Fed Chairman Jerome Powell said that much of the inflation is pandemic-related. However, this is not true as the reason why inflation reached a 40-year high is that the Fed made a mistake when they allowed the figure to rise to 8% before they took action.

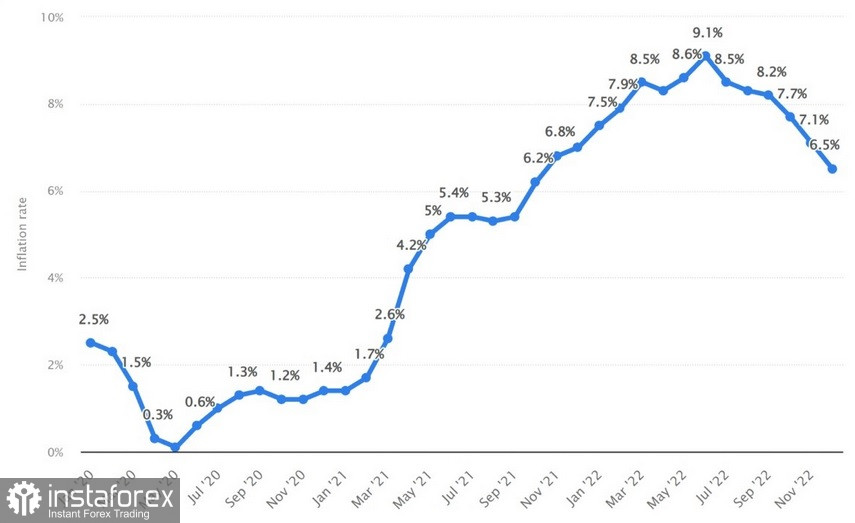

Back then, the central bank said inflation was temporary and would naturally slow down, but it hit 9.1% instead. Had they acted when inflation was 1.7% in March 2020 or 2.6% in May 2020, inflation could have been effectively controlled with a series of small rate hikes, bringing the Fed's base rate to 2.5%, which would have equaled the inflation rate at that time.

Historically, every spike in inflation has caused the Fed to respond in the same way, that is, to raise rates just below or above the current rate of inflation. Although the problems faced by the Fed were unforeseen, the situation now is the first one as they did not follow the path of former officials who smoothed and reduced high inflation promptly.

Accordingly, the Fed is in a crisis, forcing it to take an aggressive approach to monetary policy. On the bright side, these actions could open up opportunities for investors in gold and precious metals.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română