Technical outlook:

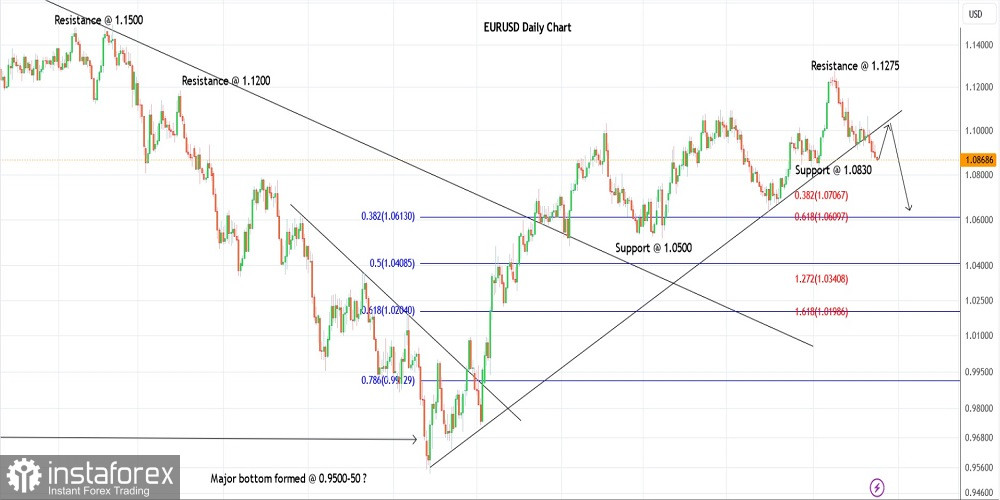

EUR/USD slipped through the 1.0862 lows during the early Asian session on Thursday and the bears might be targeting a break below 1.0830 before giving up. The support at 1.0830 is close to being taken out and a pullback rally might be due soon. The single currency pair is seen to be trading around 1.0865 at this point in writing and could pull back through 1.1100 in the near term.

EUR/USD has carved a larger-degree upswing between 0.9535 and 1.1275 in the past several months. It is currently being retraced and the price is expected to pull back at least towards 1.0500 as highlighted on the daily chart. Before dropping further lower, we can expect a small counter-trend rally towards the 1.1100-50 zone as projected on the daily chart here.

EUR/USD has further completed its first leg of a corrective drop between 1.1275 and 1.0862 or is close to terminating around 1.0830 soon. The bulls would be poised to produce a counter-trend rally through 1.1100 in the next few trading sessions. Also, note that the Fibonacci 0.618 retracement is seen through 1.1150 which is a potential reversal zone.

Trading idea:

A potential drop from 1.1275 looks complete. A counter-trend rally towards 1.1150 might soon resume.

Good luck!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română