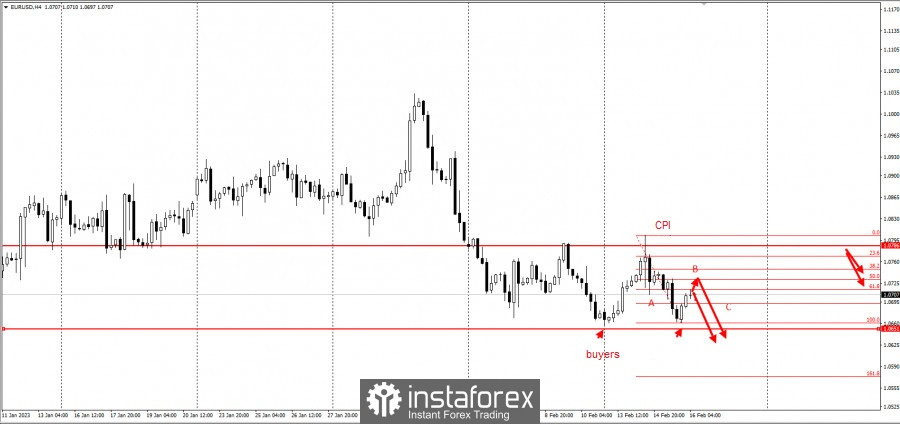

Following the decline in EUR/USD, which was due to the rising inflation in the US, a good buy-stop level is seen in the daily (D1) timeframe.

Considering that there is a long correction, it is likely that the end of it will prompt a further decline of the pair. The scenario will be like this:

This is a three-wave (ABC) pattern, in which wave A represents the selling pressure in the pair. With this, traders can enter the market by selling from the 50% and 61.8% retracement levels and set stop-loss at 1.08. Exit by taking-profit at the breakdown of 1.0655.

The trading idea is based on the "Price Action" and "Stop hunting" methods.

Good luck and have a nice day! Don't forget to control the risks.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română