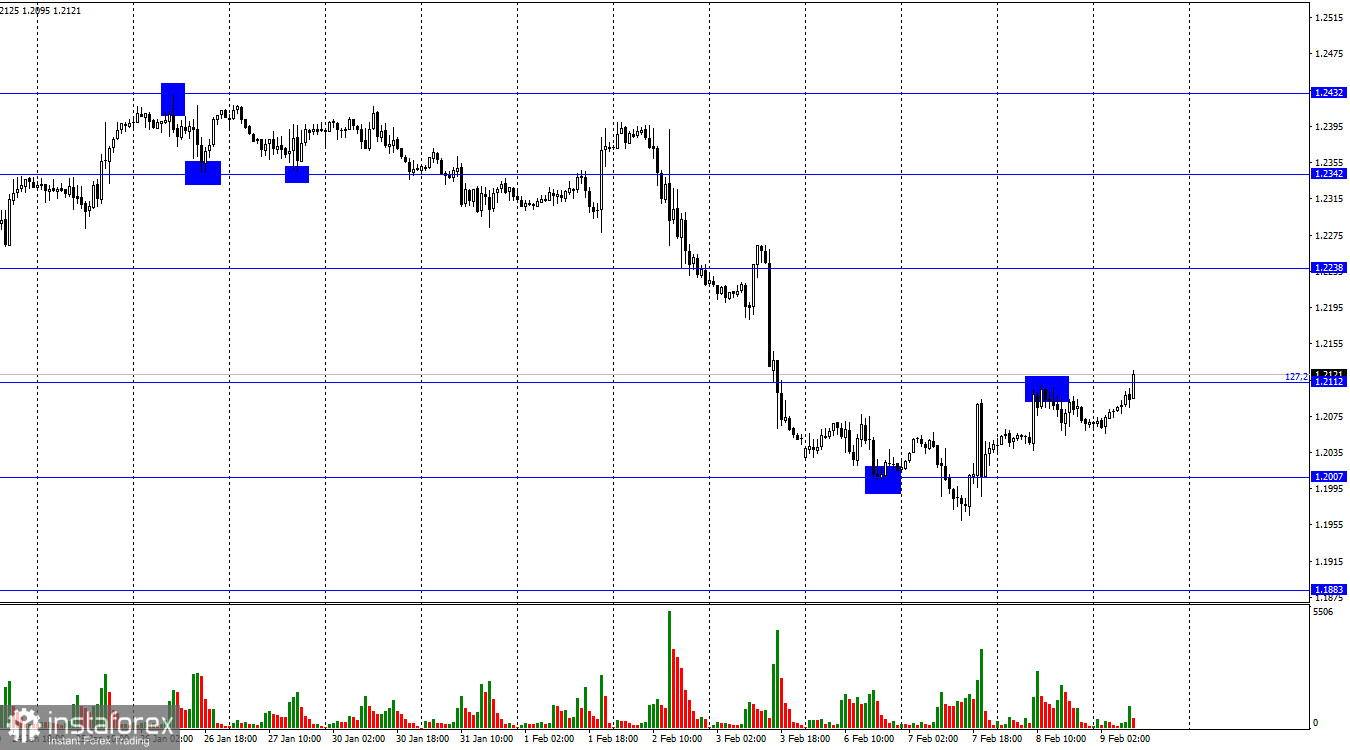

Hello, dear traders! According to the 1-hour chart of GBP/USD, the pair returned to the 127.2% retracement level of 1.2112, pulled back, and went down on Wednesday. Today, the quote may settle above this mark in case the level is tested. The upward target is seen at 1.2238. Another pullback will drive the pair to 1.2007.

The market is now in the so-called "wait-and-see mode". Last week, three leading central banks held board meetings. The macroeconomic calendar is almost empty today. Although the pair has shown a sluggish movement over the past two days, the selling pressure eased somewhat. The bears have recently lost grip on the market. The bears haven't managed to get stronger yet. It all ended in a deadlock. Traders simply cannot find a way out of this situation. They are still focusing on interest rates, especially those of the US Federal Reserve. There is new information about the issue every day, which fuels uncertainty.

The American regulator is now expected to hike rates twice by 0.25%. However, Jerome Powell on Tuesday suggested there could be a stronger rate increase if the jobs market and unemployment stay robust as in January. Yesterday, New York FRB President John Williams said he would back interest rates at 5.25% if they remained that high for a couple of years. Therefore, we can hardly predict the future of interest rates at this point. A lot will depend on GDP, unemployment, and inflation. Monetary policy will be adjusted depending on how those figures change. The bears are not quite happy with such an answer as it does not encourage them to continue selling.

