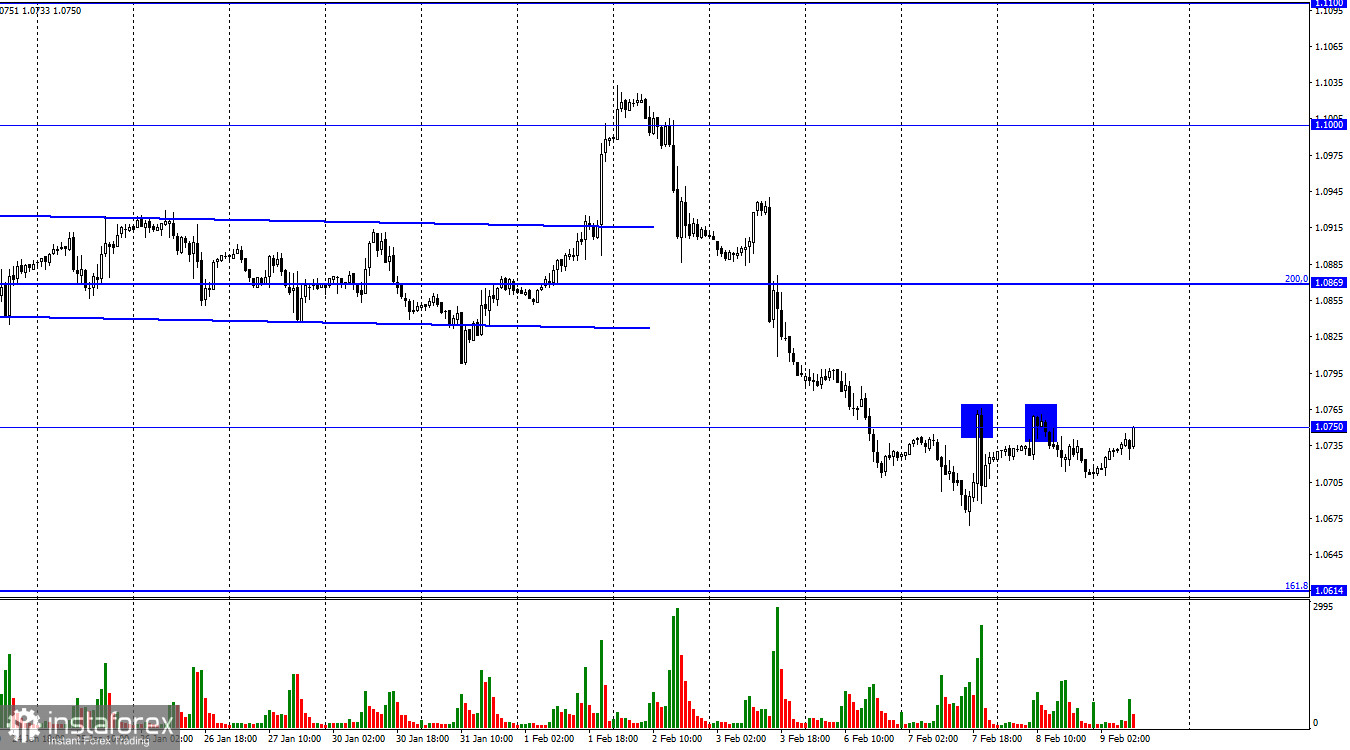

On Wednesday, the EUR/USD pair made a new return to the level of 1.0750, recovered from it, and then saw a minor decline. A new return to the level of 1.0750 occurred on Thursday. Fixing the rate of the pair above this point will encourage further growth toward the following corrective level of 200.0% (1.0869). A fall in the direction of the corrective level of 161.8% (1.0614) indicates a new rebound.

The 1.0750 level has been the target of bullish traders as German inflation continues to rise. Why does this matter? Despite traders' expectations for a faster rise, the consumer price index grew by 0.1% to 8.7% in January. Why did they wait if the ECB rate has been rising at each meeting when inflation has been falling for some time? The issue, in my perspective, is that the indicator's initial response to the PEPP's tightening and the drop in oil and gas prices has already happened. Both causes have had an impact on inflation, but like any market, it now requires new triggers to keep decelerating. A new increase in inflation is both good and bad for the euro currency. On the one hand, given that the present rate level is insufficient to guarantee a steady decline in inflation, the ECB may now opt to extend the program of tightening the PEPP for several additional meetings. On the other hand, if the rate does increase, rising inflation will gradually limit EU economic growth. High rates are detrimental to the European economy but beneficial to the euro currency. Only recently did everyone appears to agree that there wouldn't be a severe recession in the European economy. However, a recent increase in the consumer price index goes against the central bank's intentions. Of course, comparing European inflation to German inflation is incorrect. We must wait for the EU indication before making any judgments. The "bell," however, is unsettling. However, given the anticipated ECB rate hike of another 0.75%, it's possible that this surge is only temporary and that inflation will eventually start to decrease again.

