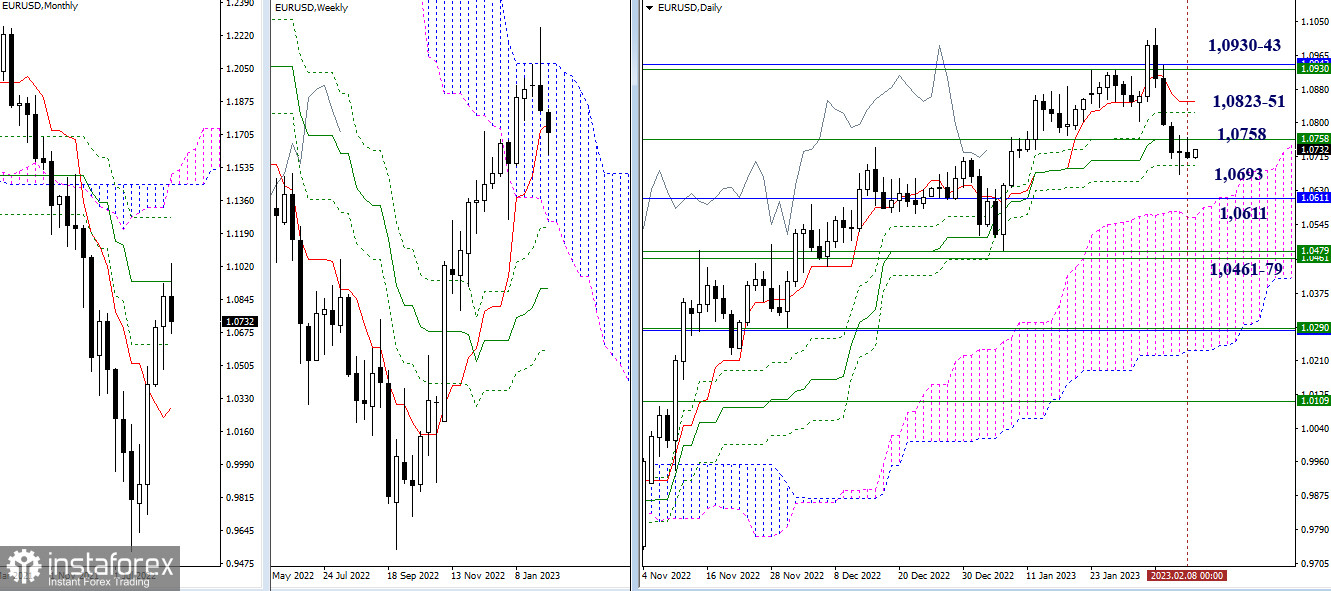

EUR/USD

Higher time frames

The price traded sideways after a downtrend. The previous targets are still intact. Upward targets are seen at the 1.0758 resistance level (intraday short-term trend line + weekly short-term trend line) – 1.0823-51 (daily cross levels) – 1.0930-43 (upper limit of a weekly cloud and a medium-term trend). Downward targets stand at 1.0693 (level of a daily Ichimoku cross) – 1.0611 (monthly level) – 1.0565 (upper limit of a daily cloud).

