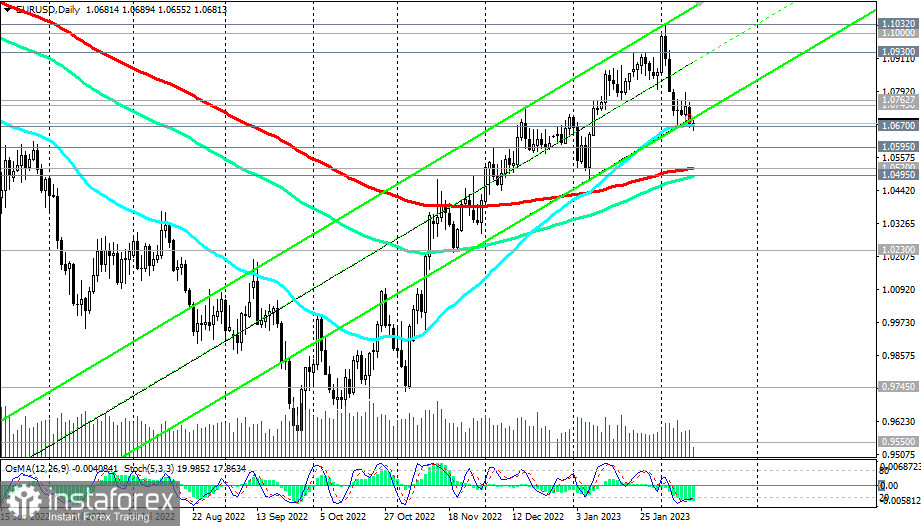

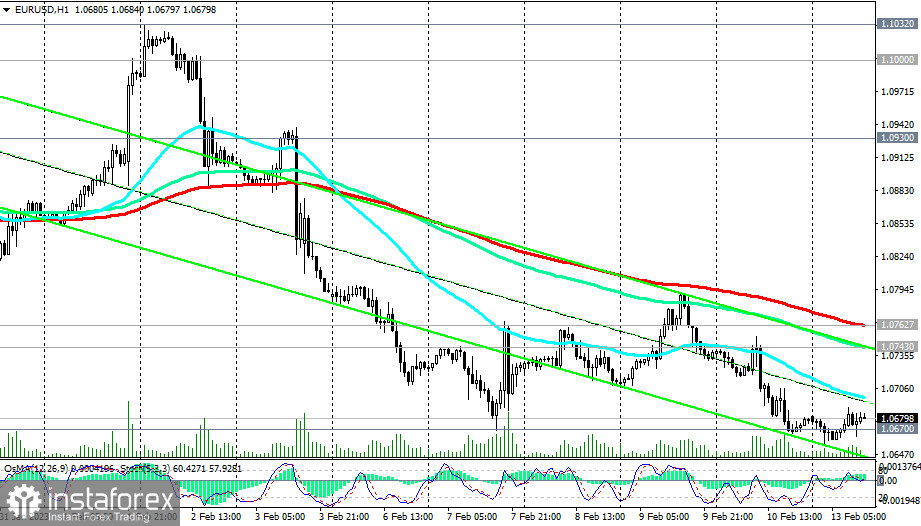

The EUR/USD pair found support today at the important level of 1.0670 (50 EMA on the daily chart), having also managed to update the 4-week low at 1.0656 during the Asian trading session.

The pair is trading in the area below the important short-term resistance levels 1.0763 (200 EMA on the 1-hour chart), 1.0743 (200 EMA on the 4-hour chart), and the breakdown of the 1.0670 support level will be an additional signal in favor of increasing short positions with the target at key support levels 1.0570 (200 EMA on the daily chart), 1.0495 (144 EMA on the daily chart). Their breakdown will finally return EUR/USD to the long-term bear market zone.

In an alternative scenario, EUR/USD will resume its upward correction. However, to resume long positions, it is necessary to wait for the pair to consolidate in the zone above the resistance levels 1.0763, 1.0743.

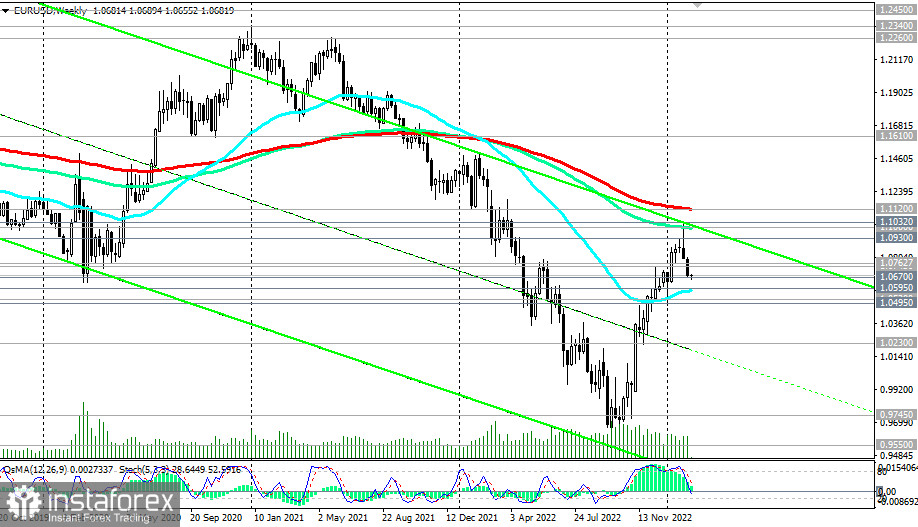

However, it is also necessary to remember that below the key resistance levels 1.1000 (144 EMA on the weekly chart), 1.1120 (200 EMA on the weekly chart), EUR/USD remains in the zone of a long-term bearish market. Therefore, price growth above these marks is not yet expected.

At the moment, short positions are preferable.

Support levels: 1.0670, 1.0595, 1.0520, 1.0495, 1.0230

Resistance levels: 1.0743, 1.0763, 1.0800, 1.0900, 1.0930, 1.1000, 1.1032, 1.1130, 1.1610

Trading scenarios

Sell Stop 1.0650. Stop-Loss 1.0715. Take-Profit 1.0595, 1.0520, 1.0495, 1.0230

Buy Stop 1.0715. Stop-Loss 1.0650. Take-Profit 1.0743, 1.0763, 1.0800, 1.0900, 1.0930, 1.1000, 1.1032, 1.1130, 1.1610

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română