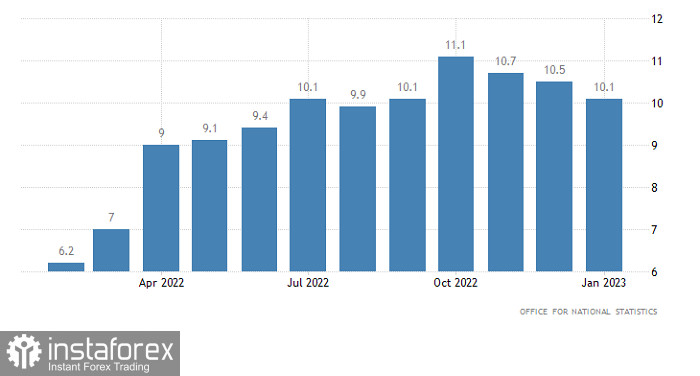

UK inflation slowed down to 10.1% from 10.5% although economists had expected it to drop to 10.3%. Inflation is still at a high rate, but in the wake of such a noticeable drop in the figures, the Bank of England may consider a reduction in the pace of rate hikes or even give up its hawkish stance and keep rates at their current level. That explains why the pound sterling tumbled post-UK inflation.

United Kingdom Inflation:

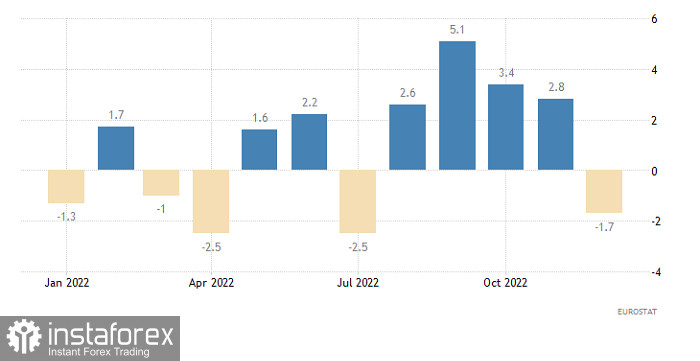

Likewise, the euro showed weakness after the publication of industrial production statistics in the eurozone. Although the previous reading was upwardly revised to 2.8% from 2.0%, the current one nosedived to -1.7.%, well below market expectations of a -0.3% fall.

Eurozone Industrial Production:

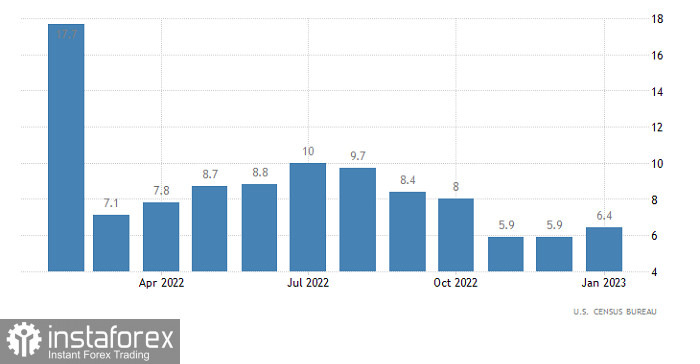

In the North American session, the pound and the euro both extended their downward moves. In fact, they were supposed to increase amid a slowdown in US retail sales growth to 4.5% versus 6.0%. Moreover, the previous reading was revised down as well. However, retail sales actually advanced to 6.4%. Clearly, the greenback strengthened.

United States Retail Sales:

Anyway, there have already been attempts to trigger a correction. After all, the US dollar is now extremely overbought. It could be that after the release of jobless claims data, it will become possible to offset the current imbalance somehow. Thus, initial claims are forecast to rise by 2,000, while continuing ones are set to climb by another 7,000. Although that is going to be a minor change in the figures, it will still be enough on the back of the overbought dollar. Of course, the actual result should come in line with the forecast first.

United States Continuing Jobless Claims:

The euro/dollar pair reached the 1.0650 level and rebounded above 1.0700. It is important that the price consolidates below 1.0650 in the 4-hour time frame at least. Otherwise, it is likely to keep hovering within the 1.0650/1.0800 range.

Speaking of the pound/dollar pair, selling volumes decreased near the psychological level of 1.2000. If the quote settles below 1.1950, we will see a bearish continuation. If it consolidates above 1.2080, the pair may recover somewhat.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română