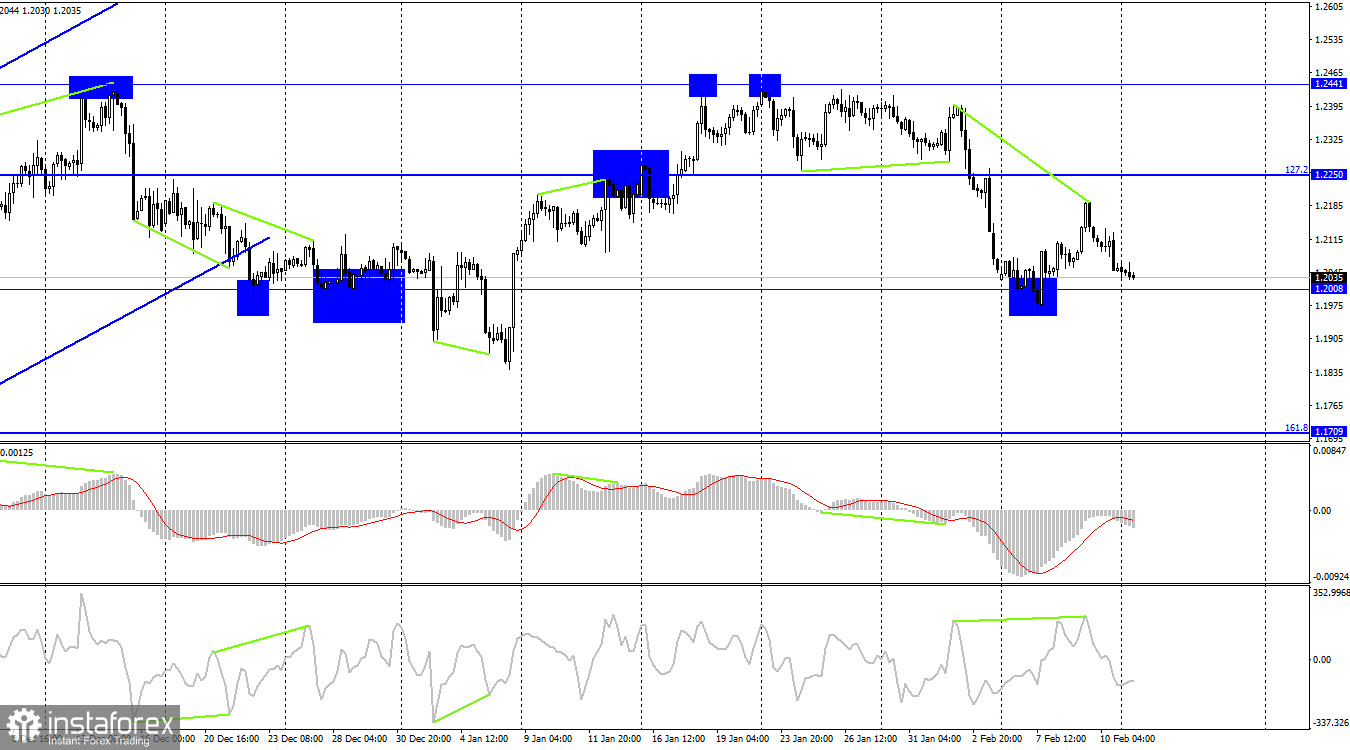

The GBP/USD pair performed a new consolidation on Friday under the corrective level of 127.2% (1.2112), allowing us to forecast that the decline will continue in the direction of the 1.2007 level. This is seen on the hourly chart. The likelihood of an even bigger decline toward the following level of 1.1883 will increase if the pair's rate is fixed below this level. The declining trend line currently describes the current trading environment as "bearish." The British pound will only benefit from correcting it.

The UK published a report on GDP in the fourth quarter as well as an updated third-quarter figure on Friday. Both the first and second reports can be viewed negatively by the British pound because the economy has contracted and is still heading toward recession. There is currently a belief that the recession won't last too long or be too severe. I would not be overly enthusiastic, though, as forecasts are frequently revised. The issue is that GDP is not the only thing declining. For instance, compared to December 2021, industrial production fell by 4% in December 2022. Additionally, 2021 was not the most prosperous year. Consumer and investor expectations are still negative, and corporate activity is still low. The Bank of England's board has been warning about the impending recession for some months, and inflation shows no signs of slowing down anytime soon.

There will be inflation this week not only in the US but also in the UK, which can only support my predictions. A third consecutive reduction in inflation is possible, but only the first slowdown can be regarded as real. Even though it has been increasing the rate at each meeting for more than a year, the Bank of England must recognize that it is currently failing miserably in its efforts to combat inflation. As a result, the British pound will now have a hard time getting help from either inflation itself or the regulator. Bull traders no longer find any justification for continuing to buy now that the price has been flying directly in the opposite direction of its lows throughout its entire history.

The pair reversed in favor of the US currency on the 4-hour chart as the CCI indicator established a "bearish" divergence. As a result, the process of falling toward the 1.2008 level started. Closing below the level of 1.2008 will raise the possibility of a further decline in the direction of the following Fibo level of 161.8% (1.1709), as no new emerging divergences are seen in any indicator.

