EUR/USD

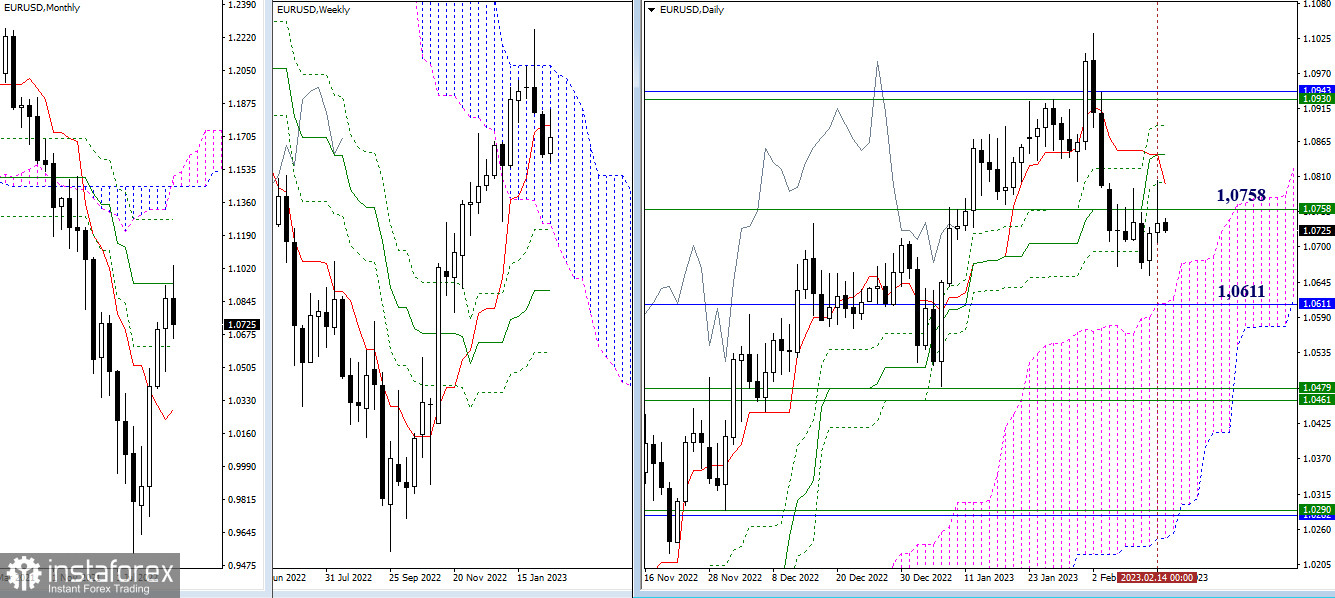

Higher time frames

Another testing of the key resistance levels ended with a daily candlestick having a long upper shadow. Bulls failed to develop an uptrend and returned to the consolidation zone. So, the main obstacles for the buyers are now found at the nearest resistance levels of the daily Ichimoku Cross (1.0800 – 1.0844 – 1.0889) fortified by the weekly short-term trend. As for the bears, their main goal for today is to overcome the monthly support of 1.0611 and settle inside the daily Ichimoku Cloud.

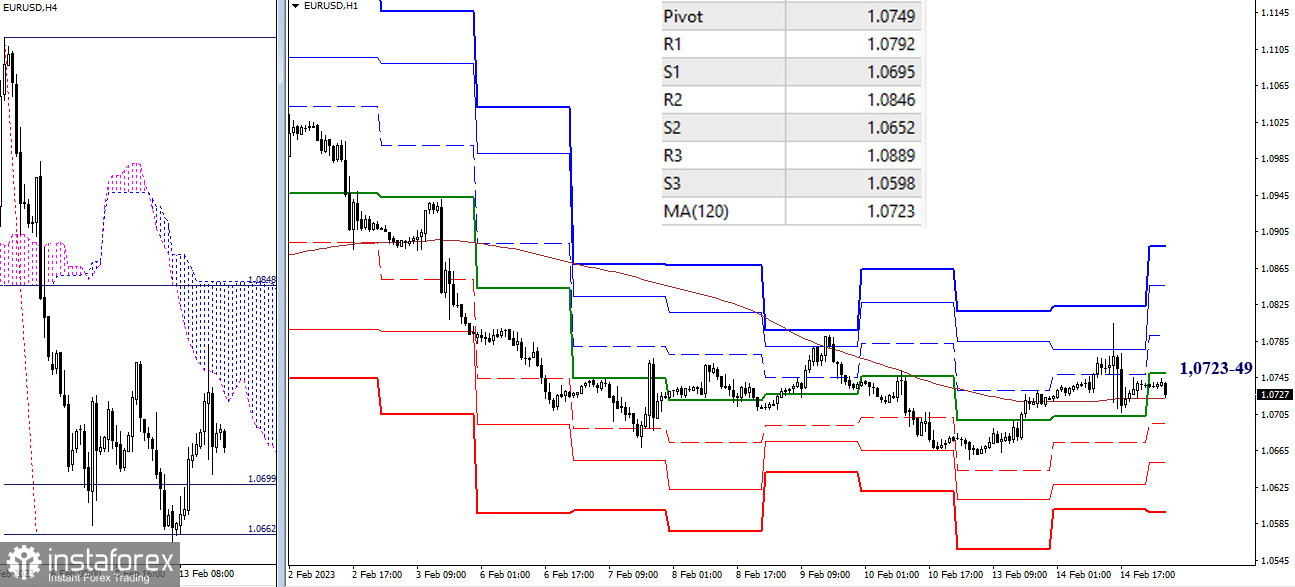

H4 – H1

At the moment, the pair is trying to settle above the key levels of lower time frames which are located at the area of 1.0723-49 (weekly pivot level + weekly long-term trend). Trading above these key levels will support the bullish bias. The next intraday target for bulls is the resistance area formed by standard pivot levels of 1.0792 – 1.0846 – 1.0889. Notably, all upward targets on lower time frames are confirmed on higher time frames as well. So, the resistance formed by standard pivot levels is intensified by the resistance of the daily Ichimoku Cross. If the pair falls below the key levels of 1.0723-49 and settles there, the market balance may change and bears may take over. The downward targets for today are found at the support formed by standard pivot levels of 1.0695 – 1.0652 – 1.0598.

***

GBP/USD

Higher time frames

The pair failed to develop an upward movement after testing the resistance area on the daily chart. Yesterday's candlestick has a long upper shadow. The final levels of the daily Ichimoku Cross (1.2203 – 1.2261) act as untested resistance. Other levels of the daily Ichimoku Cross and the weekly short-term trend (1.2115 – 1.2144) serve as support on lower time frames. The pair has no clear direction at the moment. The buyers will have to overcome the resistance levels of 1.2203 – 1.2261 – 1.2302 – 1.2373. The main goal for bears is to settle inside the Ichimoku Cloud (1.2083) and to test the support levels of 1.1842 – 1.1795 (monthly level + lower boundary of the daily cloud).

H4 – H1

On lower time frames, bulls are in control of the market although they have lost the support at the central pivot level of 1.2185. The latter serves today as an upward target among other levels, including 1.2185 – 1.2254 – 1.2337 – 1.2406 (standard pivot levels). The key support for today is the weekly long-term trend at 1.2113. A fall below this level can change the market balance. Other support levels are found at 1.2102 – 1,2033 – 1,1950.

***

Technical analysis is based on:

Higher time frames – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower time frames – H1: Pivot Points (standard) + 120-day Moving Average (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română