The speed of rate hikes is less important than the ability of the economy to withstand monetary tightening. If at the end of 2022, investors doubted that the eurozone would not plunge into recession and set modest forecasts for the deposit rate, then in 2023, the situation has changed. Optimistic estimates of the ECB and the European Commission allow derivatives to expect an increase in the European cost of borrowing up to 3.5%–3.75%. If so, then after some problems in February, EURUSD may rise from the ashes.

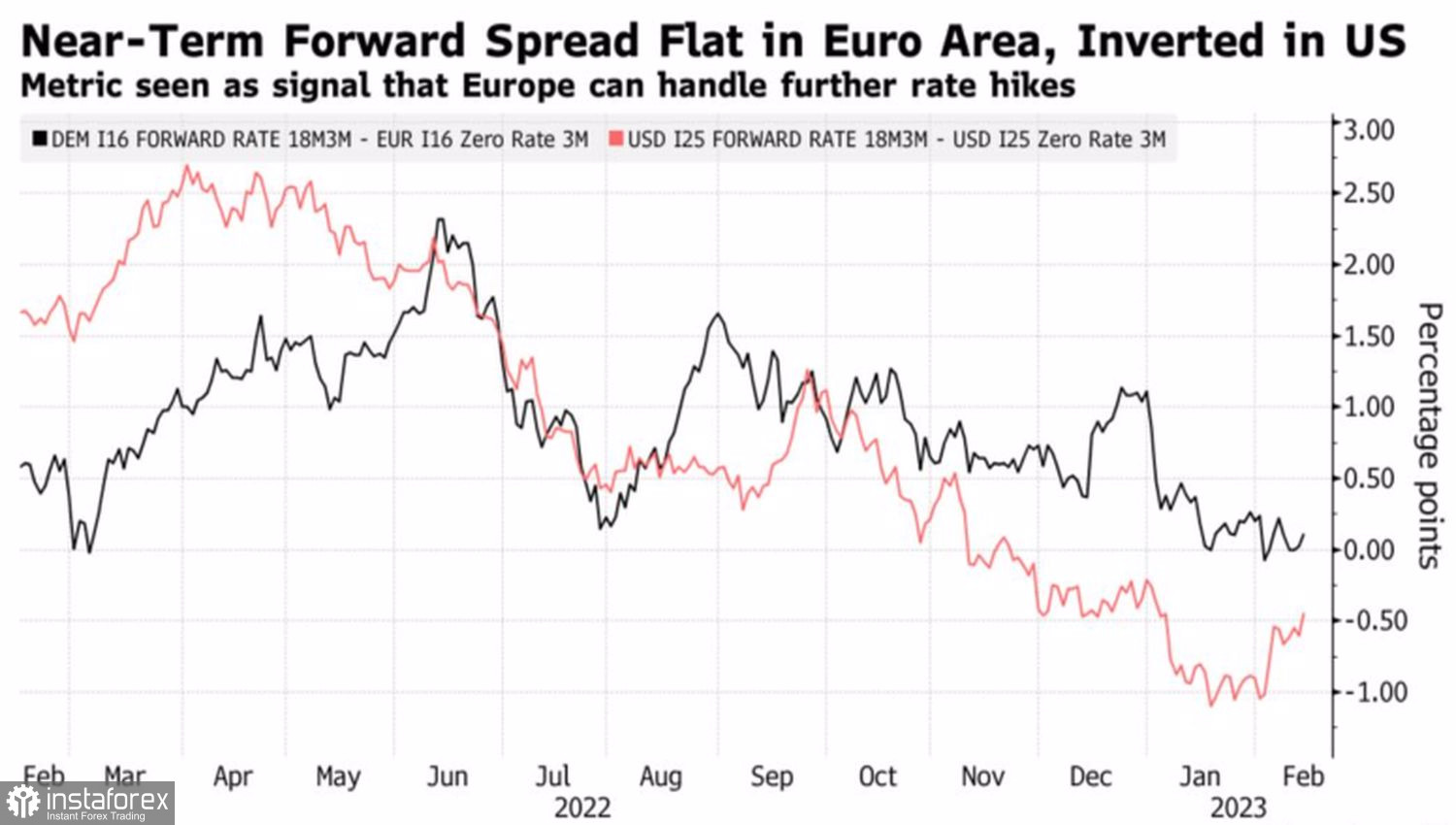

According to Morgan Stanley, the dynamics of the differential between 3-month German bond yields and what investors see in 18 months indicates that there will be no downturn in the currency bloc. By contrast, similar indicators for the U.S. and New Zealand have inverted, confirming the idea of a recession. The eurozone economy is capable of withstanding the most aggressive cycle of monetary restriction in decades. This gives Morgan Stanley reason to be optimistic about the euro.