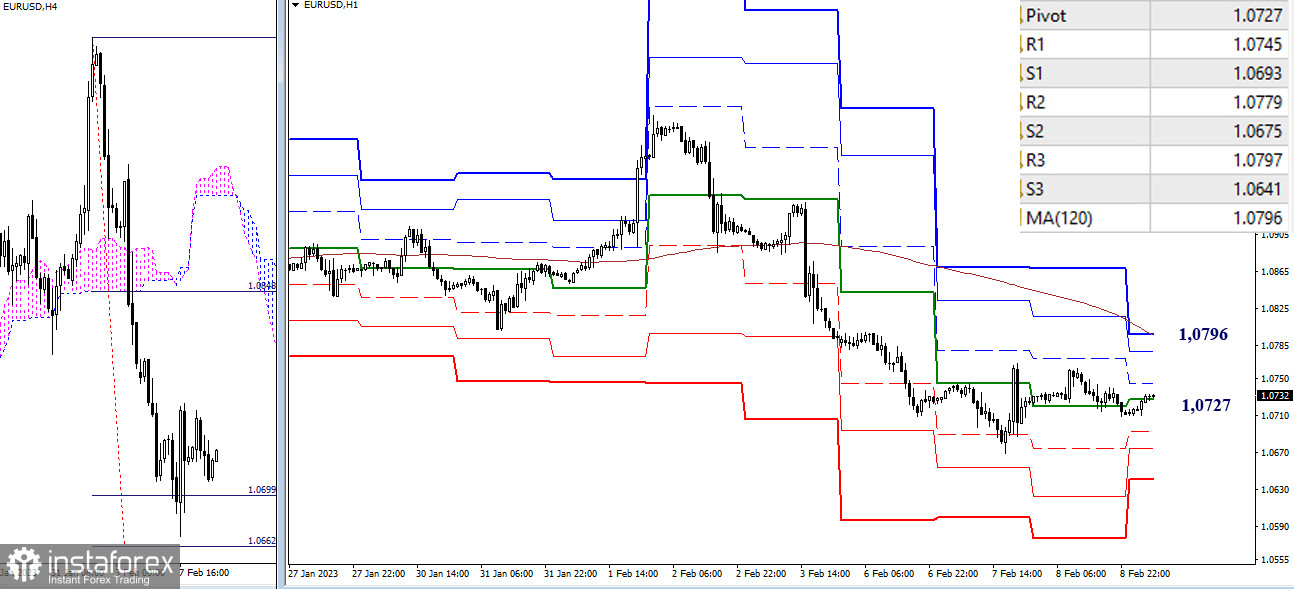

H4 – H1

In lower time frames, the quote trades under the influence of the central pivot level of 1.0727. Key upward targets are at 1.0796 (weekly long-term trend line) and the 1.0745 – 1.0779 resistance range (classic pivot levels). Downward targets stand at 1.0693 – 1.0675 – 1.0641 (classic pivot levels) and 1.0662 (100% priced target in the H4 time frame).