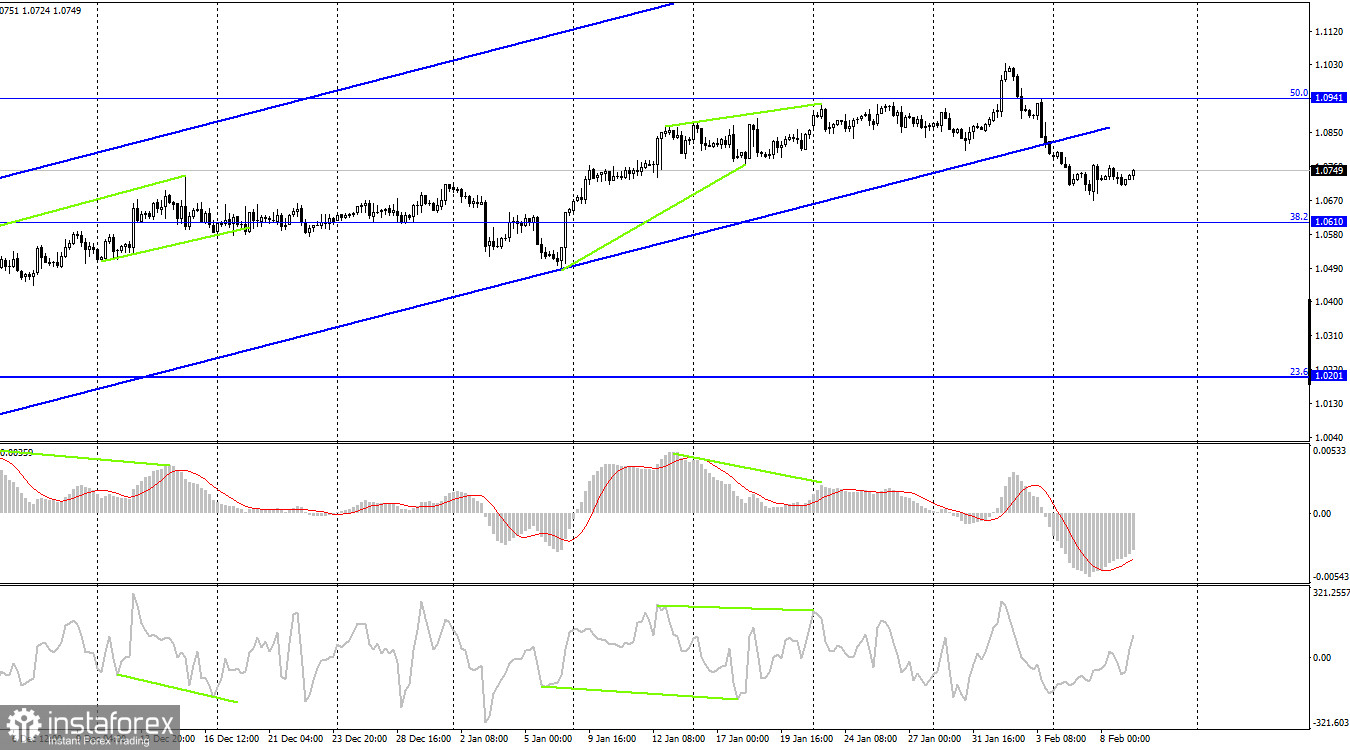

The pair is still declining on the 4-hour chart and has managed to stay under the upward trend corridor. Since the pair left the threshold where they had been since October, I believe this moment to be of the utmost importance. The current "bearish" trading sentiment offers the US dollar good growth chances with targets of 1.0610 and 1.0201. Emerging divergences are currently undetectable in any indication.

