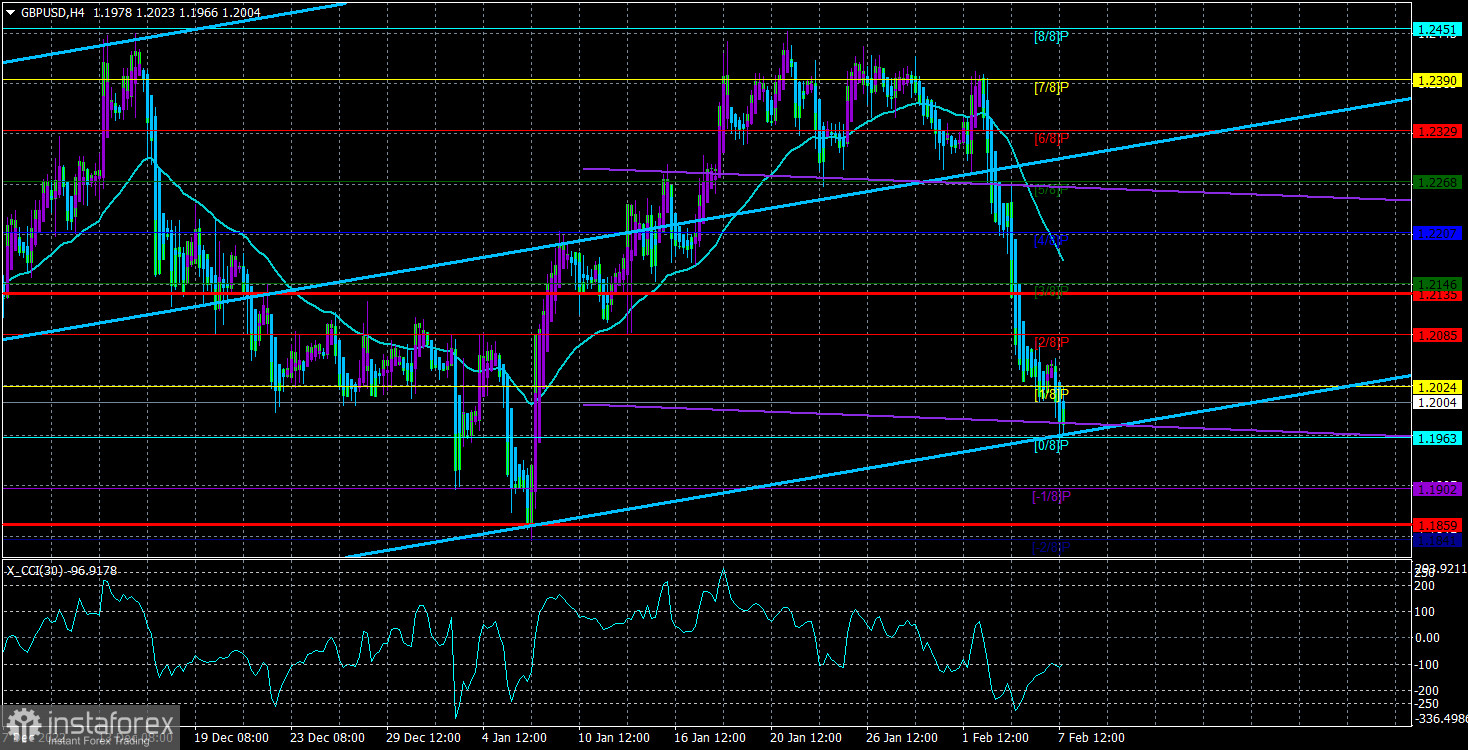

The GBP/USD currency pair continued to fall on Tuesday. The pound didn't make a significant upward movement until late in the evening, after which it dropped back down. In an article on the euro/dollar, we claimed that Jerome Powell's speech at the Economic Club of Washington on Tuesday night didn't offer anything essentially new. Nevertheless, the market experienced a surge in sentiment at this point. Within a matter of an hour, the pair initially increased their score by 100 points, then decreased it by the same amount. For now, it should be highlighted that this upward movement of the pound did not change the present technical picture in any manner. We will discuss the Fed chief's speech a little lower. The "double top" is still valid, and the pair is still trading below both the Kijun-sen line and the moving average line on the 4-hour TF. As a result, the only upward movement we observed was a short one, after which the British pound's decline can resume.

The market's thorough examination of fundamentals that support the pound is the primary cause of the continuing decline. For a while, it was assumed that the Bank of England would raise interest rates stronger and faster than the Fed in 2023. However, the most recent meeting revealed that the Fed will continue to tighten, and the Bank of England has already raised interest rates to 4%, so it is unlikely that it will be able to continue raising rates at a sudden pace. The "divergence of bets" was, however, recovered when the pound increased by 2,100 points in a matter of months. It is not surprising that market participants started to take profits on long positions, which led to the pair falling since these factors have previously been worked out. From our perspective, the British pound should continue to decline for at least a few more weeks. The Bank of England will then be the sole factor in everything. It may trigger a new, dramatic strengthening of the pound if it chooses to sacrifice its economy and raise rates "to the bitter end." This eventuality, though, is doubtful.

Powell lacked optimism while in Washington.

