Markets are facing new problems in February. The first one is the US jobs data for January, which soared above 500,000 instead of falling below 200,000. It caused a wave of sell-offs in equity markets and a strengthening in the dollar. The momentum halted only when Fed Chairman Jerome Powell said the bank is firm in its view that the country's disinflation process is gaining momentum. That was what encouraged markets to go back up on Thursday after Wednesday's decline. But the rally was once again stopped by aggressive statements from other Fed members such as Christopher Waller and John Williams, who said there is a need to keep rates high until inflation falls to 2%.

The reason why policymakers bombard markets with assurances of continued aggressive rate hikes is that they want inflation to be low so that the US economy will grow steadily. They also want to be able to pay debts. They fear that government spending and the flow of foreign capital into the US carry high risks of heating up the economy, which is extremely dangerous in an environment of high inflation. Thus, the Fed will continue to intervene verbally through its representatives in an attempt to limit the growth of employment and spending that supports inflation.

Of course, the bank may not raise rates at all despite the calls if inflation continues to decline. The most important factor here is the CPI data for January, which will be published next week. Until then, market volatility will be high due to uncertainty.

Forecasts for today:

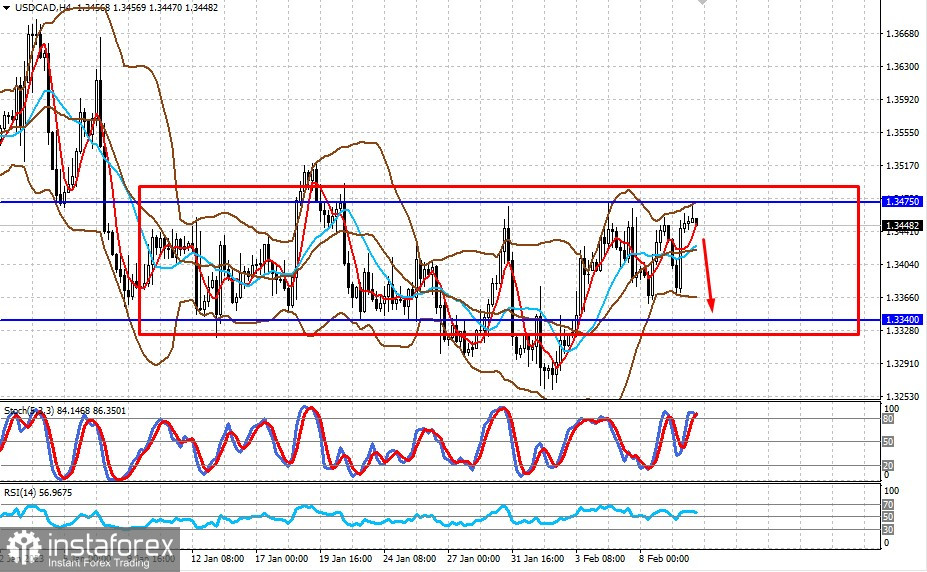

USD/CAD

The pair continues to trade within the range of 1.3340-1.3475. A consolidation in crude oil prices, as well as the release of inflation data in the US, will keep the pair in these levels, especially if the quote remains below the upper limit.

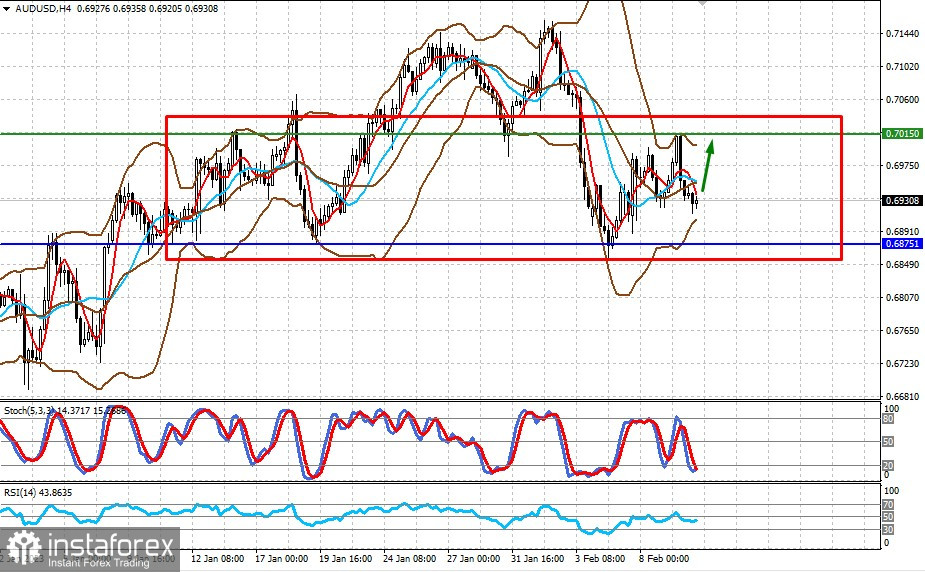

AUD/USD

The pair found support at 0.6875. If market sentiment improves today, traders will see a rise to 0.7015. The pair will remain within 0.6875-0.7015 until the US inflation data is released.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română