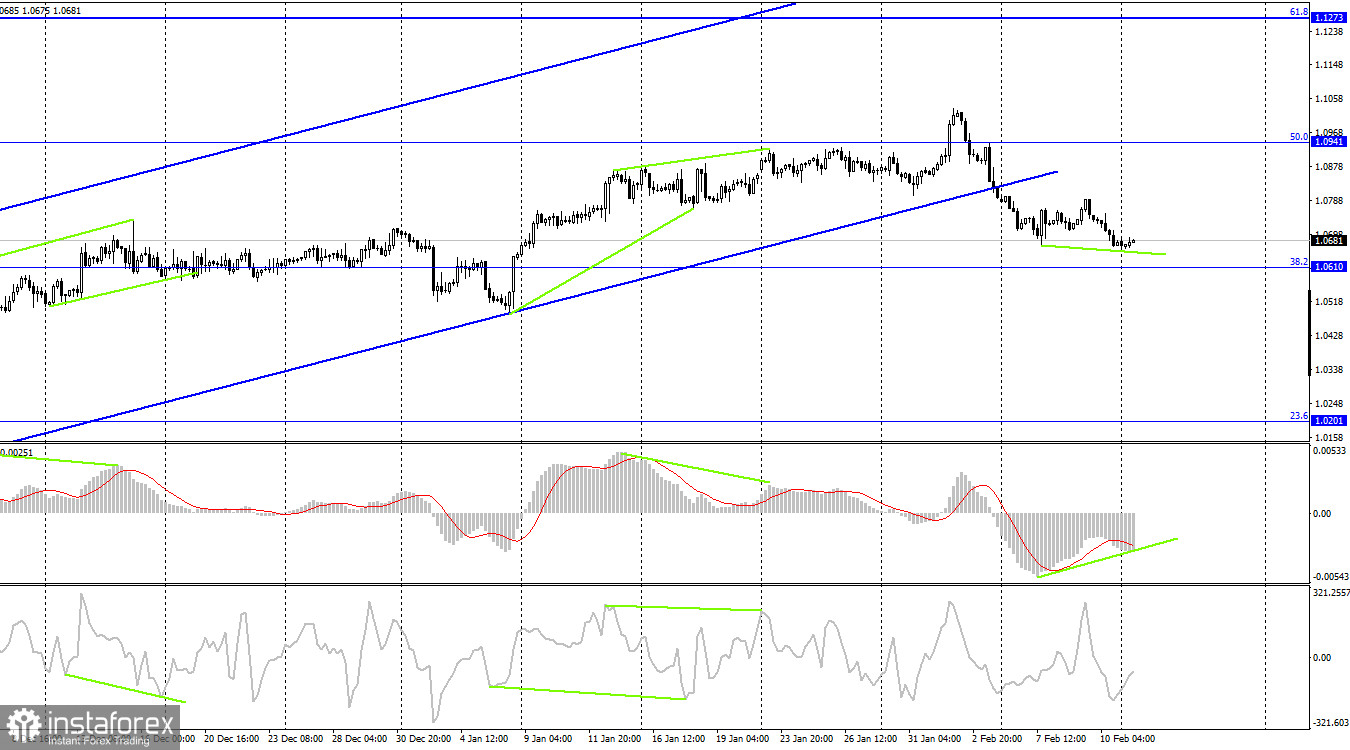

On Friday, the EUR/USD pair performed a rebound from the 1.0750 level, a new currency reversal in favor of the US dollar, and resumed its decline toward the corrective level of 161.8% (1.06140. The current downward trend line describes traders' attitudes as being "bearish." Fixing the exchange rate of the pair above it will benefit the euro and might signal that the bears are taking a break. The strength of the information background this week will be sufficient to alter the traders' outlook.

Monday, as is so often the case, will be boring. We can already predict that there won't be any significant movements today. Significant data on inflation for January will be revealed in the US tomorrow, so the situation could alter. Since central banks have set a target to bring their indices back to 2%, inflation is still the key factor in every situation. In the European Union and the United States, this target is still very far off, so the monetary policy may shift significantly more. Additionally, any modification to the PEPP may have a significant impact on the exchange rate. Therefore, a lot now depends on inflation. A further drop in the CPI to 6.2% y/y reflects the expectations of traders. If we observe this value precisely, we can say that the slowdown is reducing. But in my view, this is a typical occurrence. The Fed won't need to alter its policy's direction once more if inflation keeps falling, which is the most important factor. As of now, the market anticipates one or two additional rate increases, which traders have undoubtedly considered. Last week, Powell made it apparent that the rate might increase a bit more. Thus, the likelihood of a larger PEPP tightening increases if inflation declines less. If the inflation number is higher than 6.2–6.3% tomorrow, the US dollar may continue to increase.

The pair is still declining on the 4-hour chart and has managed to stay under the upward trend channel. Since the pair left the threshold where they had been since October, I believe this moment to be of utmost importance. The current "bearish" trading sentiment offers the US dollar good growth chances with targets of 1.0610 and 1.0201. The MACD indicator's developing "bullish" divergence gives the bulls some cause for optimism.