Powell's lone statement at the economic event in Washington was that it will take a while to combat inflation. Powell linked the protracted battle with inflation to the employment market's strength and the low unemployment rate. He predicted that rates would rise for a while before eventually leveling off for an extended period. Since the head of the Fed stated last week that there would be no slowdown in tightening monetary policy in the foreseeable future, we believe that this information is not new. It is also not breaking news that rates will stay at their highest levels for a considerable amount of time once the tightening cycle has ended. The Fed chairman also predicted that the fight against inflation would be challenging and "bumpy," although it was unclear whether Jerome Powell meant that the stakes would rise. In that case, a higher rate increase might be necessary. If not, Mr. Powell did not provide the market with any new information.

But the market itself reacted strongly to this speech. We believe that it was an emotional response. The pound's quick return to its initial levels following a period of significant growth demonstrates this. Therefore, we don't think the Fed's monetary policy will change anytime soon (or that it already has), nor do we think the monetary committee representatives' talking points will. Remember that the main Fed "hawks" believe it is fair to raise the rate over 5.25%, while the "doves" prefer to halt at a rate between 5.0 and 5.25%. Although we predict that the rate will increase to 5.5%, the dollar's growth will also depend on how much the BA rate increases. Given that it is doubtful that the regulator will halt this process after a 0.5% increase, there is reason to believe that the rate hike we saw in February was not the last. There will undoubtedly be at least two more 0.25% rises. However, the benefit of using the British pound is beginning to fade. The pair is predicted to keep falling.

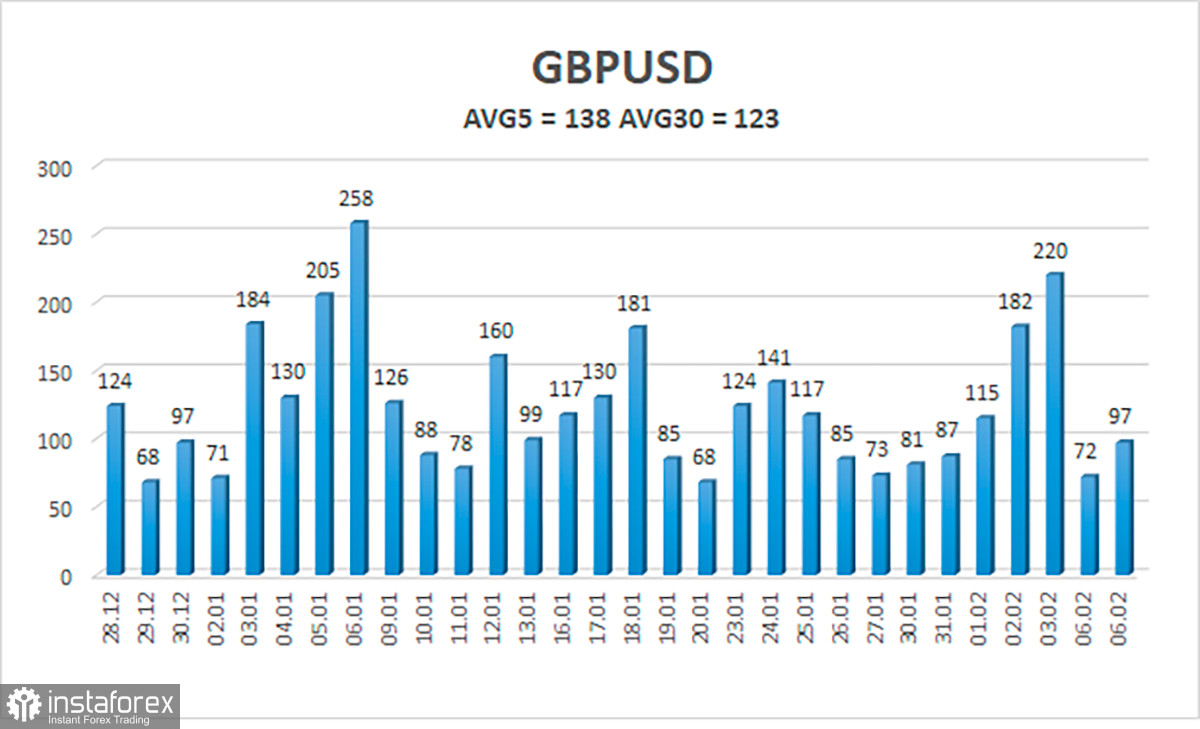

Over the previous five trading days, the GBP/USD pair has averaged 138 points of volatility. This figure is "high" for the dollar/pound exchange rate. Thus, on Wednesday, February 8, we anticipate movement that is limited inside the channel and is constrained by levels 1.1859 and 1.2135. The Heiken Ashi indicator's downward turn again will indicate that the downward momentum has resumed.

Nearest levels of support

S1 – 1.1963

S2 – 1.1902

S3 – 1.1841

Nearest levels of resistance

R1 – 1.2024

R2 – 1.2085

R3 – 1.2146

Trading Suggestions:

In the 4-hour timeframe, there was a small correction in the GBP/USD pair. Therefore, in the event of a downward reversal of the Heiken Ashi indicator, we can now consider additional short positions with targets of 1.1963 and 1.1902. If the price is stable above the moving average line, you can start trading long with targets of 1.2207 and 1.2268.

Explanations for the illustrations:

Channels for linear regression - allow us to identify the present trend. The trend is now strong if they are both moving in the same direction.

The short-term trend and the direction in which you should trade at this time are determined by the moving average line (settings 20.0, smoothed).

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română