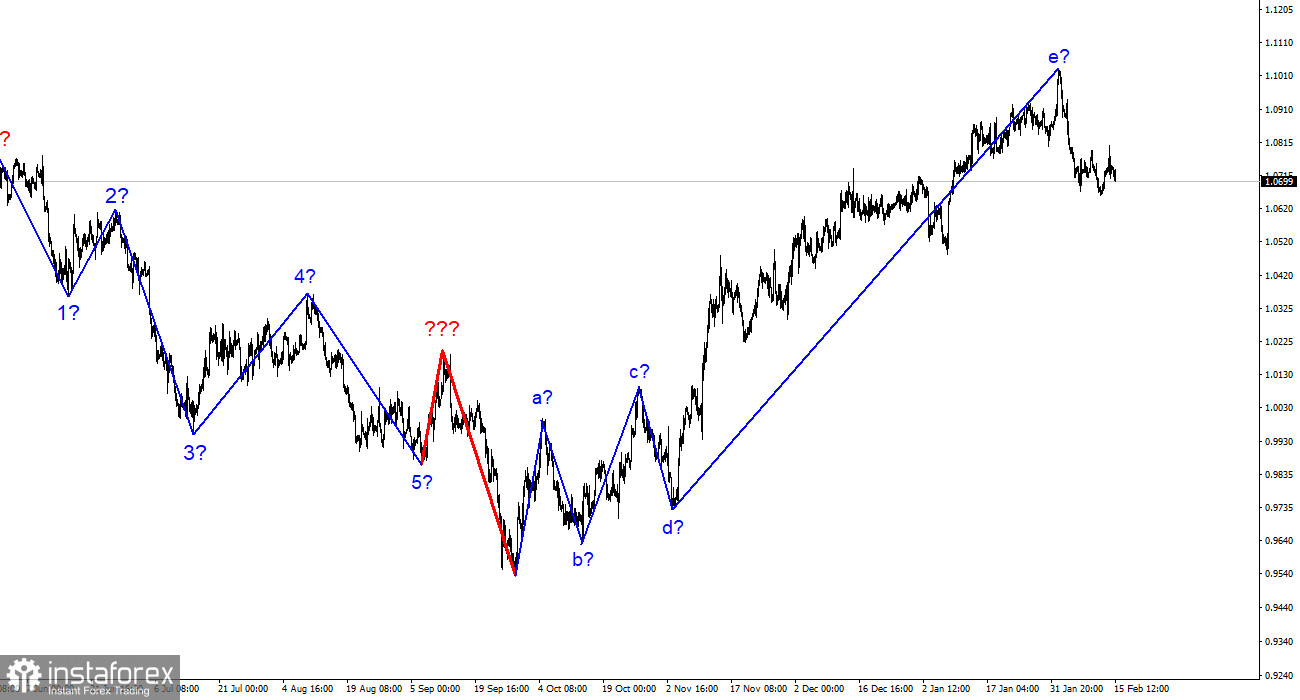

The 4-hour chart for the euro/dollar pair still shows the same wave pattern, which is excellent because it allows us to predict how the situation will develop. Although its amplitude would be more appropriate for the impulsive section, the upward section of the trend has been corrected. The wave pattern a-b-c-d-e that we were able to obtain features a wave e that is far more complex than the other waves. If the wave analysis is accurate, then this structure's development is complete, and wave e was far longer than any other wave. I still anticipate a significant decrease in the pair because we are expected to develop at least three waves downward. The demand for the euro currency was persistently high throughout the first few weeks of 2023, and during this time the pair was only able to deviate marginally from previously reached peaks. The US currency did, however, manage to escape market pressure at the beginning of February, and the present detachment of quotes from the peaks reached can be viewed as the start of a new downward trend section, which I was simply hoping for. I hope that this time, the market's mood and the news context won't impede the formation of a downward series of waves.

Despite a slowdown in US inflation, there has been no change in demand for the pair.

On Wednesday, it was evident that the euro/dollar pair did not determine the direction of trading. If the euro was increasing before the inflation data, the dollar was gaining by the time of the report. This makes sense in part because the US inflation report revealed a rather surprising value that did not placate buyers or sellers. The seventh consecutive decrease in inflation of around 0.5% was required for the currency to weaken. For the US currency to grow, inflation needed to either not decline at all or perhaps rise. However, neither the first nor the second alternative was ultimately offered to the market. Thus, the dollar first increased, then decreased, and finally increased once more. The entire movement came to an end there where it began. However, there will be repercussions for the foreign exchange market from this report. They are capable of being that.

