The news that consumer prices in the United States had increased significantly early this year, indicating persistent inflationary pressures pushing the Federal Reserve to raise interest rates even higher than anticipated, caused the euro and the British pound to decline.

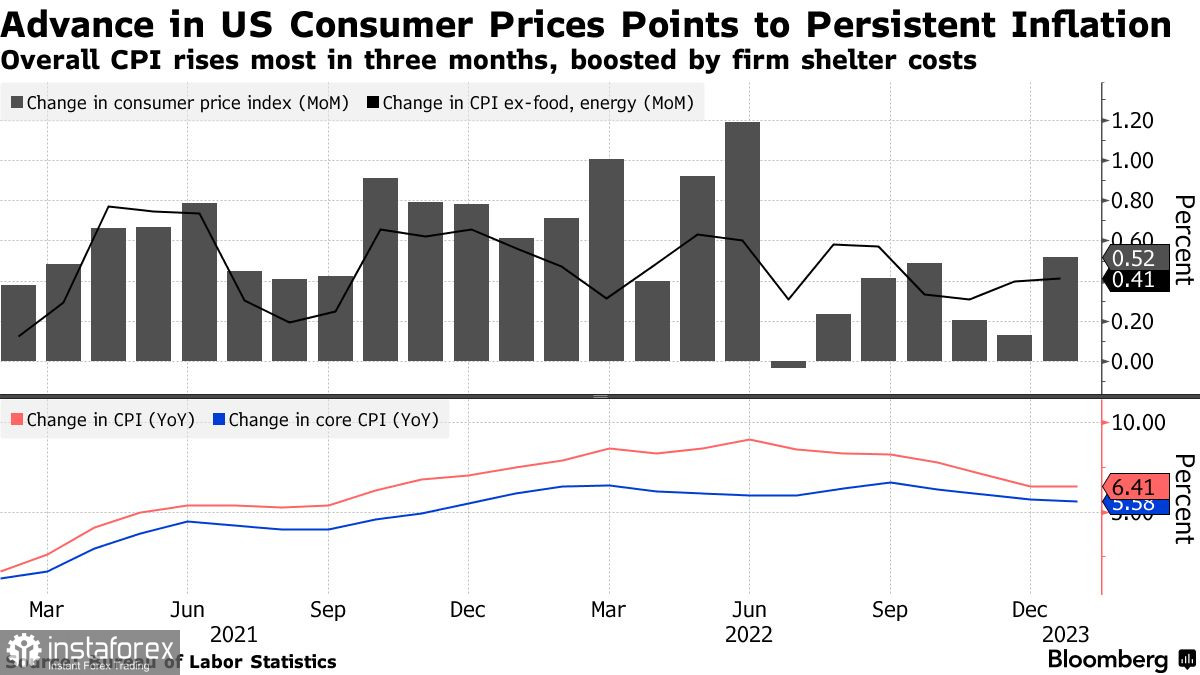

The consumer price index increased by 0.5% in January compared to December of last year, which was the largest increase in the previous three months, according to data released on Tuesday. Costs for housing and energy played a role in this. The index increased by 6.4% on an annualized basis, outpacing economists' predictions that inflation would decline to 6.2%.

The base index, which excludes food and energy, increased by 0.4% last month and by 5.6% when compared to the previous year.

As I mentioned above, economists anticipated 0.5% monthly CPI growth and a 0.4% increase in the primary measure. Both annual measures exceeded expectations and revealed a far slower downturn than in recent months. The numbers continue to be significantly above the Federal Reserve System's 2% target, which is based on a different Commerce Department index. This suggests that the Federal Reserve System will maintain its aggressive policy going forward and that the stock market and risky assets may have difficulties.

The data highlight the economy's strength and raise expectations of continued price pressure rises despite the Fed's aggressive policies, especially when combined with the January report on a significant increase in employment and signs of consumer resilience. The data reinforces recent comments by officials that interest rates must be raised much further and maintained at a high level for an extended period.

The path to the return of regular price pressure will undoubtedly be difficult and lengthy. The recent decline in total inflation caused by the deflation of goods appears to be slowing down, and the strong labor market continues to pose dangers to wage growth and service price increases.

The housing market, which is by far the largest contributor to the overall figure, was responsible for over half of the increase. For the sixth consecutive month, used automobile prices, a major contributor to recent months' deflation, declined. For the first time in three months, energy prices increased.

While a strong, positive market has recently supported wage growth, inflation at the start of the year has countered this development. In a different survey released on Tuesday, average hourly earnings after inflation were adjusted down by 0.2% from the prior month, which was the largest decrease since June. The wage fell by 1.8% from the previous year.

Regarding the technical picture for the EUR/USD, pressure on the pair increased again following the US inflation report. Staying over 1.0710 will cause the trading instrument to surge to the 1.0760 level and stop the bear market. Above this point, you can easily reach 1.0800 and update to 1.0840 in the near future. Only the collapse of support at 1.0710 will put more pressure on the pair and drive EUR/USD to 1.0670, with the possibility of dropping to a minimum of 1.0640, if the trading instrument declines.

Regarding the technical analysis of the GBP/USD, the bulls have not been able to take back the advantage. They still have to surpass 1.2180. Only if this resistance fails will there be a greater chance of a rebound to the area of 1.2260, following which we will be able to discuss a more abrupt movement of the pound up to the area of 1.2320. After the bears take control of 1.2115, from which point the bulls will likely also act more aggressively, it is possible to discuss the return of pressure on the trading instrument. As a result, it is difficult to pass this level. When 1.2115 is broken, the bulls' positions are hit, and GBP/USD is likely to fall back to 1.2070 with a possible increase to 1.2030.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română