The coming week will be crucial for investors as the January inflation data for the US will directly influence the Fed's decision on interest rates.

Earlier, Fed Chairman Jerome Powell announced that he is monitoring the process of disinflation in the US economy, which was a noticeable reason for the renewed optimism in the markets as they assume that the interest rate hike cycle will be over soon. With that thought, equities rose, while dollar came under pressure on the wave of falling treasury yields.

But now that the US inflation data is coming, market players became cautious as they understand that the US financial system has a direct impact on all financial markets without exception. If the data does not disappoint, the markets will take it as a signal that reassures Powell that disinflation is sustainable, so the central bank is unlikely to raise interest rates before May, wishing to watch further developments. This could lead to a local rally on the US Treasury stock and government bond markets, which, if happens, will pull dollar down. The ICE index will then fall below 103.00, rushing towards the psychological level of 100.00.

Of course, a higher-than-expected CPI will lead to a broader sell-off in risky assets, which could be the end of the rally in equity markets.

Forecasts for today:

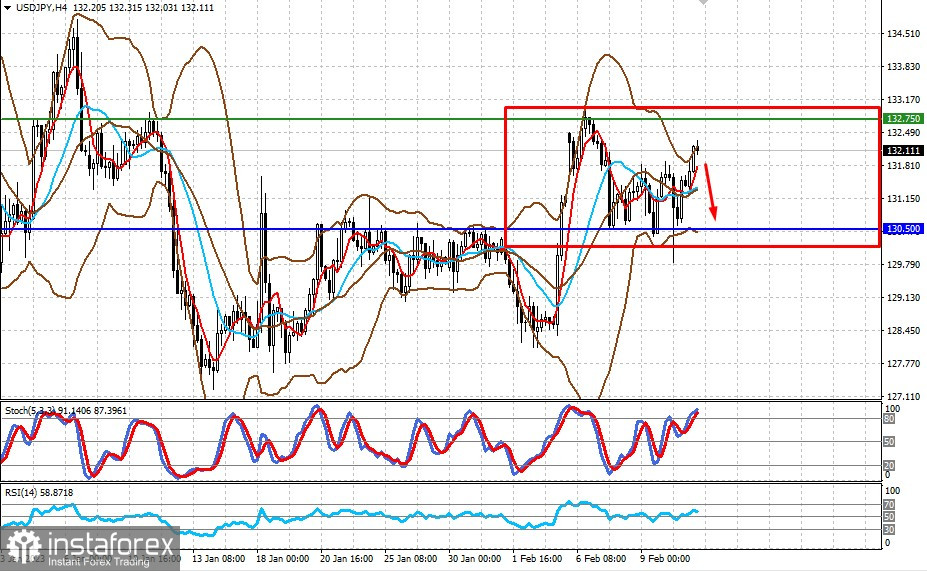

USD/JPY

The pair continues to consolidate within 130.50-132.75 while waiting for the US consumer inflation figures. It is likely to remain in this range today.

AUD/USD

The pair is trading between 0.6875-0.7015. This trend is likely to continue until the US inflation figures are released tomorrow.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română