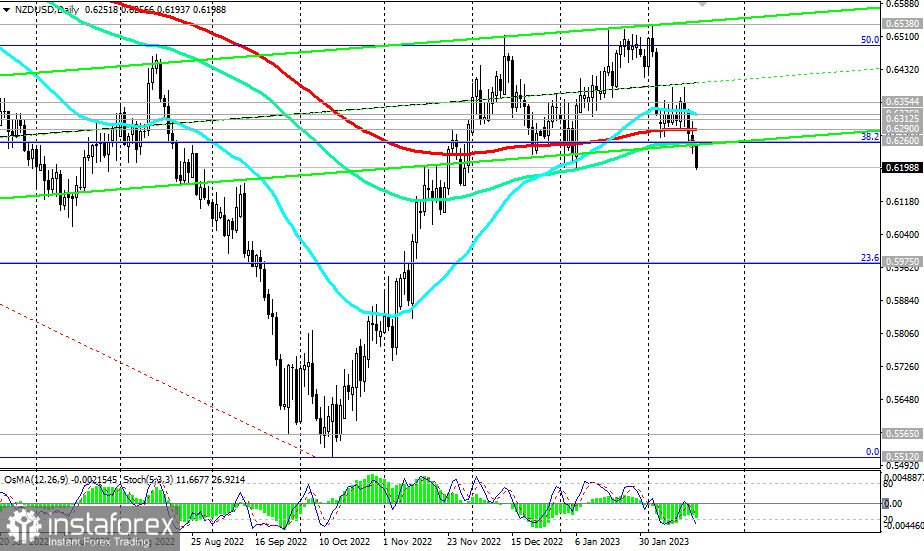

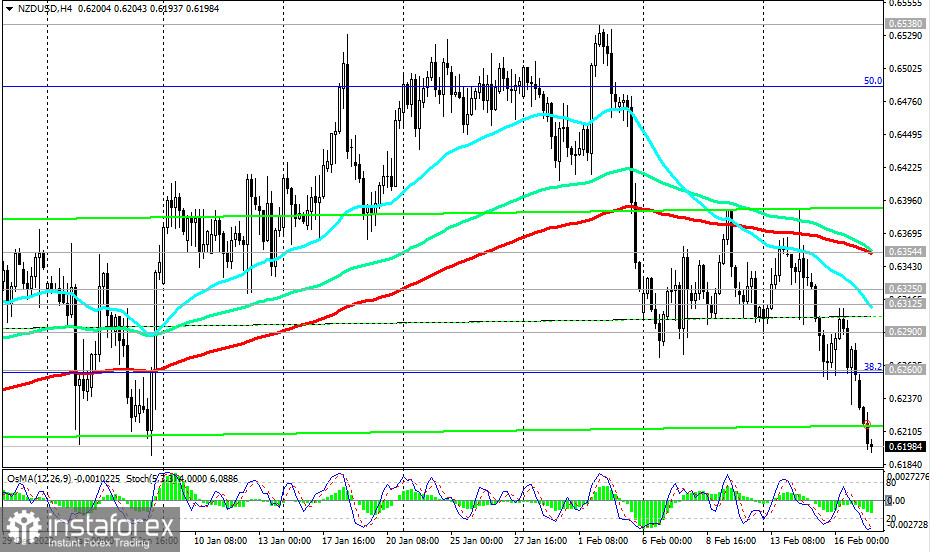

NZD/USD has broken two major medium-term support levels at 0.6290 (200 EMA on the daily chart) and 0.6260 (144 EMA on the daily chart and the 38.2% Fibonacci level in the pair's recent decline from 0.7465 in February 2012 to 0.5512, reached in October 2022). It continues to decline today, reaching a round mark of 0.6200 and deepening into the bear market zone.

Technical indicators OsMA and Stochastic on the daily and weekly charts also turned to short positions.

In an alternative scenario, a signal for the resumption of long positions will be an increase in the zone above the levels of 0.6260, 0.6290. In the meantime, short positions remain preferable. A break of the 0.6200 round mark will strengthen the downward dynamics of the pair.

Support levels: 0.6200, 0.6100, 0.6000, 0.5975, 0.5900

Resistance levels: 0.6260, 0.6290, 0.6312, 0.6325, 0.6355, 0.6400, 0.6500, 0.6538, 0.6600, 0.6625

Trading scenarios

Sell Stop 0.6190. Stop-Loss 0.6225. Take-Profit 0.6100, 0.6000, 0.5975, 0.5900

Buy Stop 0.6225. Stop-Loss 0.6190. Take-Profit 0.6260, 0.6290, 0.6312, 0.6325, 0.6355, 0.6400, 0.6500, 0.6538, 0.6600, 0.6625

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română