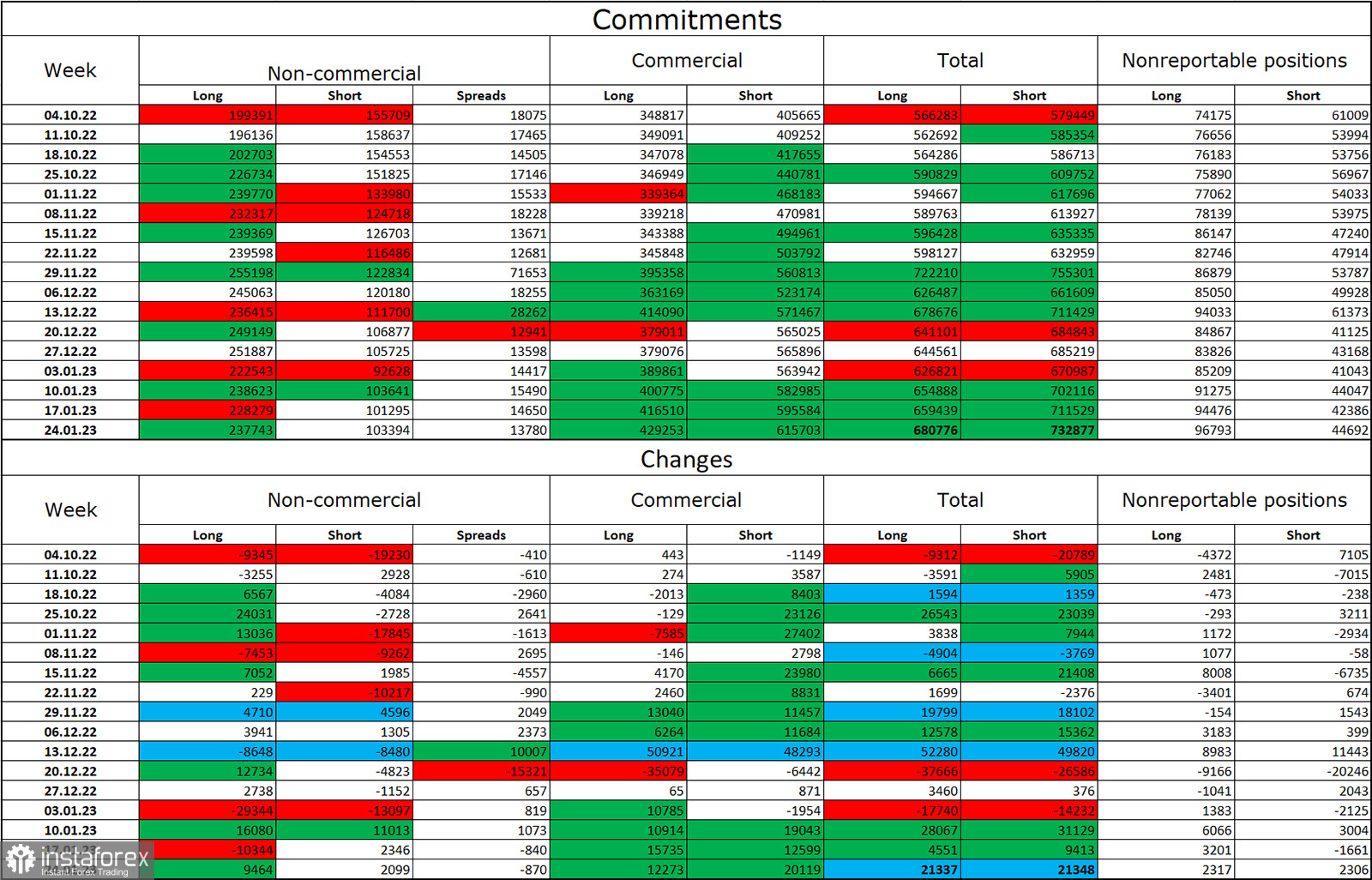

Report on Commitments of Traders (COT):

Speculators opened 9,464 long contracts and 2,099 short contracts during the most recent reporting week. Major traders' attitude is still "bullish" and has somewhat improved. Currently, 238 thousand long futures and 103 thousand of short contracts are all concentrated in the hands of traders. The COT figures show that the European currency is now growing, but I also see that the number of long positions is over 2.5 times greater than the number of short positions. The likelihood of the euro currency's growth has been steadily increasing over the past few months, much like the euro itself, but the information background hasn't always backed it up. After a protracted "dark time," the situation is still favorable for the euro, therefore its prospects are still good. Until the ECB gradually raises the interest rate by increments of 0.50%, at least.

The United States and the European Union's news calendars:

USA - number of initial unemployment benefit applications

There are no significant events scheduled for February 9 on the calendars of the US or the EU's economies. The information background will have little to no impact on the traders' attitudes today.

Forecast for EUR/USD and trading advice:

When the pair closed below the threshold on the 4-hour chart, I suggested selling the pair. The targets are 1.0614 and 1.0750. As soon as transactions close over 1.0750, the first target will have been achieved. On the 4-hour chart, purchases of the euro currency are conceivable when it recovers from the level of 1.0610 with a target of 1.0750. Or when the price is anchored above 1.0750 with a target of 1.0869 on the hourly chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română