Dynamics of interest rate differentials in the euro area and the United States

The idea is rather controversial. The yield curve in the U.S. has long been invested, but there is still no recession there. Moreover, the January statistics on employment, retail sales and industrial production indicate not only that the economy is stable, but also that it is ready to accelerate. In February, however, everything could turn out to be a mirage if the previous month's data is presented as statistical noise.

Let's wait and see. In the meantime, pleasant surprises from the European economy and the intention of the ECB to continue to tighten monetary policy at the same speed suggest that getting rid of the euro ahead of time is not worth it. The "bulls" on EURUSD will still show themselves.

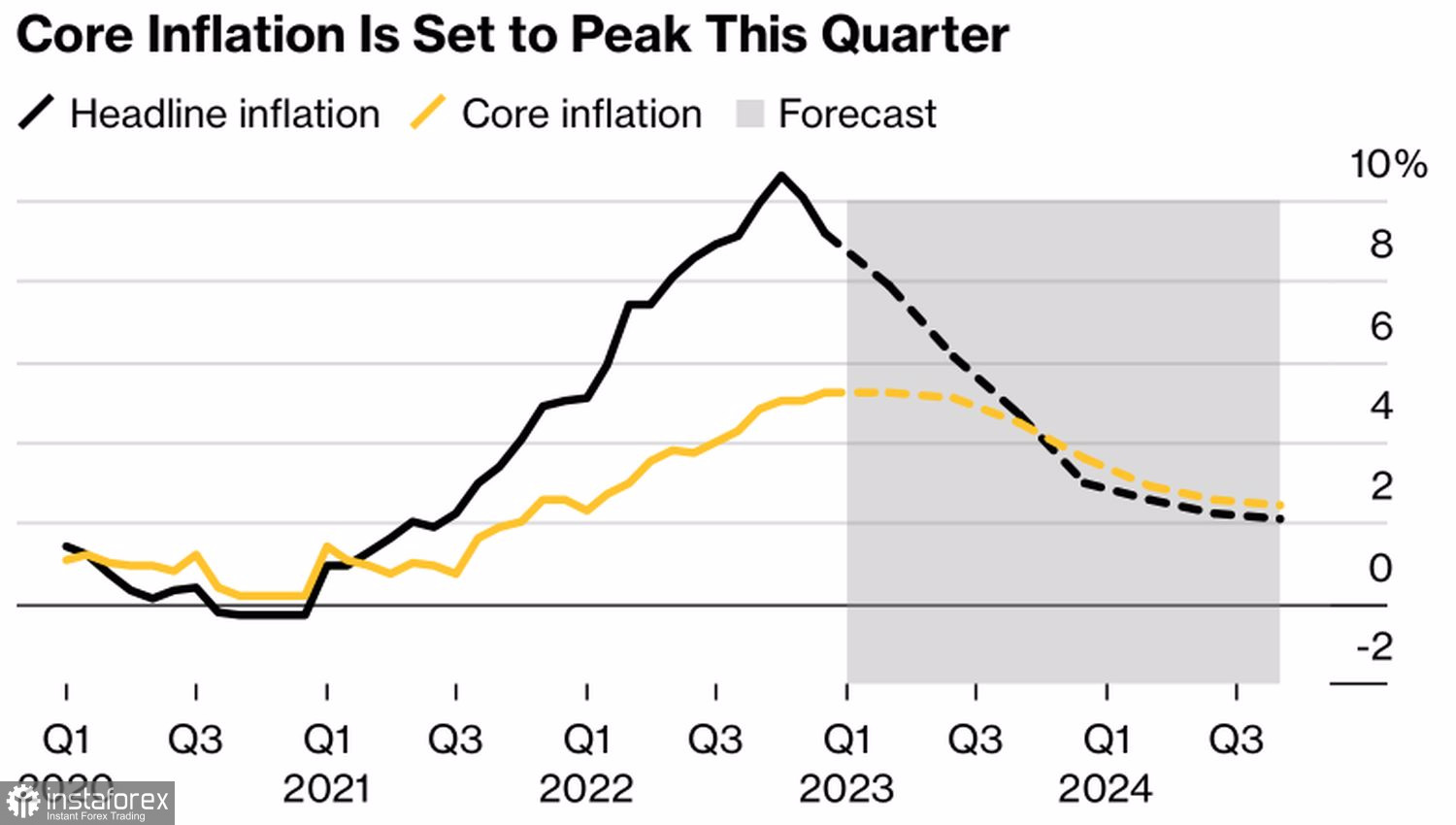

Indeed, ECB President Christine Lagarde has stated unequivocally that the deposit rate in March will be increased by another 50 bps, after which the Governing Council will assess the consequences of previous steps and develop a further strategy. The European Central Bank needs to remain decisive as core inflation in the eurozone shows no signs of slowing down.

