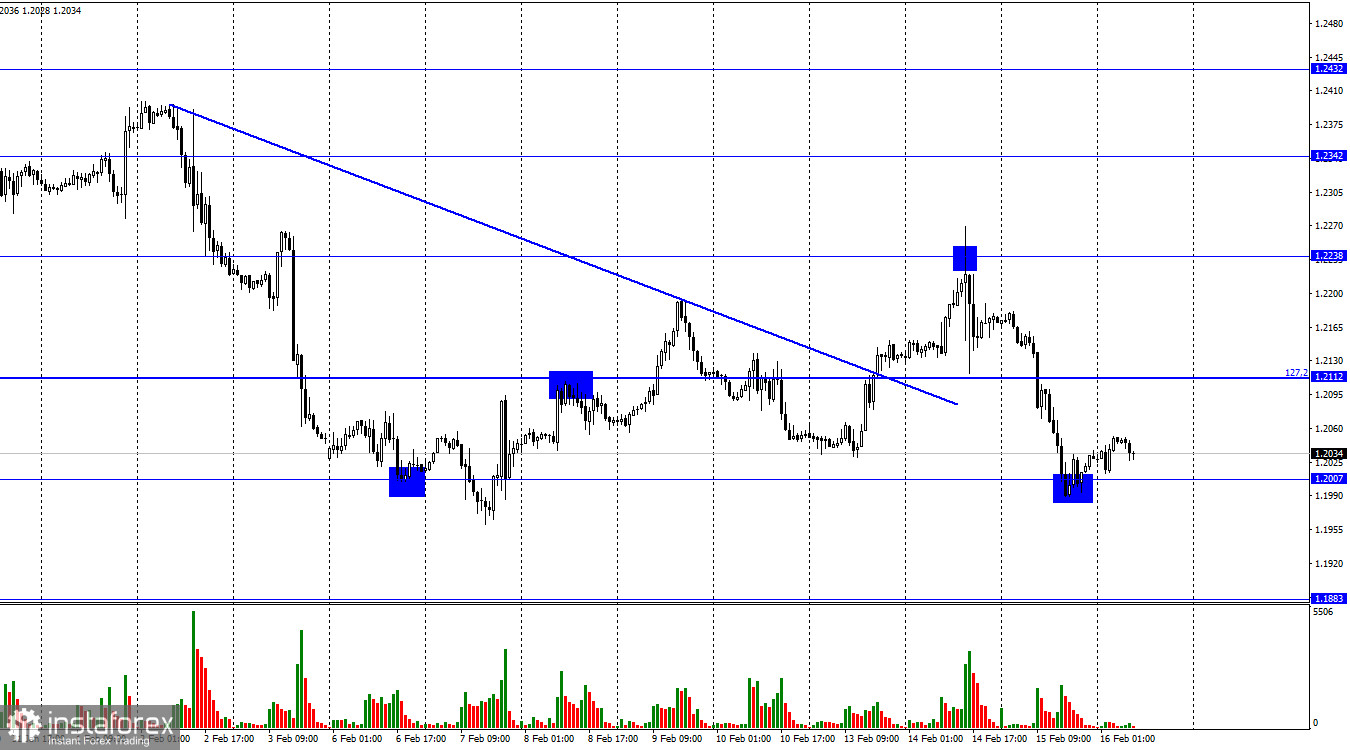

On the 1-hour chart, GBP/USD fell toward the 1.2007 level and rebounded from it. So today, the pair may rise slightly to the Fibo retracement level of 127.2% at 1.2112. If the quotes settle below 1.2007, the pair is more likely to extend its fall toward 1.1883. Trader sentiment has not changed to bullish although the price has crossed the trendline.

Yesterday was a crucial day for the pound as the inflation report in the UK was published. Inflation remains the key gauge that shapes the monetary policy of central banks. A change in inflation has almost a 60-70% probability of influencing national currencies. So, the market could not have ignored this data. The pound plunged after the CPI report revealed that inflation in the UK eased to 10.1% from 10.5% y/y. The core inflation index declined as well to 5.8% from 6.3%. Since both indicators demonstrated a decent decline, traders assumed that the Bank of England may soon start to ease its aggressive monetary policy. It seems that Andrew Bailey's prediction about a slowdown in consumer prices has come true. However, the indicator may still change several times in the near future. In the meantime, the pound has a good reason to fall as the BoE may revise the forecast for the rate hike. At the same time, the Fed is considering more monetary tightening.

