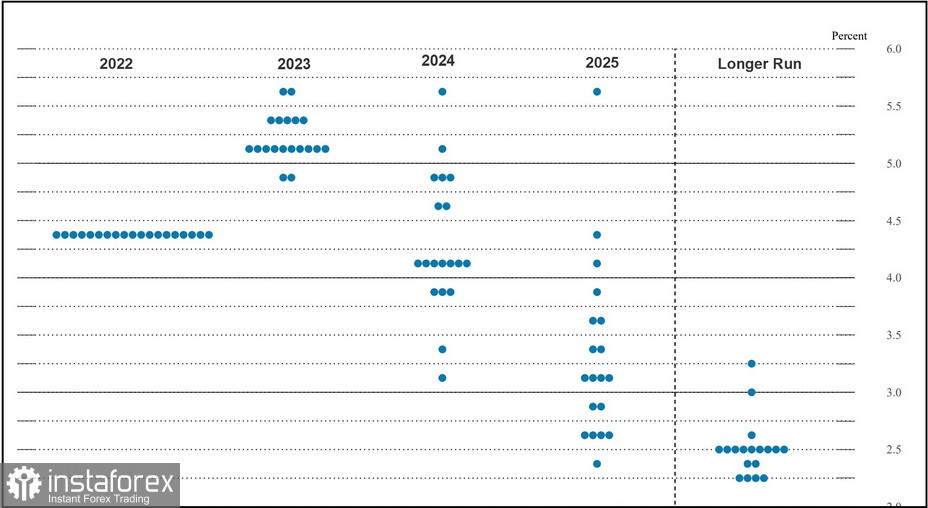

In December, the Federal Reserve released its most recent economic forecasts and a "dot plot" that contained its expected rate changes, as 17 members of the Federal Reserve placed their opinion (as a dot).

The December 2023 interest rate projections contained the clear realization that the unanimous voting members of the Federal Reserve expected to raise the current base rate to above 5% and maintain those increased rates throughout calendar year of 2023.

The elevated hawkish tone, reflecting anticipated actions by the Federal Reserve, has begun to affect current prices for precious metals, U.S. Treasuries and stocks. A faction of market participants still believe that there will be rate cuts this year, contrary to what has been and remains in the Federal Reserve's narrative. However, the Fed's statement the week before last was that they might have to raise rates to a higher target closer to 6%. This was likely the reason for the sale at the end of the week before last.

The strength of the dollar was certainly a strong component at the end of last week, providing headwinds for the markets. The dollar index rose 0.37% in trading.

Investors are waiting for the next report on headline inflation against the consumer price index on Tuesday. They hope to better understand the Federal Reserve's possible reversals in terms of rate hikes. The most important takeaway on price action over the past few weeks has less to do with any technical indicators than with event-driven news and the current version of the Federal Reserve.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română