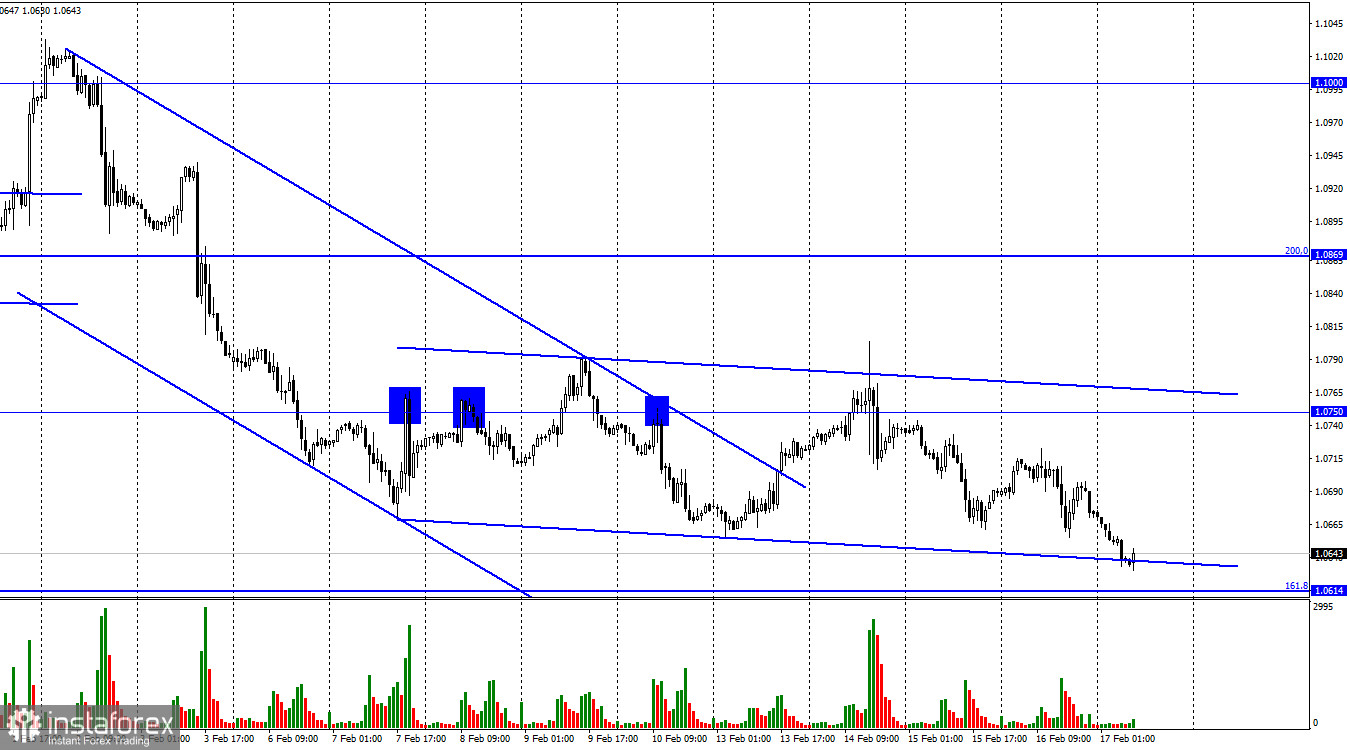

On Thursday, the EUR/USD pair took a new turn in the direction of the US dollar and started to decline once more, this time targeting the corrective level of 161.8%, or 1.0614. The downward trend line describes traders' attitudes as being "bearish." The EU currency will benefit from a rebound from this channel's lower line, or the level of 1.0614, as well as some growth in the direction of the level of 1.0750.

We may now review the initial report because this week's informational events proved to be highly active. First, the US inflation data demonstrated that the rate of decline is slowing. So far, this is only one month, and we may see a stronger reduction in the following month, but questions are beginning to surface regarding the indicator: is it capable of continuing to decline at the rate that the Fed anticipates? If not, the regulator will need to change the way it approaches interest rates. By the way, a few Fed members have already voiced their support for a more aggressive rate hike in 2023 this week and last week. Jerome Powell said that if the labor market and the condition of the economy permit it, the rate may increase further. According to Loretta Meister, the Fed might raise interest rates by 0.50% once more. The US dollar seemed strong this week since the first and second statements can both be characterized as "hawkish."