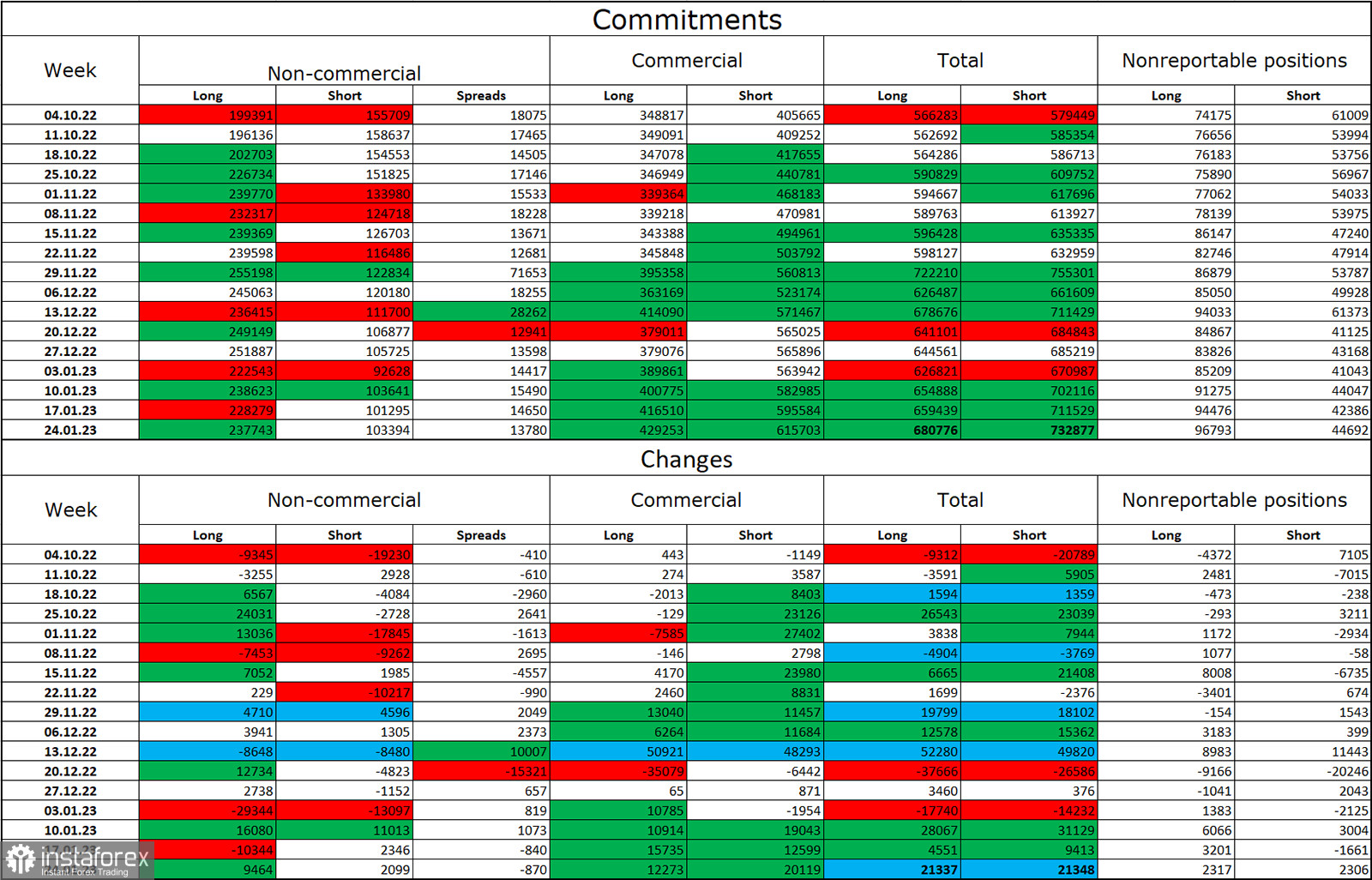

Report on Commitments of Traders (COT):

Speculators opened 9,464 long contracts and 2,099 short contracts during the most recent reporting week. Major traders' attitude is still "bullish" and has somewhat improved. Currently, 238 thousand long futures and 103 thousand short contracts are all concentrated in the hands of traders. The COT figures show that the European currency is now growing, but I also see that the number of long positions is over 2.5 times greater than the number of short positions. The likelihood of the euro currency's growth has been steadily increasing over the past few months, much like the euro itself, but the information background hasn't always backed it up. After a protracted "dark time," the situation is still favorable for the euro, therefore its prospects are still good. Until the ECB gradually raises the interest rate by a percentage of 0.50%, at least.

Calendar of events for the United States and the European Union:

There is no noteworthy event on the calendars of economic events in the United States or the European Union on February 13. Today's traders won't be affected by the information background's sentiment.

Forecast for EUR/USD and trading advice:

When the pair closed below the threshold on the 4-hour chart, I suggested selling the pair. The targets are 1.0614 and 1.0750. Open sales transactions are possible. On the 4-hour chart, purchases of the euro currency are conceivable when it recovers from the level of 1.0610 with a target of 1.0750.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română