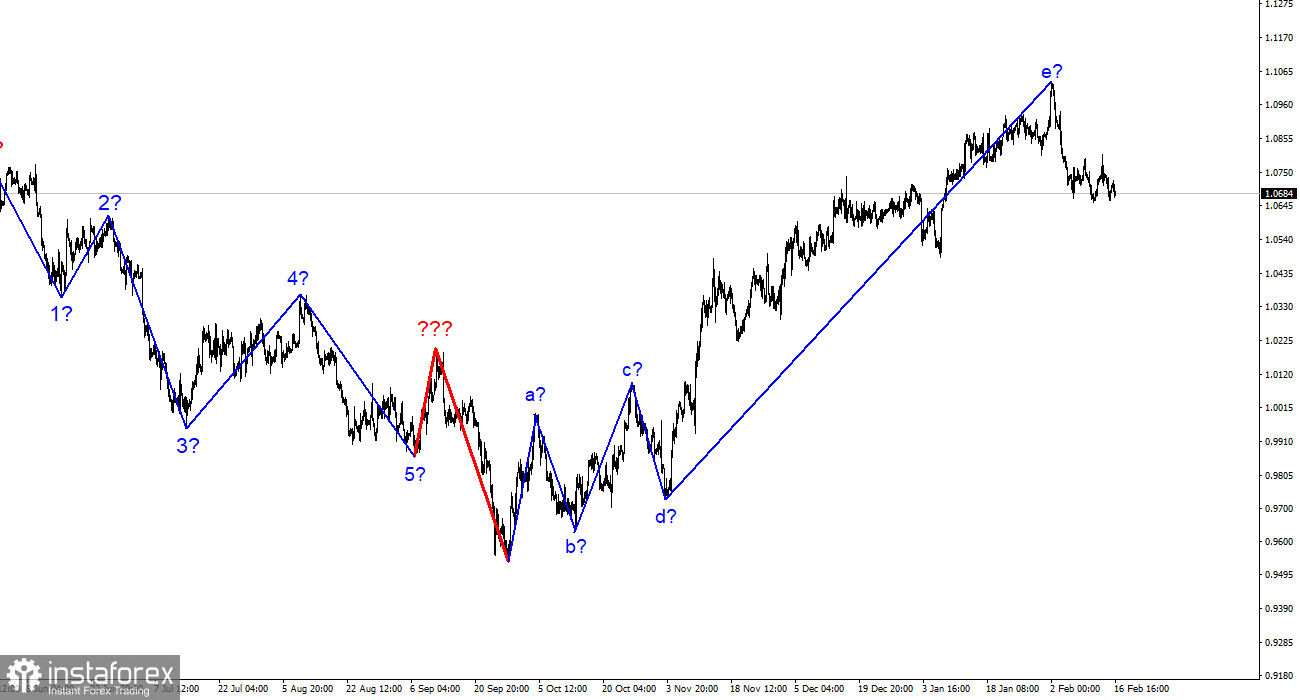

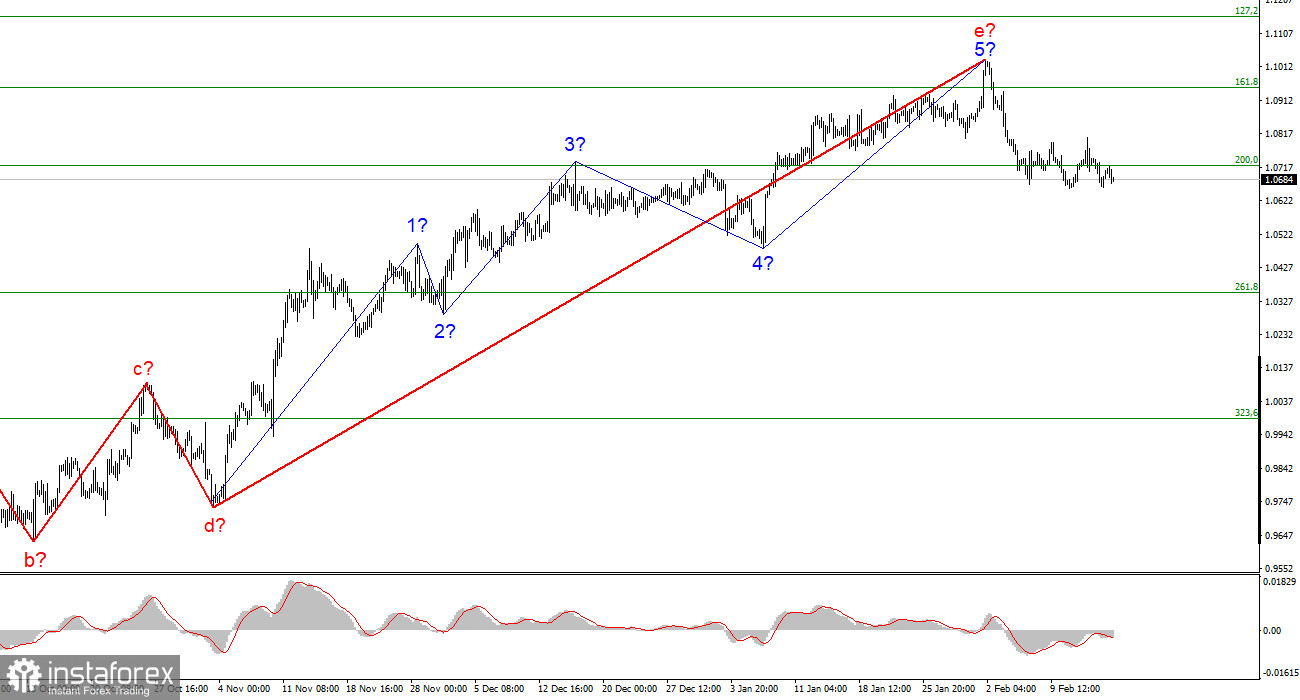

The 4-hour chart for the euro/dollar pair still shows the same wave pattern, which is excellent because it allows us to predict how the situation will develop. Although its amplitude would be more appropriate for the impulsive section, the upward section of the trend has been corrected. The wave pattern a-b-c-d-e that we were able to obtain features a wave e that is far more complex than the other waves. If the wave analysis is accurate, then this structure's development is complete, and wave e was far longer than any other wave. I still anticipate a significant decrease in the pair because we are expected to develop at least three waves downward. The demand for the euro was persistently high throughout the first few weeks of 2023, and during this time the pair was only able to deviate marginally from previously reached peaks. The US currency did, however, manage to avoid market pressure at the beginning of February, and the present detachment of quotes from the peaks reached can be viewed as the start of a new downward trend section, which I was simply hoping for. I hope that this time, the market's mood and the news context won't impede the formation of a downward series of waves.

The demand for the euro is still declining.

On Thursday, the euro/dollar pair traded with the lowest possible amplitude. Before the American session, there were no noteworthy developments in the foreign exchange market, so market players were obliged to either take a break or turn to more recent news. The market chose to take a break this week because there isn't much to remember besides American inflation. I want to emphasize that pausing does not signify giving up on the working circumstance. I continue to anticipate that the euro will fall and form at least a three-wave downward pattern. This week, it became evident that the Fed could raise rates by more than anticipated and maintain them at their maximum for a longer period. As a result, this week's "hawkish" predictions regarding the Fed's monetary policy strengthened the demand for the dollar.