If the market yesterday just did not know how to use the knowledge it had, then over time it will resolve this problem. Already today (the next day), it became known that the probability of three rate hikes in 2023 has increased to 70%, although yesterday it did not exceed 50%. This leads us to the conclusion that there is an increase in expectations for a more aggressive tightening of monetary policy. If the following inflation report likewise proves to be inconsistent, the likelihood of three rises will grow to 90%, and the likelihood of four increases will increase to 60%. And since it is currently difficult to forecast from the ECB what can be anticipated during 2023, all of this will be in the hands of the US dollar. The rate will increase, according to Christine Lagarde and other board members, although it is unclear how much it will increase. Whether the European regulator, like the Fed, is prepared to hike the rate as much as it will take to achieve 2% inflation is the most crucial question to which there is now no clear response.

Conclusions in general

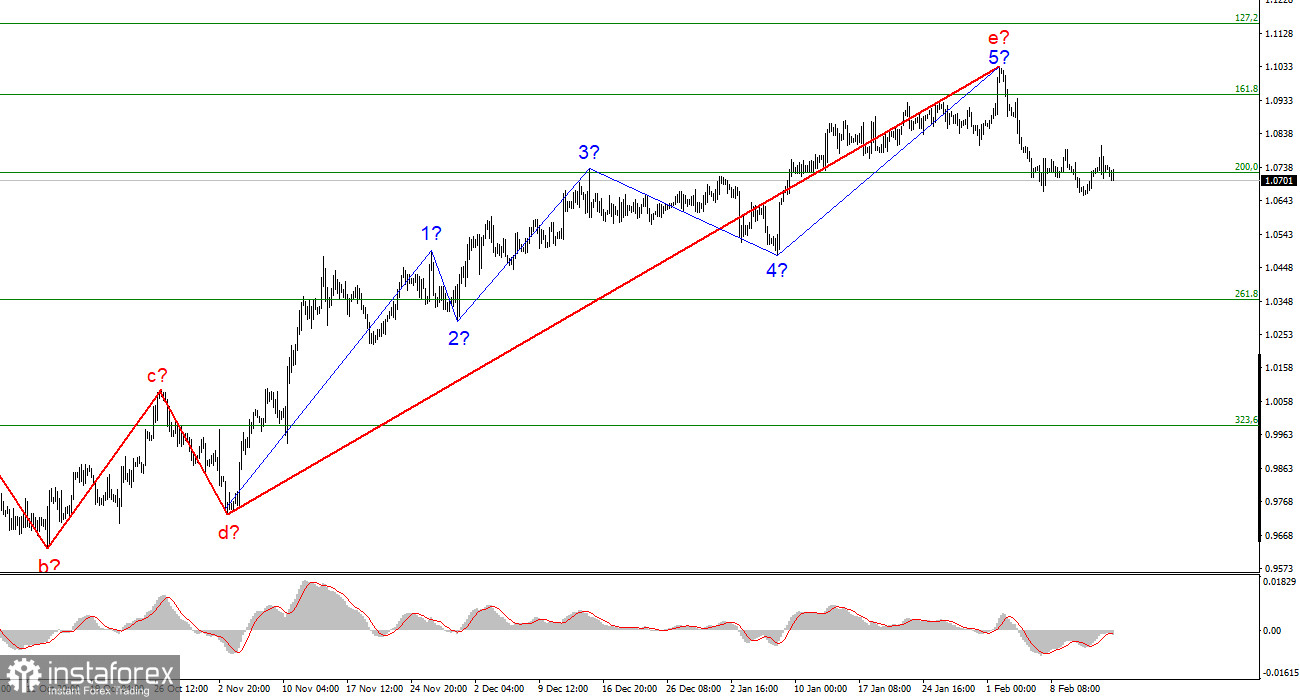

I draw the conclusion that the upward trend section's development is finished based on the analysis. As a result, sales with targets close to the predicted level of 1.0350, or 261.8% Fibonacci, can now be taken into consideration. However, almost for the first time in recent weeks, we notice on the chart a picture that can be termed the start of a new downward trend segment. The likelihood of an even bigger complication of the upward trend segment still exists.

On the older wave scale, the ascending trend section's wave analysis has grown longer but is likely finished. The a-b-c-d-e pattern is most likely represented by the five upward waves we observed. The downward trend's development has already started, and it can take any kind of structure and extent.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română