***

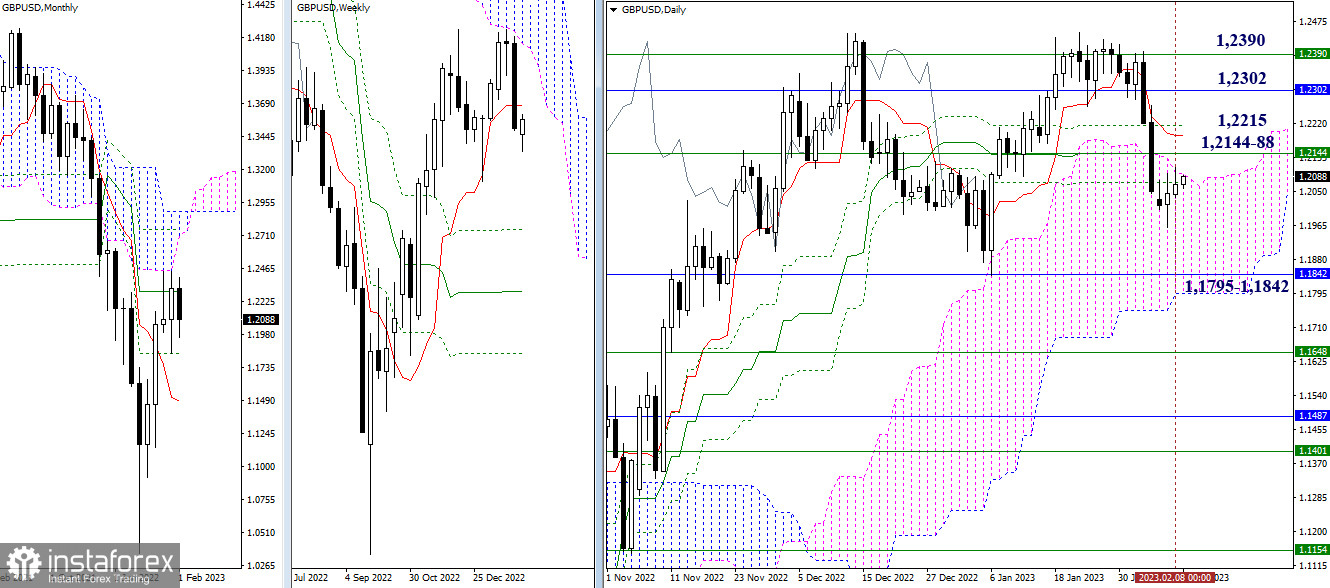

GBP/USD

Higher time frames

The pair is still moving in the daily cloud. Key intraday levels are 1.2072 and 1.2092. Other targets remain intact. Upward targets are important levels in different time frames: 1.2144 – 1.2188 – 1.2215 – 1.2302 – 1.2390. The nearest support zone is seen in the 1.1795 – 1.1842 range (monthly level + lower limit of the daily cloud).

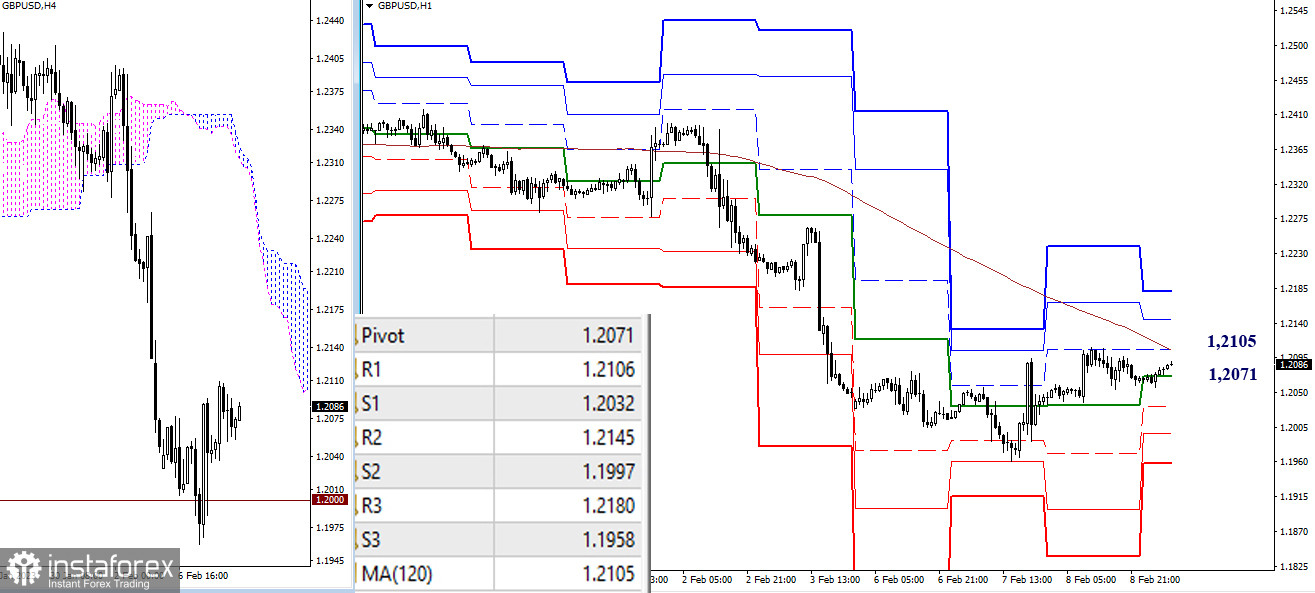

H4 – H1

The pair is still moving in the retracement zone, with the daily central pivot level at 1.2071. The bulls should break through the resistance level of the weekly long-term trend (1.2105) and reverse the moving average. That would shift the trading balance and create new targets. Other upward targets are at 1.2145 – 1.2180 (classic pivot levels). Downward intraday targets are classic pivot support (1.2032 – 1.1997 – 1.1958), the 1.1960 low, and the 1.2000 psychological level.

***

Indicators used in technical analysis:

Higher time frames - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 – classic pivot points + 120-period Moving Average (weekly long-term trendline)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română