Long positions on EUR/USD:

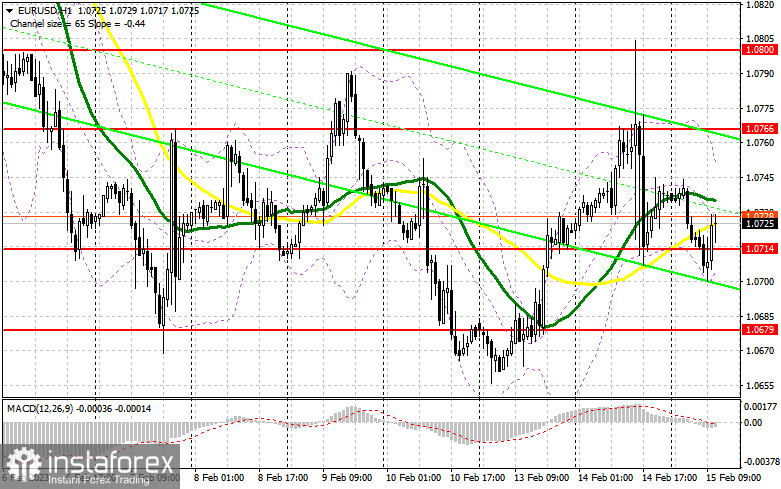

The level of 1.0714 is irrelevant now and much will depend on the market reaction to the US retail sales data. Increased sales in January may increase inflationary pressures and affect both traders' expectations and future interest rate decisions by the Fed. The market expects a strong surge in volatility and it is likely to focus on longer-term support and resistance levels. Only after a false breakout at 1.0679, one may buy the euro with the target at 1.0766. A breakthrough and a test of this level from above, against the background of a sharp decline in retail sales in the US, are likely to create an additional entry point into long positions with the target at 1.0800. The pair may pierce this level only if we see very weak US data. This is likely to trigger bears' stop-loss orders and give an additional signal with the possibility to reach 1.0834, where traders might book profits. If the EUR/USD pair declines and we see no bullish activity at 1.0679 in the afternoon, the pressure on the pair will increase and bulls will completely lose control over the market. In that case, the pair may move to the support of 1.0645. Only a false breakout at this level is likely to give a buy signal. One may go long from the low of 1.0601 or lower at 1.0565, allowing an intraday upward correction of 30-35 pips.

Short positions on EUR/USD:

Bears should defend the resistance of 1.0766. However, the EUR/USD pair's direction depends on the retail sales data, and one cannot predict which way the market will move. In case of a sell-off and a sharp surge, it would be wise to sell the euro on a false breakout from the resistance of 1.0766 with the target at 1.0714. A breakthrough and a downward test of this level may create an additional sell signal with the target at 1.0679, where the battle between bears and bulls will unfold. Fixing below this range in the second half of the day, the price may move down sharply to the area of 1.0645. Market participants may lock in profits at this level. If the EUR/USD pair increases during the North American session and we see weak activity from bears at 1.0766, the bearish scenario will be canceled, and bulls will try to return to the market. In that case, it would be better to postpone the opening of short positions to 1.0800, where you can also sell the euro only after an unsuccessful consolidation. One may open short positions on a rebound from the high of 1.0834, allowing a downward correction of 30-35 pips.