Let me remind you that the US inflation rate is now 6.4%. Consumer prices will continue to decline, according to both the ECB and the Fed, but the market is starting to have second thoughts. The fact is that recent inflation has been fueled by at least two factors. Rates often increased by large amounts when gas and oil prices fell. The Fed rate has slowed down to the smallest step of growth, and energy costs have stopped declining in recent weeks. Based on this, the central bank will need to find an alternative with a larger growth rate, and the decrease in inflation may also slow down. After a meeting in early February, Jerome Powell acknowledged that the rate could increase more than anticipated and that a strong labor market allows the Fed to take harsher action. Yet although I think this factor helps the dollar, I still think it's more crucial to generally create a set of corrective waves.

Conclusions in general

I draw the conclusion that the upward trend section's development is finished based on the analysis. As a result, sales with targets close to the predicted level of 1.0350, or 261.8% Fibonacci, can now be taken into consideration. Yet, almost for the first time in recent weeks, we notice on the chart a picture that can be termed the start of a new downward trend segment. The likelihood of an even greater complication of the upward trend segment still exists.

On the older wave scale, the ascending trend section's wave pattern has grown longer but is likely finished. The a-b-c-d-e pattern is most likely represented by the five upward waves we observed. The downward section of the trend is already taking shape and can have any kind of structure or extent.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română