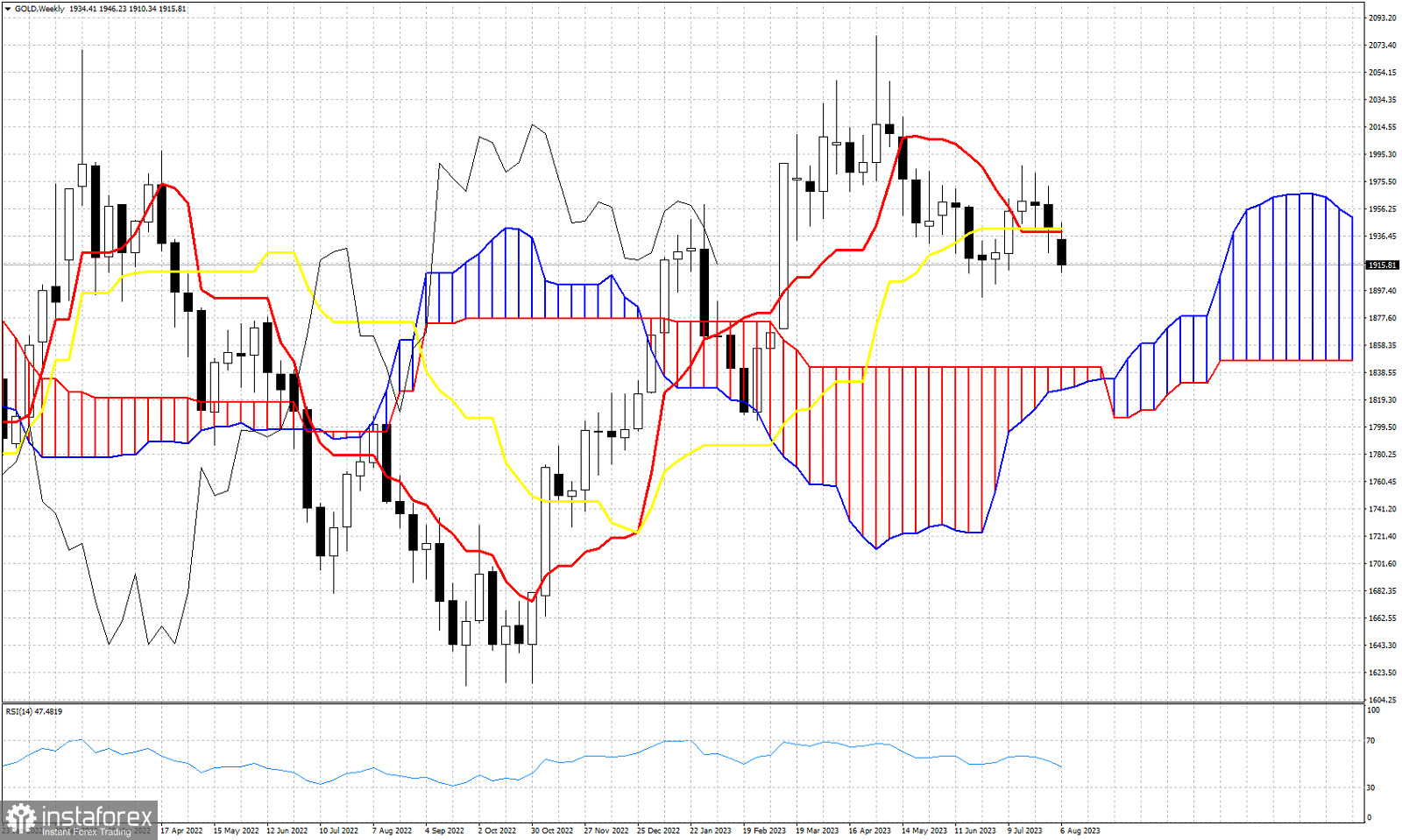

The weekly candlestick in Gold is providing a bearish warning. Price this week is trading below the tenkan-sen (red line indicator) and the kijun-sen (yellow line indicator). Both these two indicators provide resistance at $1,940. A weekly close below this level suggests that price remains vulnerable to a move towards the weekly Kumo (cloud) at $1,842. The Chikou span (black line indicator) remains above the candlestick pattern (bullish), but has a negative slope making lower lows and lower highs. Although price remains above the Kumo (bullish), having broken below the kijun-sen suggests that price is vulnerable. The tenkan-sen has also crossed below the kijun-sen providing an added sign of weakness. The weekly chart using the Ichimoku cloud indicator suggests that Gold price has more chances of falling than starting a new up trend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română