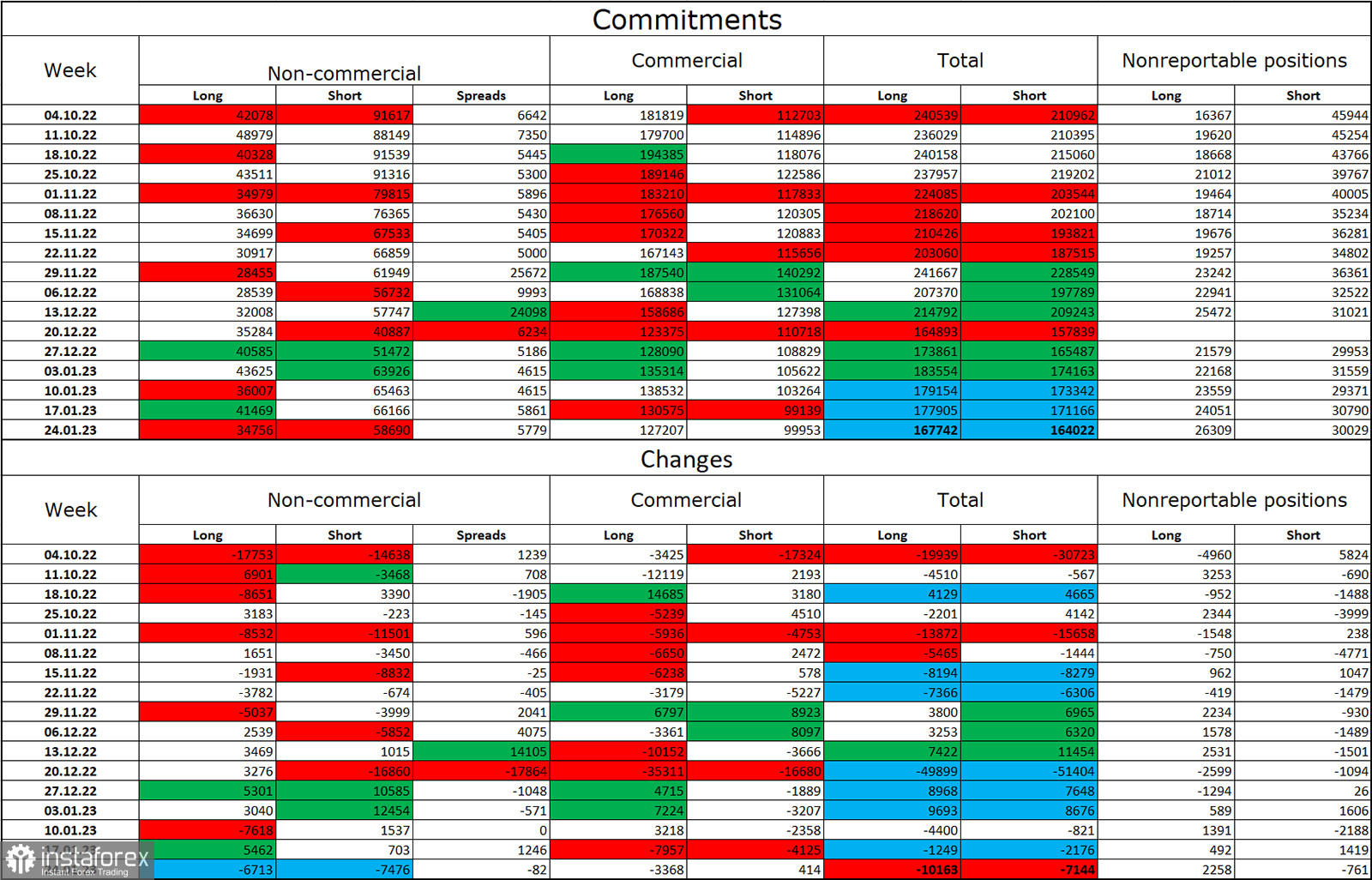

Report on Commitments of Traders (COT):

Over the most recent reporting week, the sentiment among traders in the "Non-commercial" category was less "bearish" than it had been the previous week. The number of long contracts held by investors dropped by 6,713 units, while the number of short contracts dropped by 7,476. The major players' overall outlook is still "bearish," and there are still more short-term contracts than long-term contracts. The situation has shifted in favor of the British pound over the last few months, but today the number of long and short positions in the hands of speculators is nearly doubled once more. As a result, the outlook for the pound has once again declined, but it is not eager to decline and is instead concentrating on the euro. An exit from the three-month upward area was visible on the 4-hour chart, and this development may have stopped the pound's growth.

The following is the UK and US news calendar:

The US and UK economic event calendars are both empty on Monday. The rest of the day won't see any impact from the information background on traders' attitudes.

Forecast for GBP/USD and trading advice:

When the trend line rebounds again or when the 4-hour chart closes below the level of 1.2008 with a target of 1.1883, new sales of the British pound might be initiated. On a 4-hour chart, purchases of the pair can be initiated when it rises over the 1.2008 level with targets of 1.2112 and 1.2238.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română