Dynamics of European inflation

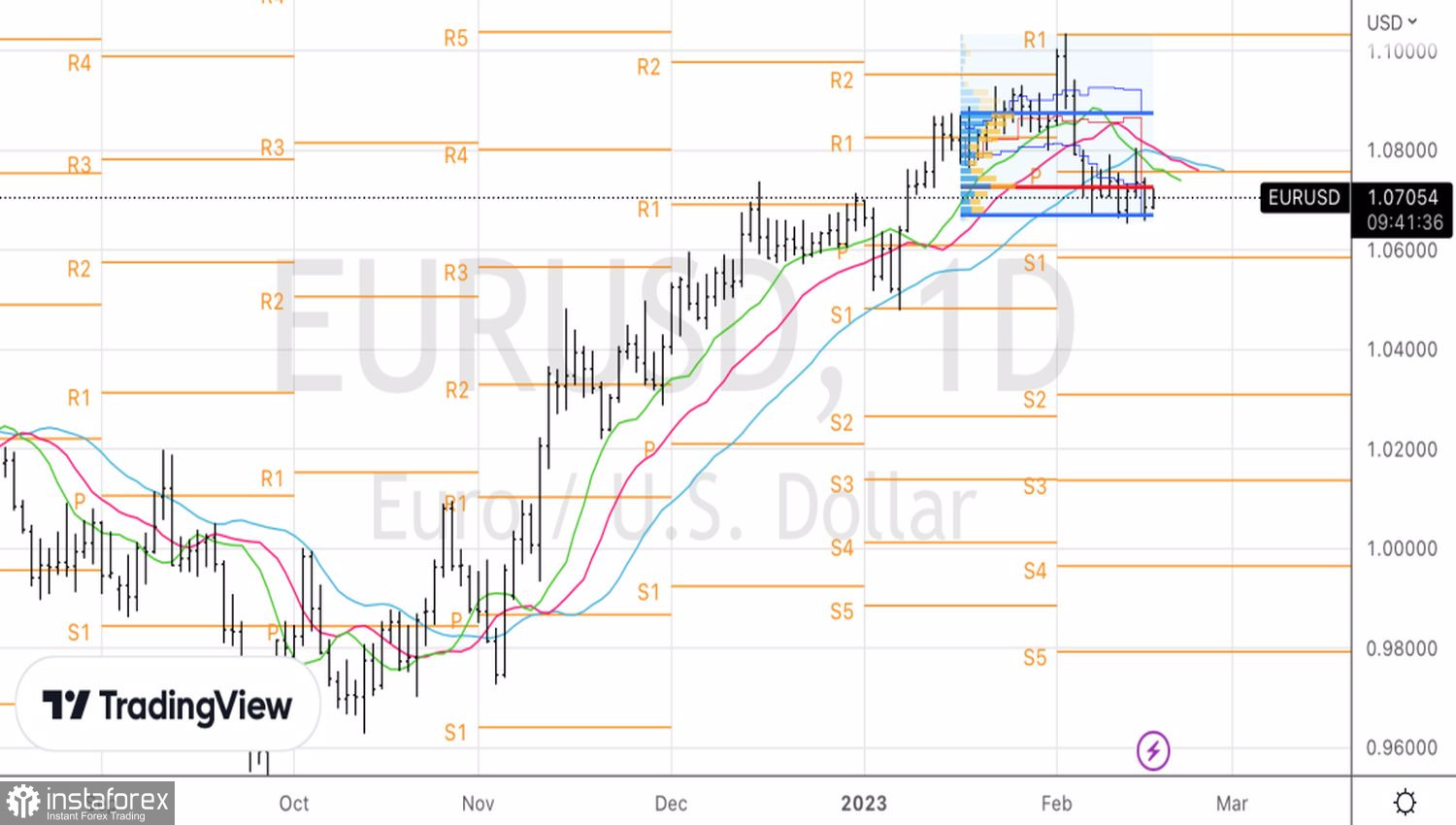

Most likely, the upward trend in EURUSD will be restored. The question is, when exactly? If, following consumer prices, producer prices in the U.S. accelerate, the correction may pick up new momentum. Bloomberg experts predict PPI acceleration from -0.5% to +0.4%, the base indicator – from +0.1% to +0.3% month-on-month. It seems that the Fed still has a lot of work to do, the federal funds rate will continue to grow, lending leverage to the dollar. And only when interest in it fades away, the euro will be able to regain lost ground.

Technically, on the EURUSD daily chart, a break of the lower boundary of the fair value range 1.067–1.087 will allow increasing the short positions formed from the level of 1.0705. The pivot points 1.0615, 1.0585 and 1.056 serve as the target for the downward movement on the main currency pair. A rebound from them will give grounds to reverse.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română