The U.S. Consumer Price Index (CPI) report expectedly provoked increased volatility in the EUR/USD pair. But despite the price turbulence, traders failed to interpret the report. "In the moment," during the first minutes after the release, the pair fell sharply to 1.0729. Then the price soared to 1.0800. However, the bulls were also unable to hold steady in the area of the 8th figure. When this article was being prepared these lines showed chaotic fluctuations within the 7th figure, reflecting how indecisive both bulls and bears were.

The resonance report

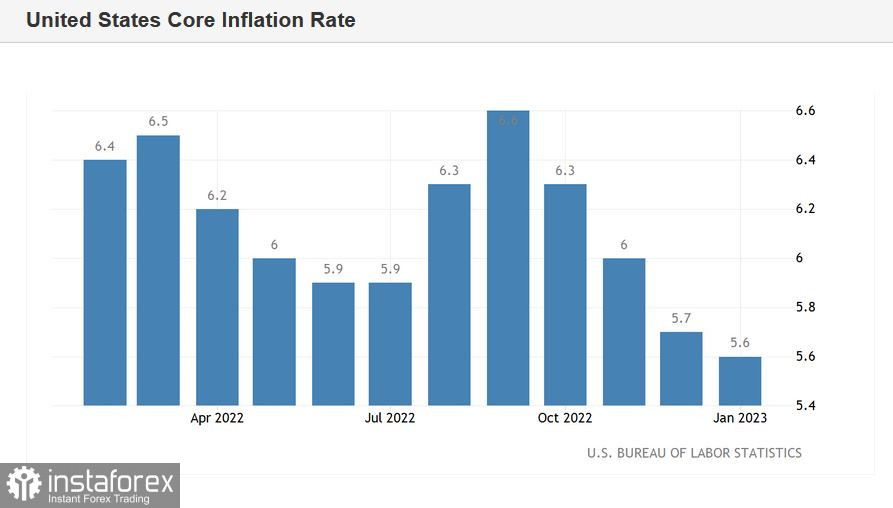

The contradictory reaction to the report can be explained by the contradictory nature of the release itself. For example, on a monthly basis the CPI (both general and core) showed a positive trend. US January CPI increased 0.5% m/m (the strongest growth rate since June 2022), the core CPI to 0.4% m/m (as in the previous reporting period, i.e. in December). In annual terms, inflation slowed down, but the rate of decline decreased. The CPI came in at 6.4% (in December at 6.5%), while experts predicted a more significant decline to 6.2%. The base index, excluding food and energy prices, came out at 5.6%, while the forecast was for a decline to 5.5%.

The structure of the report suggests that the energy measure advanced by 8.7% in January (in December there was a 7.3% increase). In particular, gasoline rose by 1.5%, while in the previous reporting period it had become cheaper by the same amount. The cost of food rose 10.1% in January, after an almost identical increase (10.4%) the month before.

What does inflation say?

The big question is: What do these figures tell us? On the one hand, year-over-year inflation in the U.S. continues a gradual but consistent decline. The CPI has been showing a downtrend for the seventh straight month, while the core index for the fourth straight month. But on the other hand, the latest report showed that inflation is no longer slowing down that fast. The "green color" of this data is an eloquent testament to that.

The dynamics of January inflation should be viewed through the prism of recent statements from Federal Reserve officials - most notably Fed Chairman Jerome Powell. He made it clear last week that the central bank intends to continue to pursue a hawkish course, despite the fact that the disinflationary process has begun in some sectors of the U.S. economy. Powell said that inflation in the U.S. is likely to fall to the target level only in 2024. In the context of such prospects, it became clear that, firstly, the Fed would continue to raise the rate, and secondly, the central bank would keep the policy at a restrictive level for quite a long time (for example, the head of the New York Fed recommended keeping the rate high for several years).

After strong Nonfarm data and fairly hawkish comments from Powell, the probability of a rate hike at the March meeting rose to 95%, to 70% at the May meeting, and to 33% at the June meeting (according to CME FedWatch Tool).

Based on the latest release, the market is still nearly 100% confident in a 25-point rate hike in March. But hawkish expectations for the Fed's next moves have also risen. Thus, the probability of a 25-point rate hike in May is now at 78% and in June it is 52%.

However, at the moment, these are traders' respective conclusions on the results of the controversial inflation report. How Powell and/or other representatives of the Fed (primarily those who have voting rights in the Committee) interpret the report is an open question.

Let me repeat: y/y inflation is still on a downtrend. But the rate of decline in CPI has clearly slowed.

Conclusions

The market has not yet formed its attitude towards the latest US inflation report. Despite the increased volatility, traders could not determine the vector of price movement. In my opinion, the January inflation report can strengthen the dollar's position in prospect, but it will need additional support from the central bank. If representatives of the Fed will express some form of concern about the slow pace of CPI decline, bears will have a reason for a breakthrough.

In that case bears will be able not only to consolidate in the area of the 6th figure, but also to overcome the support level of 1.0650 (bottom line of the Bollinger Bands indicator on the D1 chart). Take note that Patrick Harker, John Williams, Loretta Mester, James Bullard, Lisa Cook, Thomas Barkin and Michelle Bowman are expected to speak this week. Their comments will help traders form their views on the dynamics of January inflation. In other words, it will become clear soon: will the bears be able to return the price to the area of the 6th figure, or will the bulls develop their attack to the range of 1.0800 - 1.0850.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română