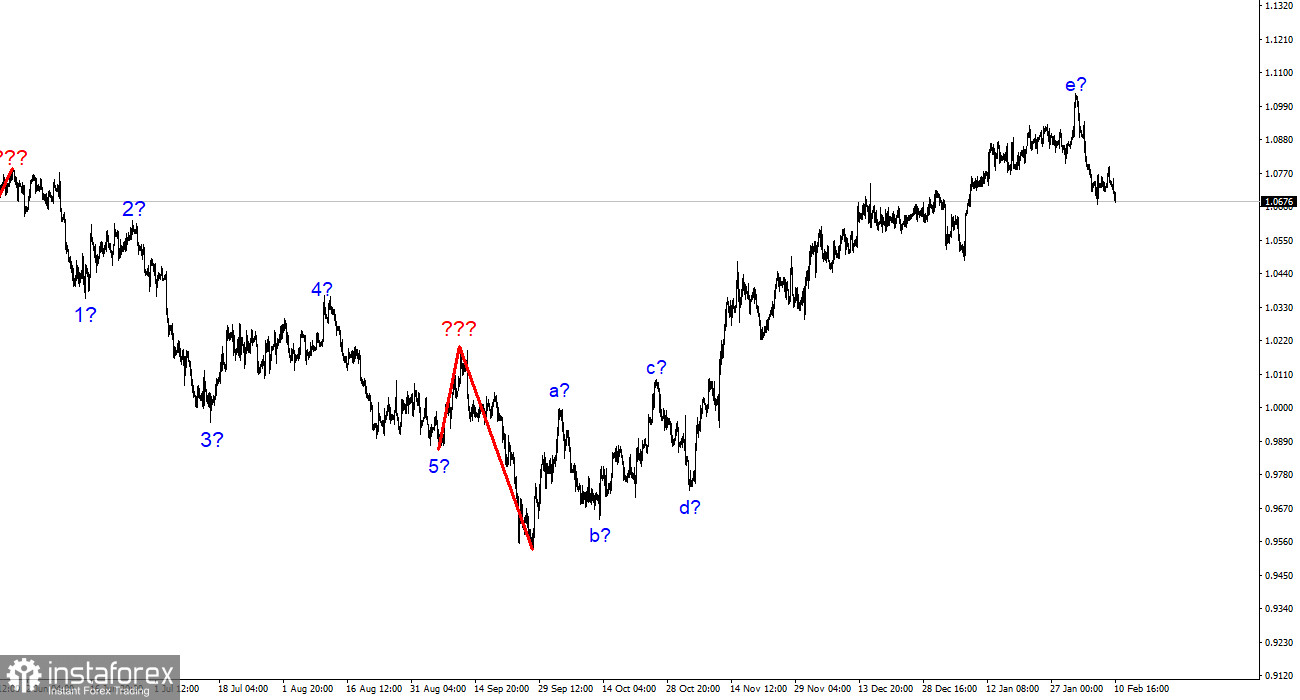

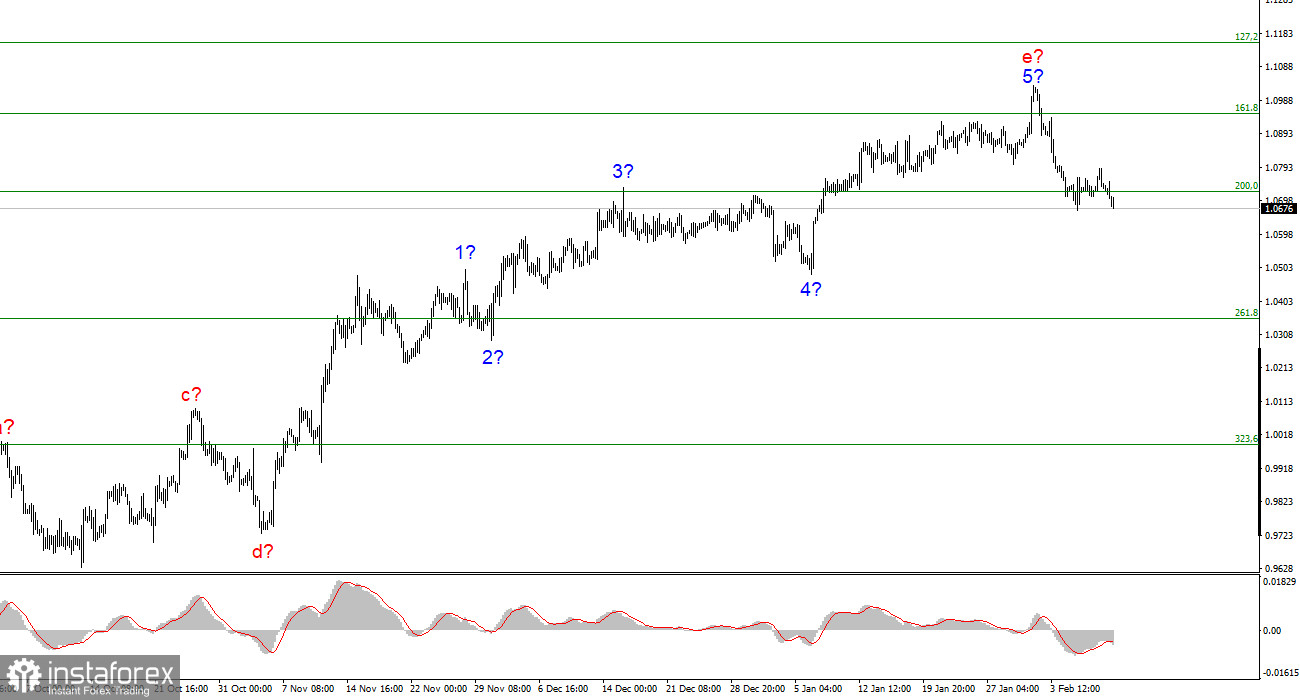

The 4-hour chart for the euro/dollar pair still shows the same wave pattern, which is excellent because it allows us to predict how the situation will develop. Although its size would be more appropriate for the impulsive section, the upward section of the trend has been corrected. The wave pattern a-b-c-d-e that we were able to obtain features a wave e that is far more complex than the other waves. If the wave analysis is accurate, then this pattern's development is complete, and wave e was far longer than any other wave. I still anticipate a significant decrease in the pair because we are expected to develop at least three waves downward. The demand for the euro was persistently high throughout the first few weeks of 2023, and during this time the pair was only able to deviate marginally from previously reached peaks. The US currency did, however, manage to escape market pressure at the beginning of February, and the present detachment of quotes from the peaks reached can be viewed as the start of a new negative trend section, which I was simply hoping for. I hope that the current news environment and market sentiment will not impede the formation of a downward series of waves this time.

Updated prediction for Eurozone GDP

On Monday, the euro/dollar pair barely moved at all. No price changes have been made. No news context is provided. Almost nothing has changed since Friday. Based on this, we may anticipate a continuation of the drop in quotes, as wave analysis is now, in my opinion, the most crucial component in contrast to other aspects. The European currency reached its high value a little over a week ago, and since the market was not prepared to support further growth in demand for it, it is now necessary to create a trend correction. Given how much length the wave e has acquired, the correction ought to be appropriate.

