This leap propelled the information technology index up by 1.85%, making it stand out among other sector indices of the S&P 500.

Apart from Nvidia, stocks of other tech giants, such as Alphabet and Amazon.com, also demonstrated steady growth, increasing by 1.4% and 1.6% respectively. Jay Hatfield from Infrastructure Capital Advisors notes: "Tech has rarely surprised us lately, and now it has surpassed all expectations. With Nvidia's upcoming report, the tech market could receive an additional boost."

Next week, Nvidia plans to publish its quarterly results, sparking particular interest among analysts and investors. On Monday, Morgan Stanley highlighted the company's influence on the market, especially considering the current interest in artificial intelligence.

Meanwhile, Tesla's shares dropped by 1.2% due to the company's decision to reduce prices for some models in China. This week promises to be eventful for the market, with expectations of quarterly reports from major retailers such as Walmart and Target, as well as the release of July retail sales data, which may impact the US economic landscape.

The Market in Anticipation: Retail sales for July are expected to influence the US Federal Reserve's interest rate forecasts. According to CME Group Fedwatch's instrument data, analysts are 89% confident in the Fed's rate stability over the next month. However, Goldman Sachs expects the beginning of rate cuts only by the second quarter of 2024.

Meanwhile, on the global stage, there's growing concern about real estate in China, especially after the country's largest developer, Country Garden, decided to delay payments on its bonds.

Against this backdrop, news from the IT sector: PayPal shares confidently rose by 2.8% after the appointment of Alex Kress, former leader of Intuit, as the CEO.

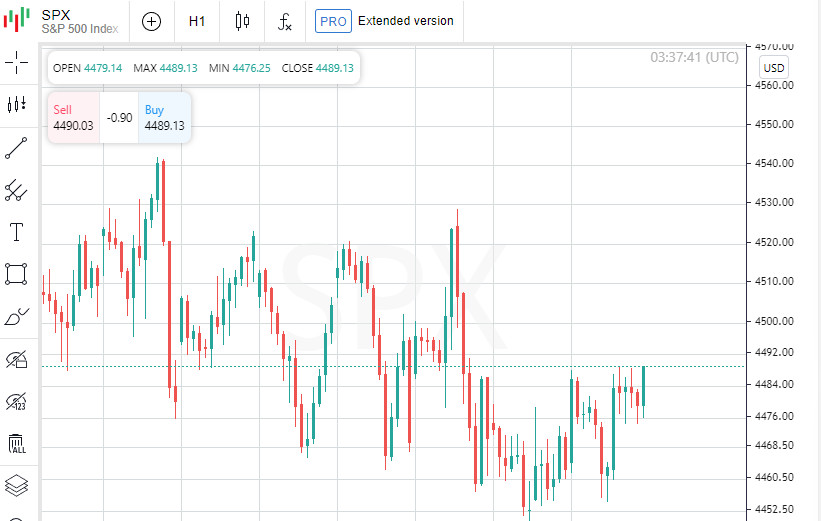

In the entertainment sector, AMC Entertainment shares took a deep dive, losing 36% due to a court decision to review the agreement with shareholders, while shares of Hawaiian Electric Industries dropped 34% on news of the company's possible involvement in forest fires in Maui. The overall trading volume in the US was below average, with declining shares dominating over rising ones on the S&P 500. Meanwhile, BioXcel Therapeutics shares fell sharply, reaching a three-year low. In conclusion, the CBOE Volatility Index, which reflects the dynamics of S&P 500 options, decreased by 0.13%, indicating a relative market calm.

Gold futures for December delivery fell by 0.36% or $7.05, amounting to around $1,000 per troy ounce. As for oil, WTI futures for September delivery dropped by 0.73% or $0.61, settling at $82.58 per barrel. Meanwhile, Brent futures for October lost 0.59% in price, or $0.51, hovering around $86.30 per barrel. In the currency market, the EUR/USD pair showed minimal change, losing 0.36% and standing at 1.09. The USD/JPY pair, on the other hand, grew by 0.36%, reaching around 145.48. The US dollar index, reflecting the dynamics of the American currency against a basket of major currencies, rose by 0.34%, hitting the 103.04 level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română