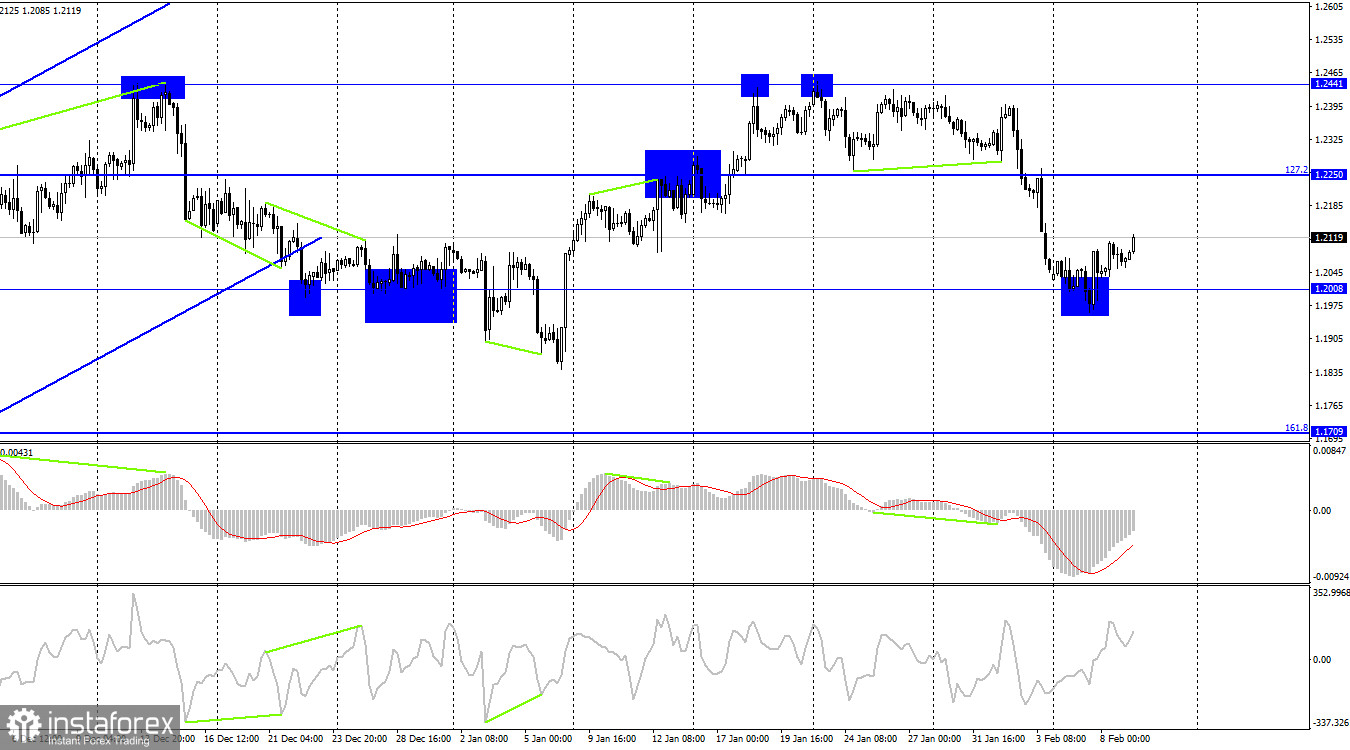

In the 4-hour time frame, the pair fell to 1.2008 and rebounded. It is now heading toward the 127.2% retracement level of 1.2250 but at a sluggish pace. If the price closes below 1.2008, a reversal will occur. The quote may then go to the 161.8% retracement level of 1.1709. Neither of the technical indicators shows divergence today.