On Monday, though, something intriguing happened. Today, the European Commission released a new estimate for 2023's economic growth, increasing the previous estimate. In contrast to the earlier forecast of 0.3% growth, it is now predicted to increase by 0.9%. This comes as a big surprise considering that analysts have recently nearly completely written off the European economy since they think a recession is inevitable. However, a lot of individuals made the same claim about the United States and the United Kingdom last year. According to official economic data, it appears premature to conclude that a recession has started anywhere. All recent predictions, nevertheless, tend to be untrue. Many people feared a recession last summer, but by January 2023, oil and gas prices had declined, making it feasible to avert an energy crisis. And as it is right now, there may not even be an economic decline. The ECB is planning for future interest rate increases, although inflation is decreasing far too slowly. It is difficult to predict how many further increases will be made. Long-term predictions are risky given how dependent the present news environment is on itself. I believe it is advisable to continue the wave pattern at this time.

Conclusions in general

I draw the conclusion that the upward trend section's development is finished based on the analysis. As a result, sales with targets close to the predicted level of 1.0350, or 261.8% Fibonacci, can now be taken into consideration. However, almost for the first time in recent weeks, we notice on the chart a picture that can be termed the start of a new downward trend segment. The likelihood of an even bigger complication in the upward trend segment still exists.

On the older wave scale, the upward trend section's wave marking has grown longer but is likely finished. The a-b-c-d-e pattern is most likely represented by the five upward waves we observed. The negative section of the trend is already taking shape and can have any form or extent.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română