Second, there was no sign of tighter rhetoric in Christine Lagarde's speech. Also, the ECB president mentioned raising the rate by 0.50% at the following meeting, something traders have known about for some time. As a result, this argument has developed over time, and the euro has not gained popularity. The dollar has a much better chance of continuing to grow than the euro currency in the short term. Fixing quotes below the significant level of 1.0614 will raise the possibility that prices will continue to decline toward the next level of 1.0483.

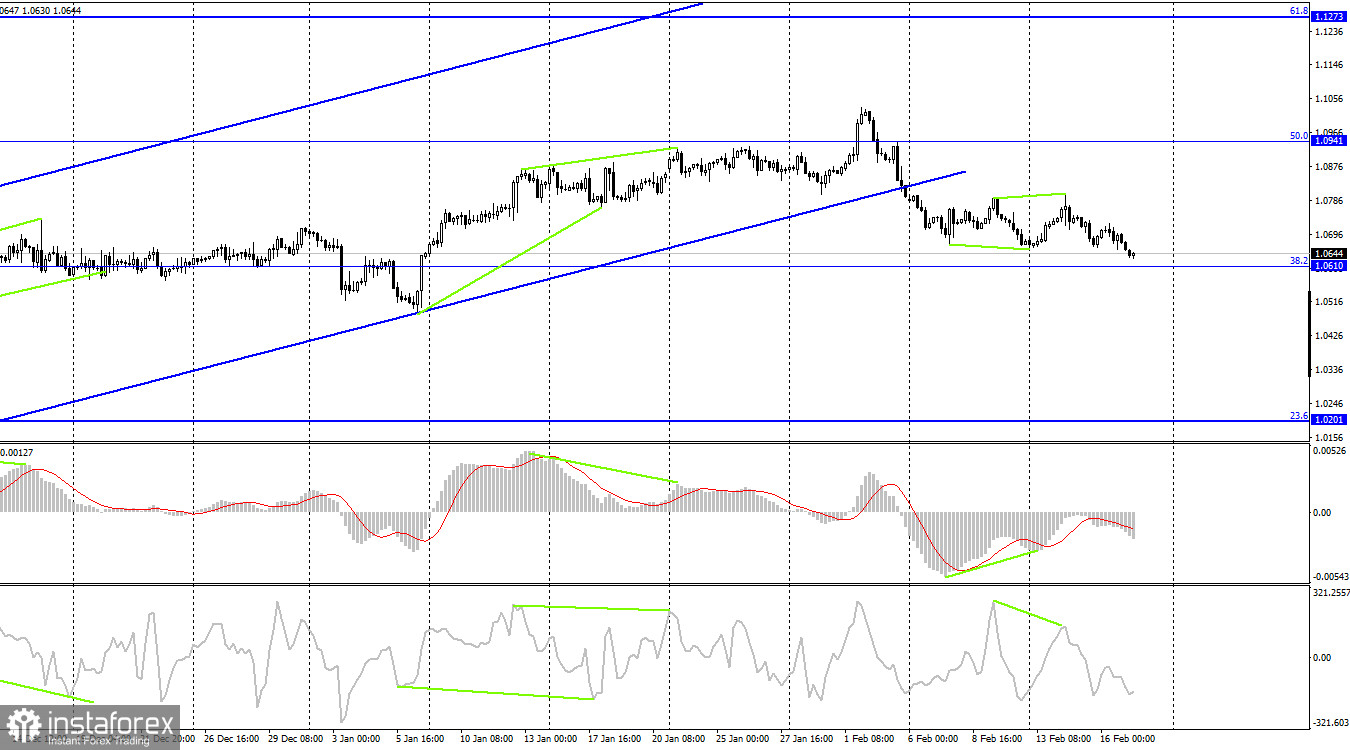

The pair was held under the upward trend line on the 4-hour chart. I believe this is an important moment because the pair has left the channel where they have been since October. The current "bearish" trading sentiment offers the US dollar good growth chances with targets of 1.0610 and 1.0201. The likelihood of a further decline in the pair is increased by the CCI indicator's new "bearish" divergence.

