Long-term outlook.

The GBP/USD currency pair attempted to restart its upward movement this week. On Friday, there was a slight downward movement in response to the line's rebound. Additionally, the GDP report for the fourth quarter and other variables sparked this movement, which was almost the only significant event for the pound this week. In actuality, given the recession estimates from three to six months ago, the GDP result wasn't that bad. The British economy is not in a dire state, the recession has not yet started (however, depending on which side to look at), and the Bank of England has even raised its predictions for economic growth and the duration of inflation. It is now projected that the economic downturn will span 5 quarters rather than 8, with the economy losing no more than 1%. Of course, this forecast could be changed multiple times, just like the last one. Inflation is the only persistent issue facing the British economy. Despite 10 rate hikes by regulators, it essentially does not decrease. The assumption of a large drop in the pace of price growth in 2023 is therefore uncertain based on the assertions made by Andrew Bailey.

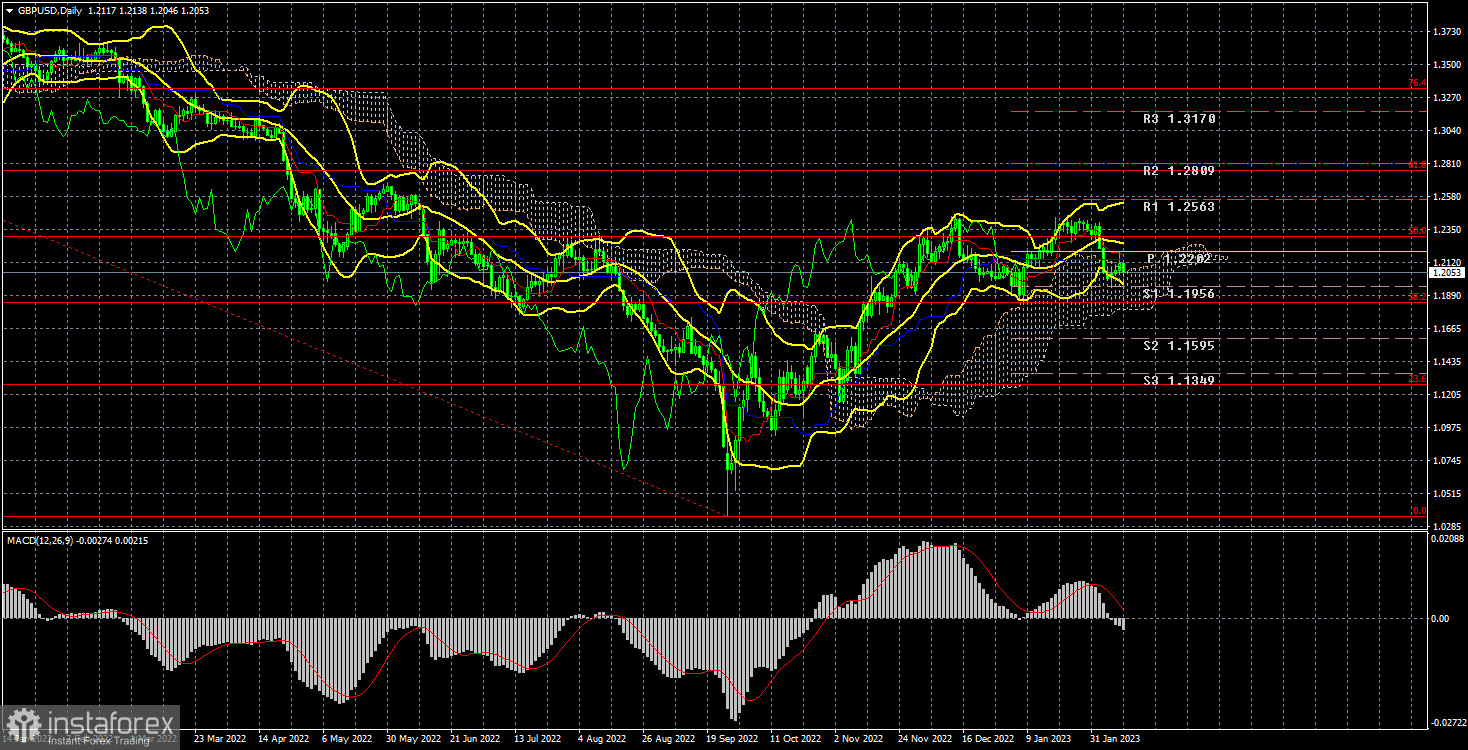

A deeper economic fall and a longer recession could result if BA decides to tighten monetary policy once more. As a result, everything still depends on inflation. The pound has been declining thus far, although not significantly. It can reach the Senkou Span B line, which is now located close to the Fibonacci level of 38.2% (1.1841), by crossing the important line. This is where the pair's fall is most likely to occur. If they manage to get through it, they can keep falling. In summary, we do not yet see any compelling arguments for the continuation of the "bullish" trend. Correction or extended consolidation is therefore preferred.

COT evaluation.

The "bearish" sentiment appeared to be fading in the most recent COT report on the British pound. The non-commercial group concluded 6,700 buy contracts and 7,500 sell contracts throughout the week. As a result, non-commercial traders' net position increased by 0.8 thousand. The net position indicator has been slowly rising over the past few months, and although it hasn't yet, it suggests that significant players' attitudes may soon turn "bullish." Although the value of the pound against the dollar has increased recently, it is quite challenging to identify the basic reasons behind this growth. Since there is still a need for adjustment, we cannot rule out the possibility that the pound may continue to decline in the near (or medium) term. There are no questions because COT reports have generally matched the trend of the pound sterling in recent months. Purchases may continue in the future for a few months, but they must have the right "base" underneath them, which they do not now have because the net position is not even "bullish" yet. A total of 59 thousand sales contracts and 35,000 purchase contracts have now been opened by the non-commercial group. Although there are some reasons to believe that the British currency would increase over the long run, geopolitics does not support such a significant and quick pound sterling strengthening.