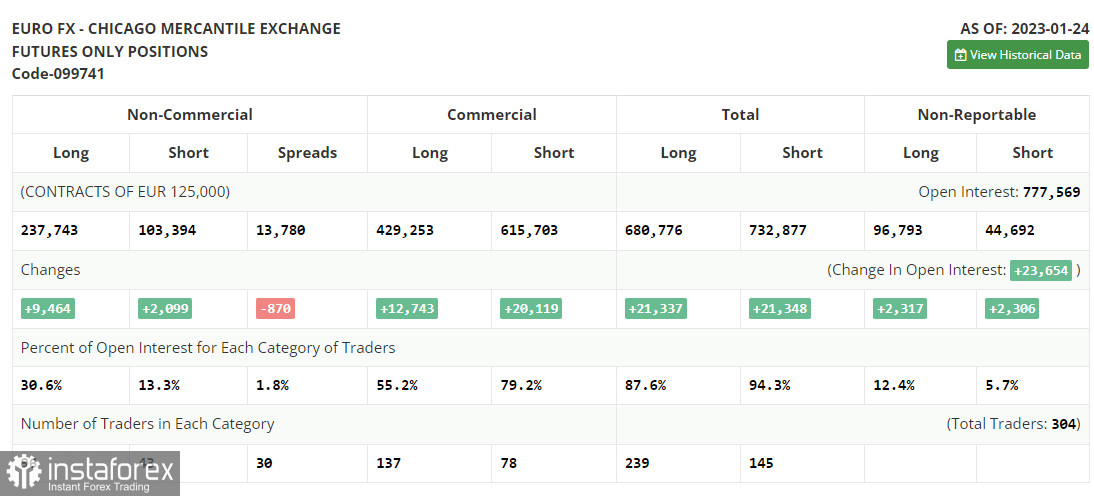

COT report

Since a technical problem in the CFTC has been settled yet, we will use the COT report published on January 24. Thus, the COT report for January 24 logged a rise in both short and long positions. Traders have significantly increased long positions following hawkish speeches of ECB policymakers. They are betting on further monetary tightening by the ECB and the Fed's dovish stance. The US regulator may slow down the pace of rate hikes for the second time in a row. Weak macro statistics on the US economy, namely a drop in retail sales and a slowdown in inflation, may force the central bank to take a pause in rate hikes to avoid any damage to the economy. This week, several central banks will hold their meetings. Their results will eventually determine the trajectory of the euro/dollar pair. According to the COT report, the number of long positions of the non-commercial group of traders increased by 9,464 to 237,743 while short positions advanced by 2,099 to 103,394. At the end of the week, the total non-commercial net position rose to 134,349 from 126,984. It appears investors believe in the upside potential of the euro. Nevertheless, they are waiting for more clues from central banks regarding interest rates. The weekly closing price grew to 1.0919 from 1.0833.

Signals of indicators:

Moving Averages

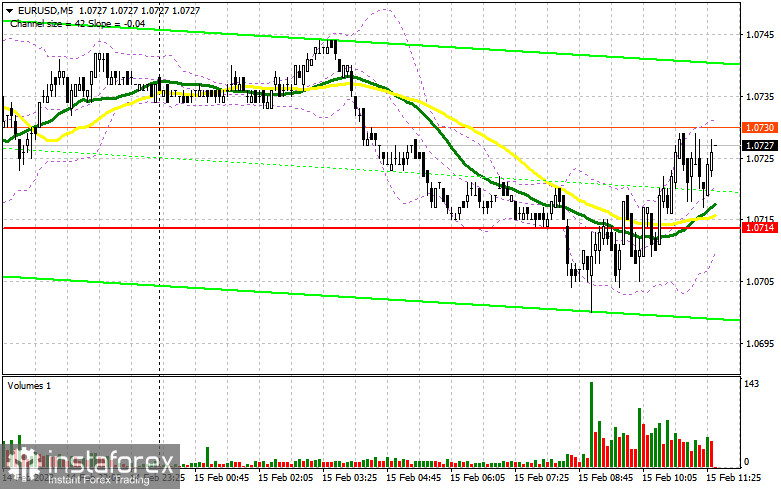

The pair is trading near the 30- and 50-day moving averages, which points to the balance in the market.

Note: The author considers the period and prices of moving averages on the one-hour chart which differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

If the pair declines, the lower band of the indicator located at 1.0705 will offer support.

Description of indicators

- Moving average determines the current trend by smoothing out volatility and noise. Period 50. Marked in yellow on the chart.

- Moving average determines the current trend by smoothing out volatility and noise. Period 30. Marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total number of long positions opened by non-commercial traders.

- Short non-commercial positions are the total number of short positions opened by non-commercial traders.

- Total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română