You require the following to open long positions on the GBP/USD:

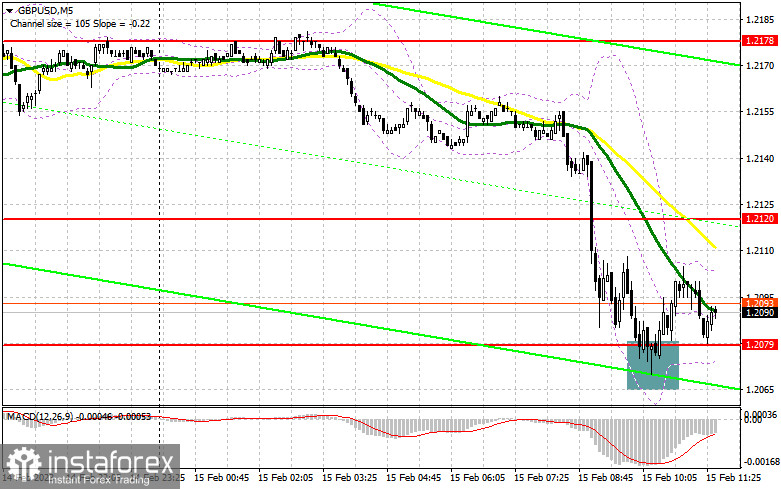

I focused on the level of 1.2079 when I made my morning forecast and suggested trading actions based on it. Let's analyze the 5-minute chart to see what happened. Following the rapid decline of the pound amid reports that UK inflation had slowed down more than anticipated, the formation of a false breakout around 1.2079 provided a great entry point to purchase, leading to a movement of more than 25 points in the GBP/USD. The technical situation barely changed in the afternoon.

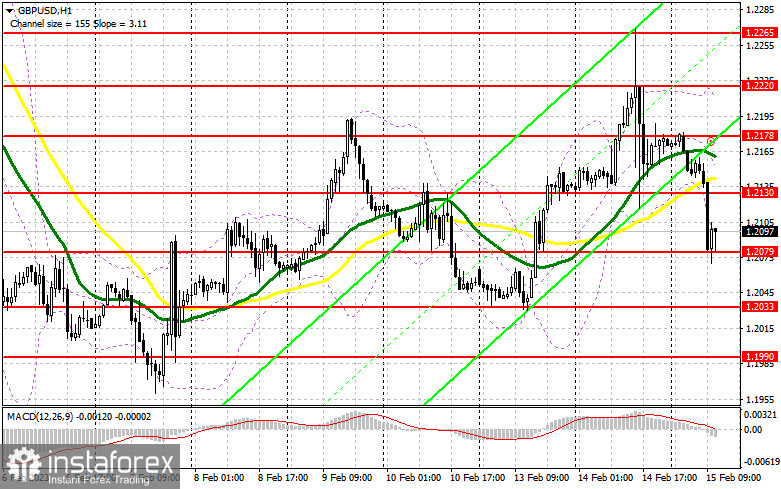

The British pound actively declined as a result of the UK's strong decline in inflation, which was quite predicted, as I said in the morning assessment. But things could change in the afternoon, making it simple for the buyers of the pound to take back their positions. To do this, all you need is bad news on declining retail sales in the US, which will weaken the dollar and cause the pair to move up. We can expect the pair to continue growing and correcting further until trading is completed above 1.2079. The next occurrence of a false breakout around 1.2079 will be indicative of the presence of significant market participants who are betting for the pair's recovery to the 1.2130 level, which is just above where moving averages are already favoring the bears. At 1.2178, where I'll set profits, an exit above this range will also open up growth chances. The pressure on GBP/USD would grow even more if the bulls are unable to complete the tasks assigned to them and miss 1.2079, as the US data will resolve every issue. In this situation, I suggest against making hasty purchases and only starting long positions at the next support level of 1.2033, and only in the event of a false breakout. To achieve a correction of 30-35 points within a day, I will buy GBP/USD right away on the rebound only from 1.1990.

You require the following to open short trades on the GBP/USD:

The intermediate support level of 1.2079 is the bears' current target after they decisively capitalized on the opportunity. The preservation of 1.2130, a new resistance level that developed at the end of the first half of the day, should not be overlooked because a lot will depend on retail sales in the United States. If there is an upward movement, the only way to obtain a sell signal is if there is a false breakout there in the second half and the GBP/USD repeatedly moves significantly down to the 1.2079 level, which has served as support throughout European trade. I anticipate a breakthrough and a reverse test from the bottom up if we do not witness active growth at this level. This will thwart any buyer expectations for ongoing growth, strengthen the bearish sentiment in the market, and provide a sell signal with a decline to 1.2033. The area of 1.1990 will be the farthest target, and any movement there will signal a potential resumption of the downward market. I'll set the profit there. The bulls will feel strong given the potential for a GBP/USD rise and the lack of bears at 1.2130 during the American session. In this instance, the only entry point for short positions is a false breakout in the area of the subsequent resistance level of 1.2178. If there isn't any activity, I'll sell GBP/USD right away at its highest price of 1.2220, but only if I believe the pair will decline another 30-35 points during the day.

Signals from indicators

Moveable Averages

Trading is taking place below the 30 and 50-day moving averages, which suggests that sellers of the pound have returned to the market.

Notably, the author considers the time and prices of moving averages on the hourly chart H1 and departs from the standard definition of the traditional daily moving averages on the daily chart D1.

Bands by Bollinger

The indicator's upper limit, which is located at 1.2220, will serve as resistance in the event of growth.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

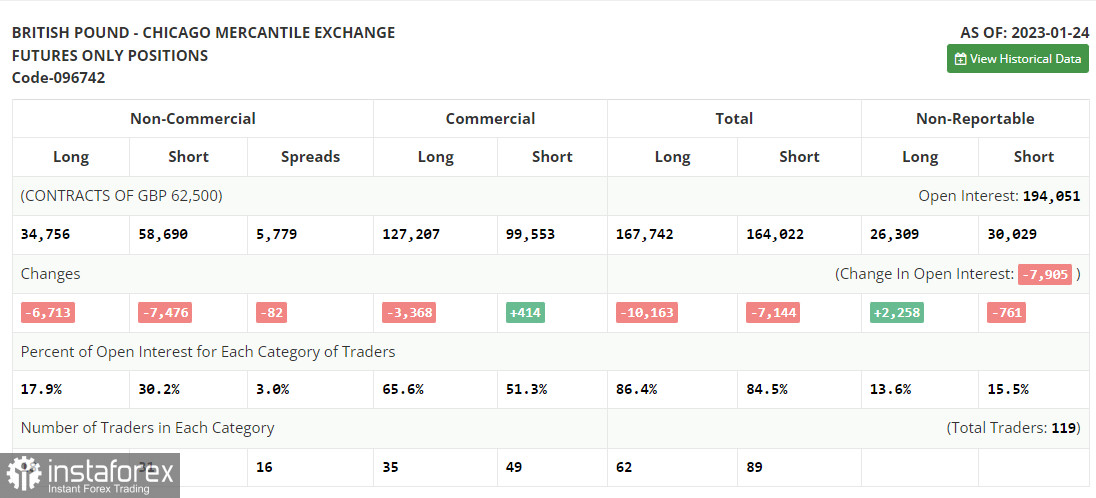

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română