Analysis of important events.

In the UK, this week's data on industrial production were also issued in addition to the GDP report, and it marginally outperformed expectations. Given that the pound was rising at the time the report was published, rather than falling, there was no market response to it, and we question if traders even paid attention to GDP. When there were no new important reports in the afternoon, it started to fall. Additionally, it should be emphasized that although the value of industrial production for November was revised upward, the growth is minimal. This week in the States, there were merely speeches by various Fed members who provided no noteworthy reports. We have reason to believe that the rate will rise by another 0.5% in the next two sessions since some members of the monetary committee are in favor of raising it to 5.25% and others are slightly more against it. What to anticipate from the Bank of England is yet unknown, though. The pound may restart growing in the longer term if "hawkish" signals from the regulator start to appear.

The trading strategy for the week of February 13–17:

1) The pound/dollar pair has consolidated below the Kijun-sen line; therefore, long positions are no longer important. Waiting for a price consolidation back above the crucial line, or, in this case, a bounce off the Senkou Span B line, is a good indication that you should start trading again for gains. The level of 1.2563 in this situation will be the closest purchase target. We anticipate the fall to continue for the time being, though.

2) In contrast, sales are now significant. The Senkou Span B line, which lies at the level of 1.1800, is the closest target for moving south. About 250 points remain, which does not appear to be an impossible task. The pound can move in the direction of its all-time lows if the bears are successful in breaking through the Ichimoku cloud. The pair may well hit the $1.13–$1.15 level, but we do not anticipate a decline in the price parity area because there is no equivalent fundamental basis for such a scenario.

Explanations for the illustrations:

Fibonacci levels, which serve as targets for the beginning of purchases or sales, and price levels of support and resistance (resistance/support). Take Profit levels may be positioned close by.

Bollinger Bands, MACD, and Ichimoku indicators (standard settings)

The net position size of each trading category is represented by indicator 1 on the COT charts.

The net position size for the "Non-commercial" category is shown by indicator 2 on the COT charts.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română