Today, the focus of market participants following the quotes of the Canadian dollar will be the publication (13:30 UTC) of the report of Statistics Canada on the national labor market for January.

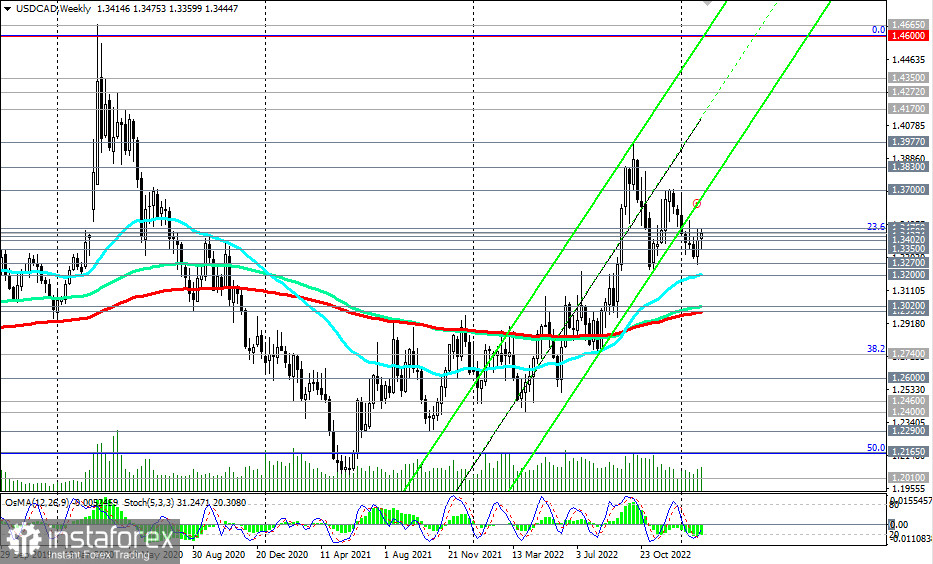

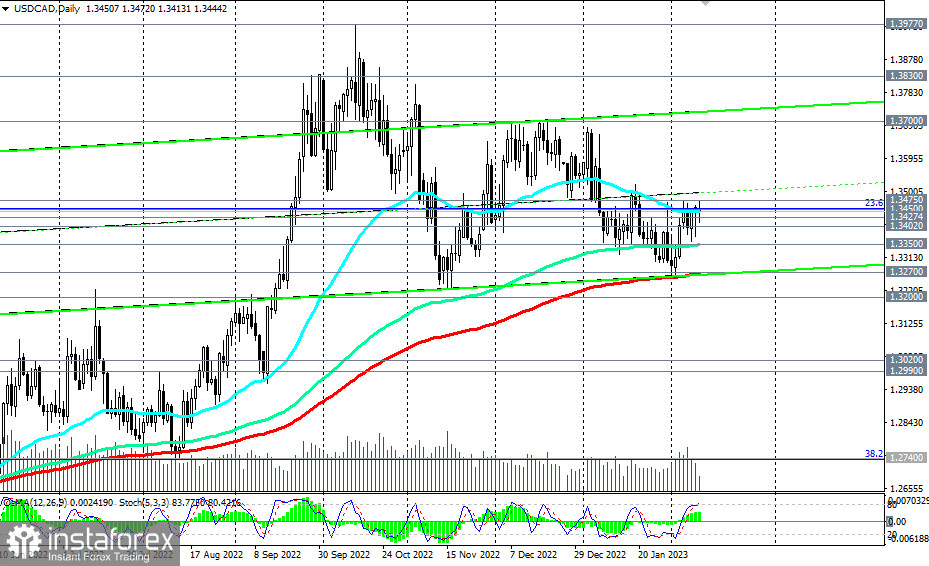

From a technical point of view, being above the key support levels 1.3350 (144 EMA on the daily chart), 1.3270 (200 EMA on the daily chart), 1.3200 (50 EMA on the weekly chart), 1.3020 (144 EMA on the weekly chart), 1.2990 (200 EMA on the weekly chart), USD/CAD remains in a long-term bull market zone, which means long positions are still preferable.

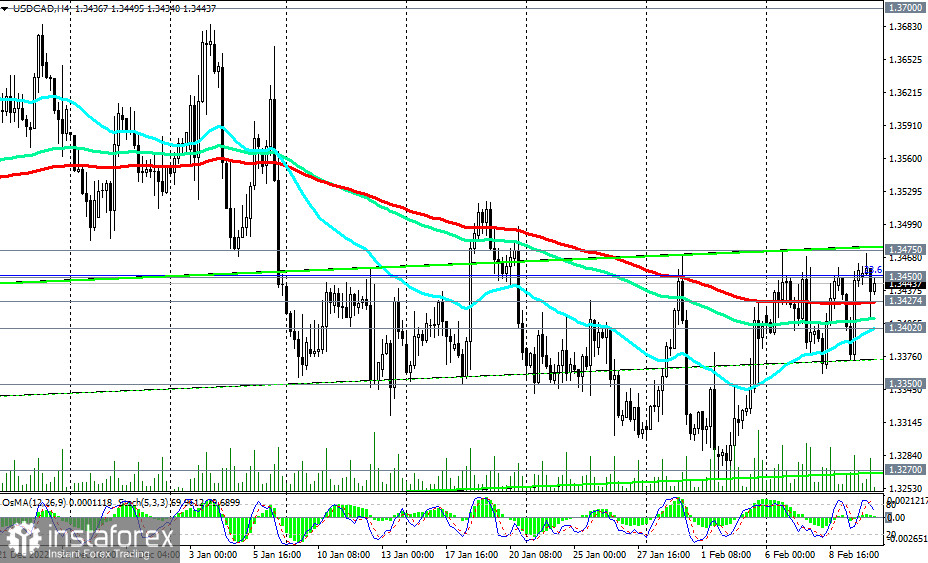

In this case, the breakdown of the local resistance level 1.3475 will confirm the main scenario of the pair's growth.

Alternatively, the breakdown of the important short-term support levels 1.3427 (200 EMA on the 4-hour chart), 1.3402 (200 EMA on the 1-hour chart) will signal the resumption of short positions with the targets at the support levels 1.3350 and 1.3270. A breakdown of the 1.3200 support level will aggravate buyers' position and increase the risk of the pair's further decline towards the key support level 1.2600 (200 EMA, 144 EMA on the monthly chart), separating the long-term bullish trend of USD/CAD from the bearish one with intermediate targets at the support levels 1.3020 and 1.2990.

Support levels: 1.3427, 1.3402, 1.3350, 1.3300, 1.3270, 1.3200, 1.3100, 1.3020, 1.2990, 1.2740, 1.2600

Resistance levels: 1.3450, 1.3475, 1.3500, 1.3600, 1.3700, 1.3800, 1.3830, 1.3900, 1.3970, 1.4000

Trading scenarios

Sell Stop 1.3410. Stop-Loss 1.3480. Take-Profit 1.3402, 1.3350, 1.3300, 1.3270, 1.3200, 1.3100, 1.3020, 1.2990, 1.2740, 1.2600

Buy Stop 1.3480. Stop-Loss 1.3410. Take-Profit 1.3500, 1.3600, 1.3700, 1.3800, 1.3830, 1.3900, 1.3970, 1.4000

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română