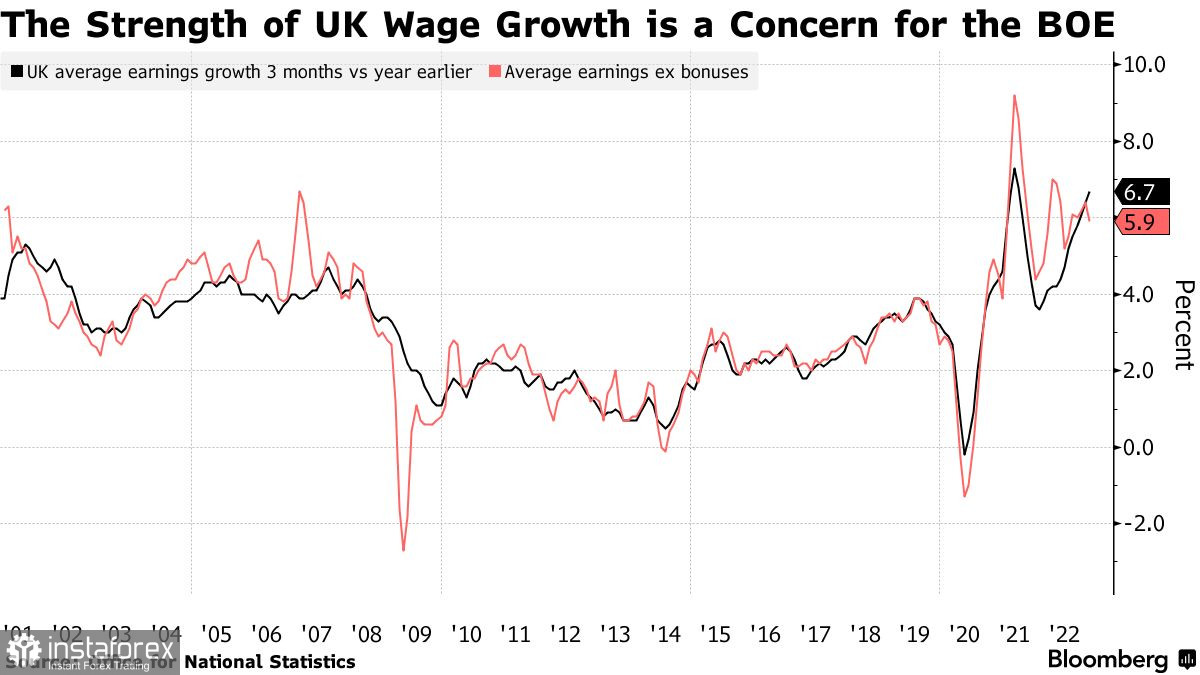

Pound jumped after data showed that UK wages rose faster than expected at the end of 2022. This is sure to put pressure on the Bank of England to raise interest rates again next month, keeping policy still aggressive.

According to the report, average earnings, excluding bonuses, rose 6.7% in the three months to December. This is the fastest rate since accounting began in 2001.

The figures provide a further argument for Bank of England policymakers, who have recently stated that they need to take a pause in further monetary policy tightening as it is very damaging to the economy. They will now have to do a lot more to bring double-digit inflation back to the 2% target. Tension in the labor market also poses a big problem to the central bank.

The situation is similar to that of the US, where Federal Reserve officials were stunned by the latest January labor market report, which showed continued growth in new jobs even with the interest rate hovering around 5.0%.

Many UK politicians have repeatedly pointed out that high inflation risks entrenching the economy if workers continue to raise wages as companies continue to raise prices to cover their wage costs. That creates an inflationary spiral, which, in a healthy economy, unwinds very quickly. Obviously, the tight labor market situation will remain a source of domestic inflationary pressure for a few more months, and it is likely that the Bank of England will be forced to keep raising rates.

As noted above, the UK economy has continued to create new jobs at a healthy pace with employment rising by 74,000 in the last quarter of 2022, almost three times the rate of the previous three-month period. Wage growth was even faster, increasing by 0.1% to 6.5%. Chancellor of the Exchequer Jeremy Hunt view these figures as a sign of a strong economy, but said officials needed to bring inflation down. "In difficult times, unemployment remaining close to record lows is an encouraging sign of the resilience of our labor market," he said. "The best thing we can do to increase people's wages is to stick to our plan to cut inflation in half this year," he added.

In GBP/USD, the bulls have almost regained all the advantage they lost at the end of last week. The breakdown of 1.2190 is needed so that the pair will proceed to 1.2240 and 1.2290. But if bears gain control of 1.2115, a drop to 1.2030 and 1.1965 is possible.

Pressure on EUR/USD eased as everyone is focused on the new fundamental data. To stop the bear market, a hold above 1.0710 is needed as that will spur a rise towards 1.0750, 1.0790 and 1.0830. In case of a decline below 1.0710, the pair will rush down to 1.0670 and 1.0640.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română