Actually, the importance of this factor is very low because nobody knows exactly what the BoE peak rate is going to be. It may well rise to 6%. Yet, the regulator is probably planning to evaluate the inflation rate every month to make an appropriate decision. I do not think that this is a good approach. The rate has already increased to 4% which puts the UK economy under big pressure. The UK regulator will probably try to avoid the risks and may want to slow down the pace of monetary tightening.

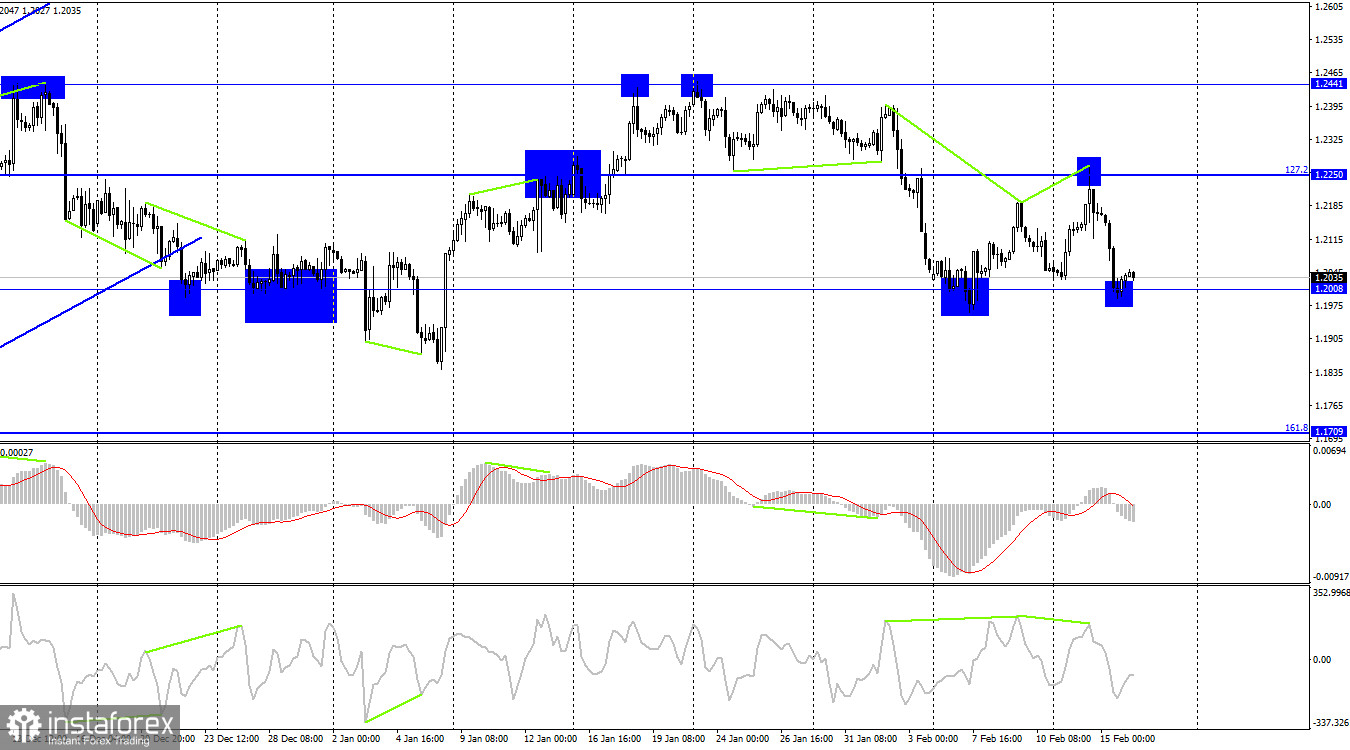

On the H4 chart, the pair dropped to the 1.2008 level and rebounded from it. So, it may soon start to rise toward the retracement level of 1.2250. Consolidation below 1.2008 will make the fall toward the next Fibo level of 161.8% - 1.1709 more likely. Currently, none of the indicators is showing any upcoming divergences.