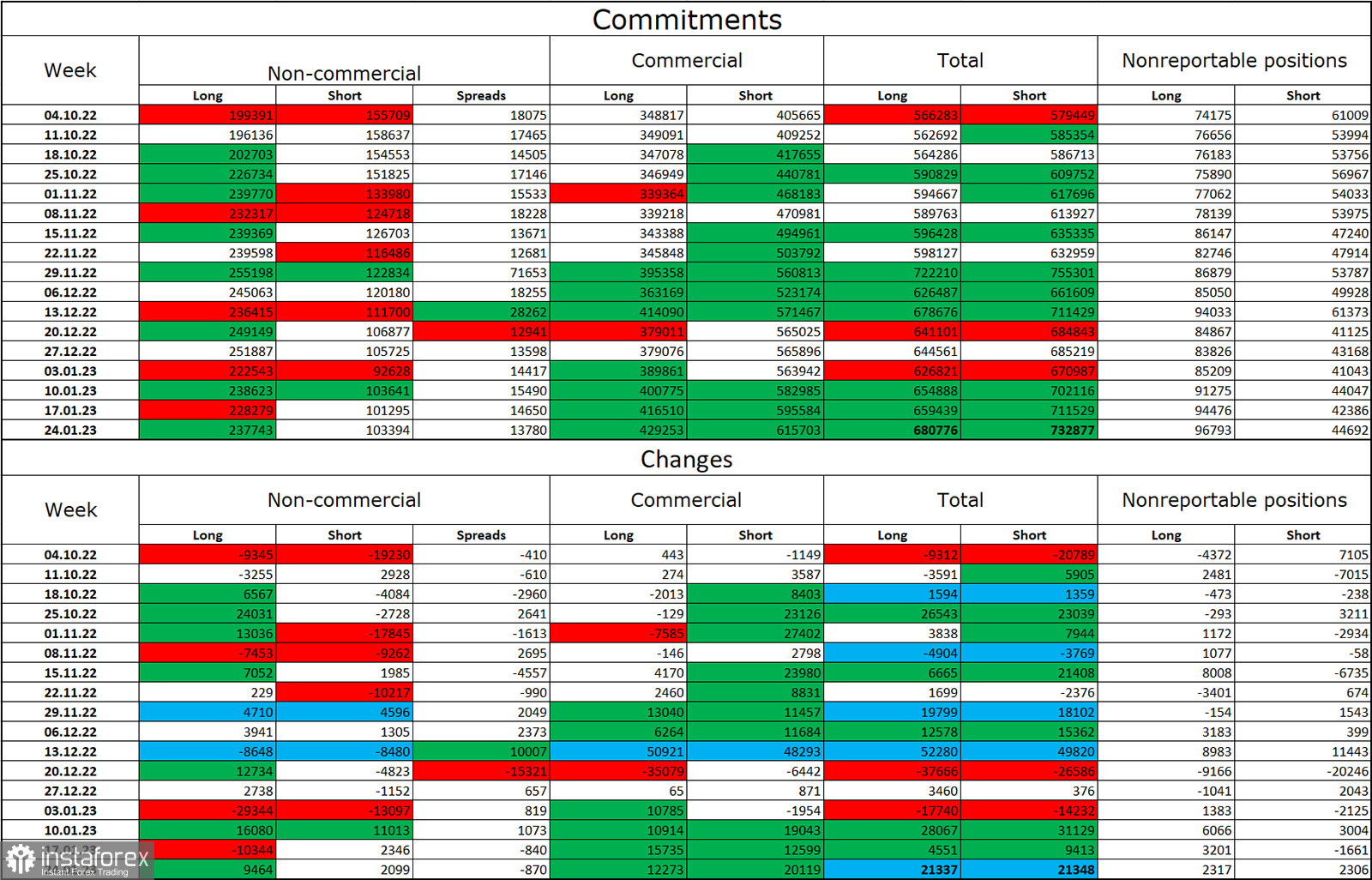

Report on Commitments of Traders (COT):

Speculators opened 9,464 long contracts and 2,099 short contracts during the most recent reporting week. Major traders' attitude is still "bullish" and has somewhat improved. Currently, 238 thousand long futures and 103 thousand short contracts are all concentrated in the hands of traders. The COT figures show that the European currency is now growing, but I also see that the number of long positions is over 2.5 times greater than the number of short positions. The likelihood of the euro currency's growth has been steadily increasing over the past few months, much like the euro itself, but the information background hasn't always backed it up. After a protracted "dark time," the situation is still favorable for the euro, therefore its prospects are still good. Until the ECB gradually raises the interest rate by increments of 0.50%, at least.

Calendar of events for the United States and the European Union:

There are no noteworthy or intriguing events scheduled for February 17 in either the European Union's or the United States' economic calendars. The information background will not affect the mood of traders today.

Forecast for EUR/USD and trading advice:

When the pair closes below the level of 1.0610 on the 4-hour chart, new sales of the pair with a target price of 1.0483 are probable. In the 4-hour chart, purchases of the euro currency are conceivable when it recovers from the level of 1.0610 with a target of 1.0750.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română