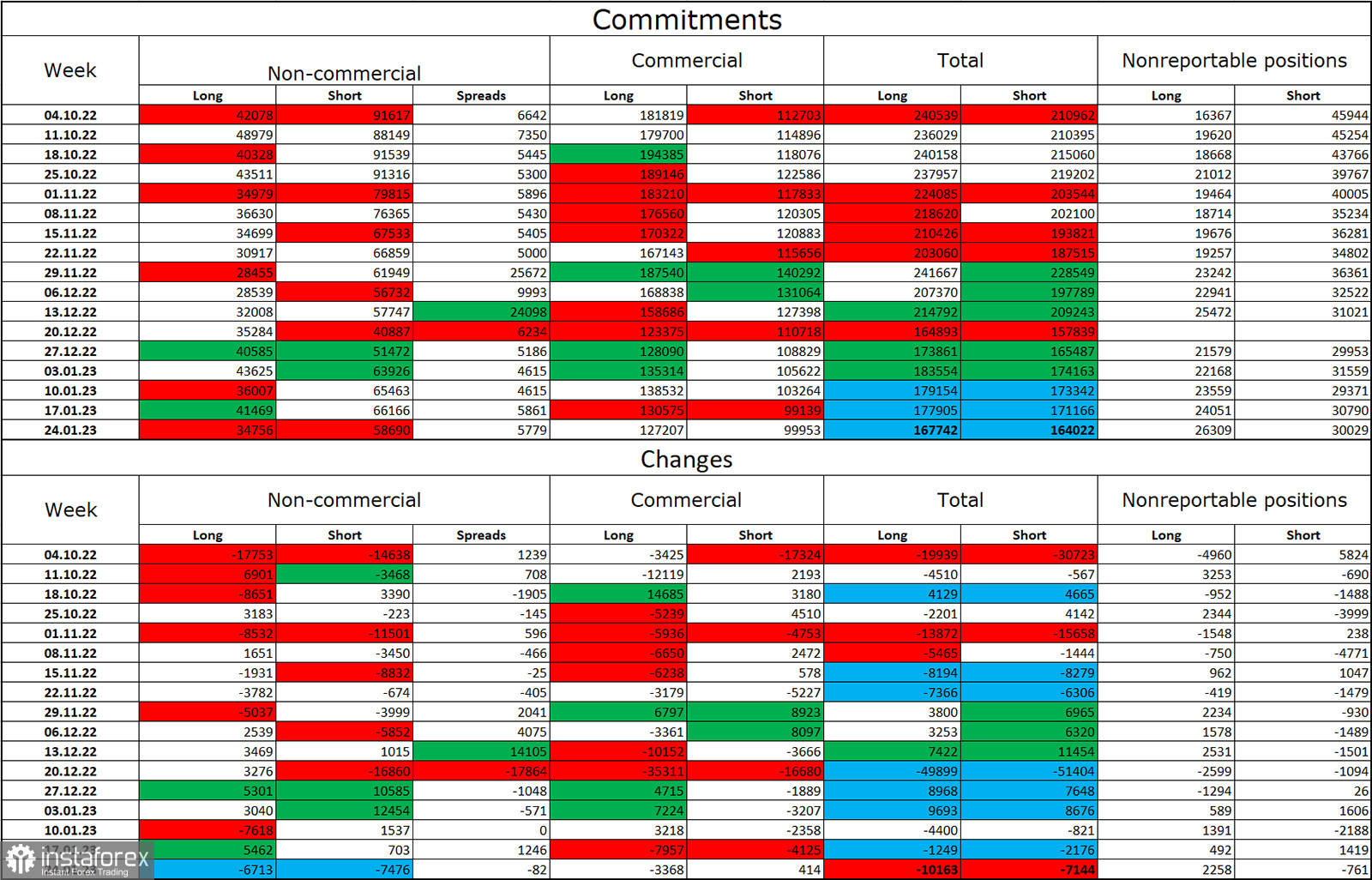

Commitments of Traders:

The bearish sentiment of non-commercial traders decreased last week. Speculators closed 6,713 long positions and 7,476 short positions. Overall, sentiment is still bearish with a wide gap between shorts and longs. Although the pound sterling has limited growth potential now, it is in no rush to go down. In the 4-hour time frame, the pair left the limits of the 3-month ascending corridor, which may become a restraining factor for a bullish continuation.

Macroeconomic calendar:

United States: Initial Jobless Claims (13-30 UTC).

Today, fundamental factors may have little influence on market sentiment due to a lack of important macro data.

Outlook for GBP/USD:

I previously said it would become possible to open short positions if the pair settled below 1.2238 in the 1-hour time frame with targets at 1.2112 and 1.2007. The price hit both targets. Now short positions could be considered after a pullback from 1.2112, targeting 1.2007. Apart from that, I suggested that the right time for buying would be after a rebound from 1.2008 in the 4-hour time frame, targeting 1.2112. The quote reached this level. So, long positions could now be opened after the price closes above 1.2112 with the target at 1.2238.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română