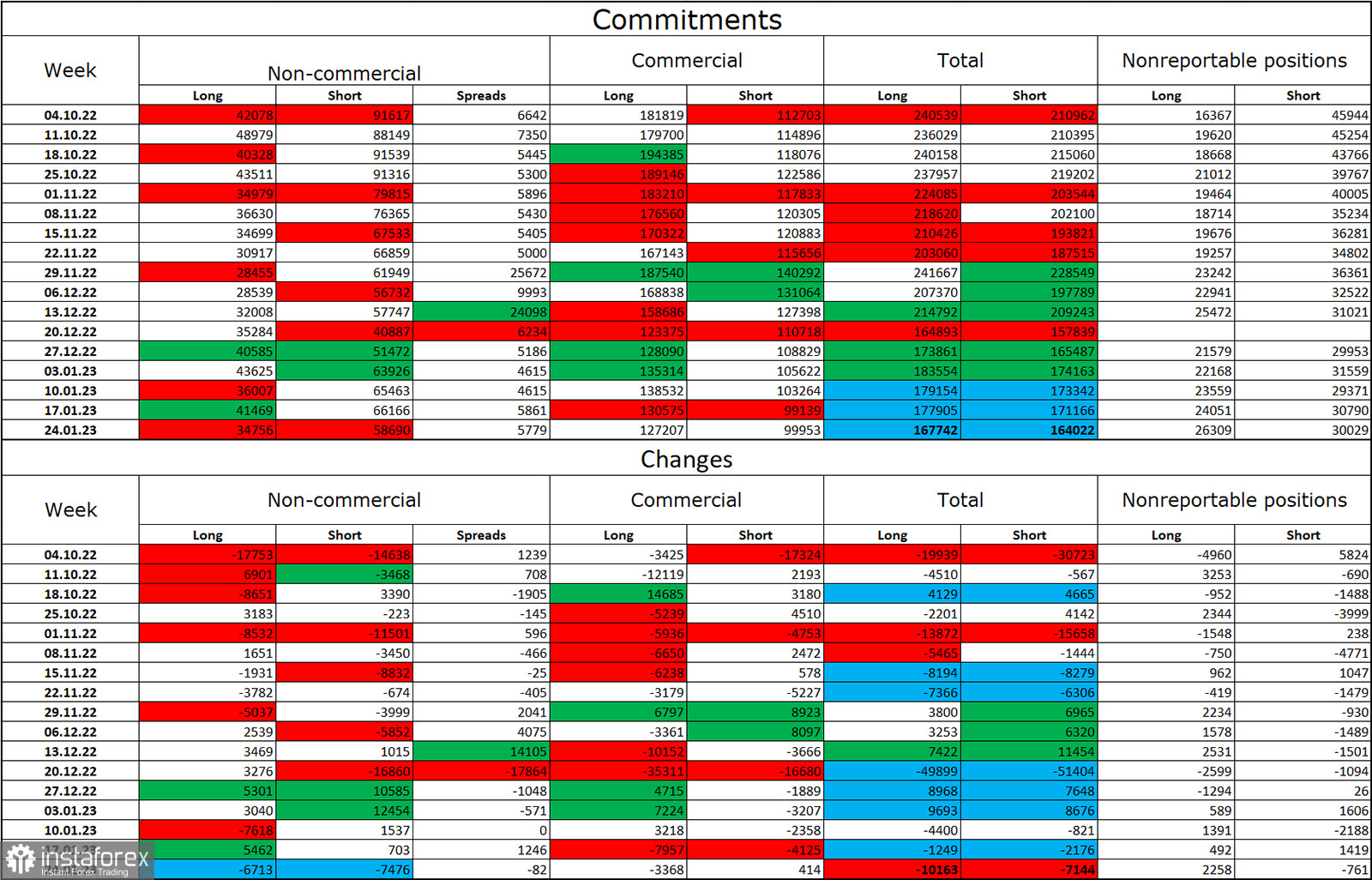

Commitments of Traders (COT) report:

The sentiment of the non-commercial group of traders has become less bearish over the past week. The number of Long contracts opened by traders decreased by 6,713 while the number of Short contracts fell by 7,476. The overall sentiment of large market players remained bearish as the number of short positions still exceeds the number of long ones. In recent months, the pound has been gaining ground. In recent months, the British pound has been gaining ground. However, today, there are twice as many short contracts as the long ones. Therefore, the outlook for the pound has again worsened over the past few weeks. The pound, however, is holding steady, following the trajectory of the euro. On the 4-hour chart, the price left the ascending channel that has been there for three months. This can serve as a factor limiting the pound's upside potential.

Economic calendar for UK and US:

US – Building Permits (13-30 UTC).

US – Initial Jobless Claims (13-30 UTC).

On Thursday, there are no important events in the UK economic calendar. Meanwhile, the US will publish the data of minor importance. So, the influence of the information background on the market will be weak today.

GBP/USD forecast and trading tips

It was possible to sell the pound when the pair rebounded from 1.2238 or 1.2250 with the targets at 1.2112 and 1.2007. Both targets have been reached. You can open new short positions when the pair closes below 1.2007 with the next target at 1.1883. Buying the pair will be possible when the price bounces off 1.2008 with the targets at 1.2112 and 1.2238.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română