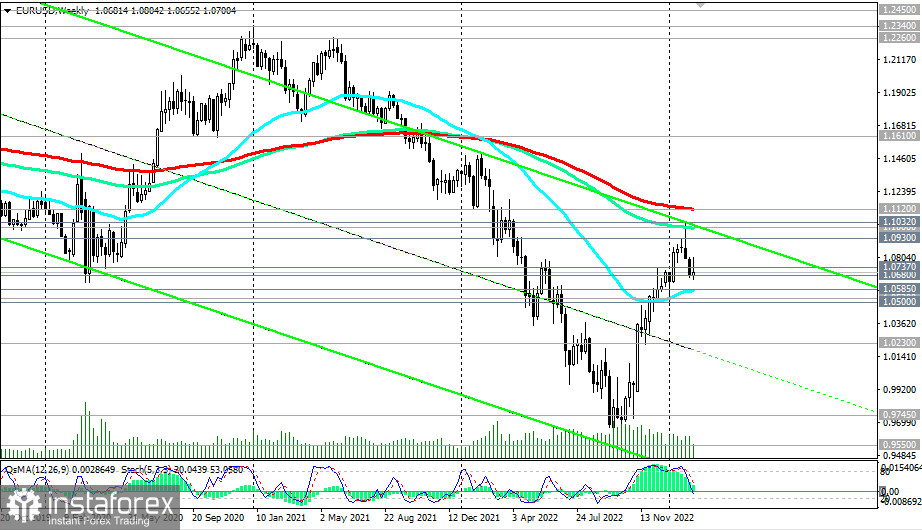

The EUR/USD pair has sharply declined since start of February, losing about 1.5% in value after reaching a local 10-month high of 1.1032 at the beginning of the month.

The euro is under pressure by unconvincing macro statistics from the eurozone. Nevertheless, investors remain optimistic about the EUR/USD pair, including on expectations of a weakening dollar.

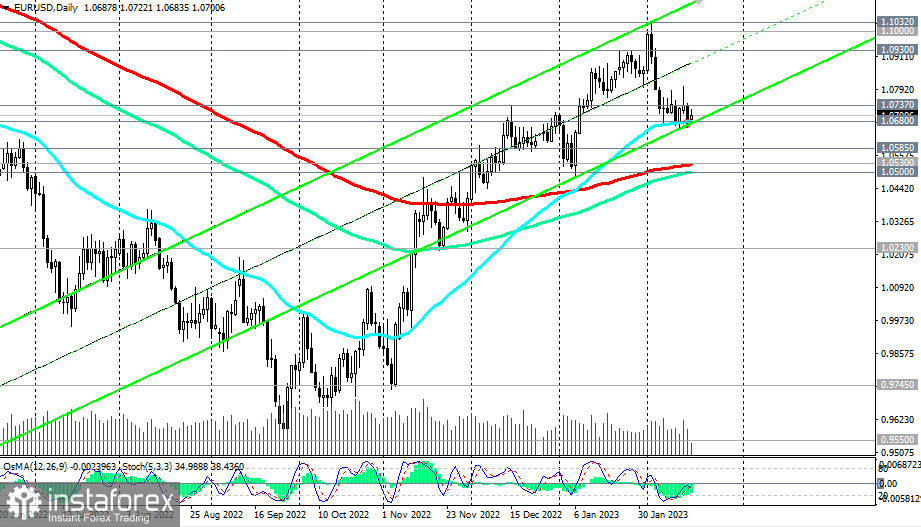

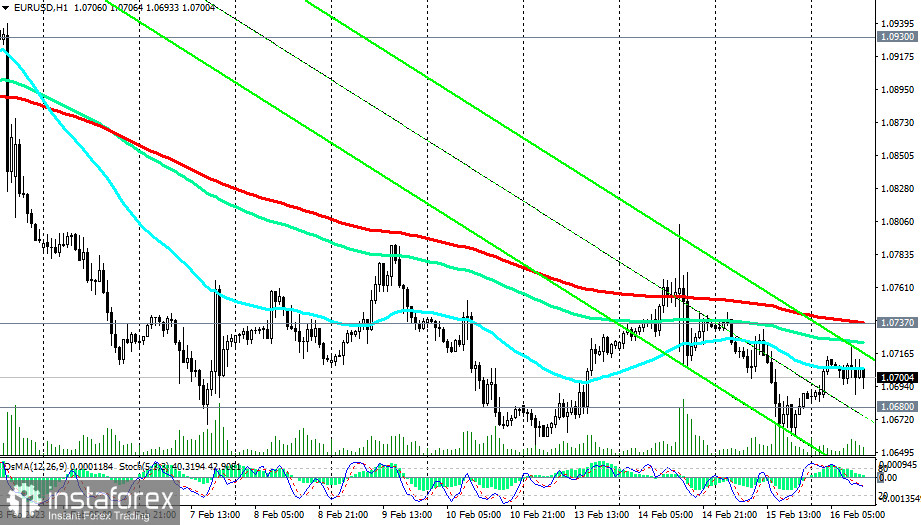

The breakdown of the important short-term resistance level 1.0737 (200 EMA on the 1-hour chart and 200 EMA on the 4-hour chart) will be the first signal to resume long positions. The EUR/USD pair will then head towards the recent high and the upper limit of the upward channel on the daily chart at 1.1032, with intermediate targets at resistance levels 1.0930, 1.1000.

In an alternative scenario, EUR/USD will try again to break through the important support level 0.0680 (50 EMA and the bottom line of the upward channel on the daily chart). A successful attempt will give the pair a new bearish impetus in its movement to key support levels 1.0530 (200 EMA on the daily chart), 1.0500 (144 EMA on the daily chart). Their breakdown will finally return EUR/USD to the long-term bear market zone.

Support levels: 1.0680, 1.0585, 1.0530, 1.0500, 1.0230

Resistance levels: 1.0737, 1.0800, 1.0930, 1.1000, 1.1032, 1.1120, 1.1610

Trading scenarios

Sell Stop 1.0650. Stop-Loss 1.0770. Take-Profit 1.0600, 1.0585, 1.0530, 1.0500, 1.0230

Buy Stop 1.0770. Stop-Loss 1.0650. Take-Profit 1.0800, 1.0930, 1.1000, 1.1032, 1.1120, 1.1610

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română