Meanwhile, the dollar faced pressure from news out of China. Reports indicated that China's economy is experiencing deflation, causing some concerns among market participants. The European stock market received some support thanks to tax assurances from Italian banks. At the same time, oil prices rose to their highest level since January due to a supply shortage. Against the backdrop of these news, some major companies showed growth on Wall Street. Dow Inc's shares added 0.96%, closing at 55.54. Honeywell International stocks increased by 0.85%, reaching 189.24, while Caterpillar Inc rose by 0.58%, ending at 284.53. The stock market today was an arena of intense movements, where some corporations shone, while others faced pressure.

On Wall Street, Salesforce Inc experienced a noticeable drop of 2.70%, settling at 205.86. However, not everything looked grim. Intel Corporation, for instance, rose by 2.11% and closed the day at 34.28. Meanwhile, Goldman Sachs Group Inc lost 1.60% of its value.

Among the components of the S&P 500 index, shares of Axon Enterprise Inc stood out, showcasing an impressive rise of 14.06%. They were complemented by stocks of Akamai Technologies Inc and Fleetcor Technologies Inc, which increased by 8.47% and 6.29% respectively. However, major players such as NVIDIA Corporation and Paramount Global Class B dropped by 4.72% and 4.46%.

At the end of trading on NASDAQ Composite, shares of Tango Therapeutics Inc almost doubled their value, with an increase of 103.92%. Renovaro Biosciences Inc and Decibel Therapeutics Inc also showed significant growth, adding 82.35% and 80.29%. On the other side of the spectrum, Palisade Bio Inc shares fell by 62.50%, and both Bruush Oral Care Inc Unit and Yellow Corp lost nearly half of their value.

All in all, today's stock market was eventful, showing how quickly the fortunes of companies can change on the global economic stage.

On the New York Stock Exchange, there was a dominance of declining stocks: 1593 against 1324, which closed in the green. Another 83 stocks retained their positions. The situation on NASDAQ was similar: 2225 stocks decreased in value, 1284 gained, and 112 remained unchanged.

Akamai Technologies Inc (NASDAQ:AKAM) showcased splendid performance, hitting a 52-week high with a rise of 8.47%, and closed the day at 102.99. In contrast, Palisade Bio Inc (NASDAQ:PALI) shares plummeted, losing 62.50% and setting a new all-time low. The volatility index, CBOE Volatility Index, based on S&P 500 options, modestly declined by 0.19%, reaching 15.96. In the commodities market: gold futures slid 0.57%, pricing at $1,000 per troy ounce. At the same time, WTI and Brent crude increased their value, closing at $84.26 and $87.44 per barrel respectively.

On the foreign exchange market, the EUR/USD pair remained almost unchanged, ending the day at 1.10, while USD/JPY gained 0.22%, reaching 143.68. The US dollar index slightly slipped, losing 0.01%, and settled at 102.33. Experts anticipate that the Consumer Price Index (CPI) for July will show a modest annual increase of 3.3%, keeping the core rate at a steady 4.8%. On Tuesday, the financial market underwent a massive selloff, stimulated by Moody's credit agency's decision to downgrade ratings of ten small and medium US banks. This decision intensified investor concerns already troubled by high stock valuations and potential interest rate hikes, especially following the unexpected decision by Fitch agency to downgrade US government debt.

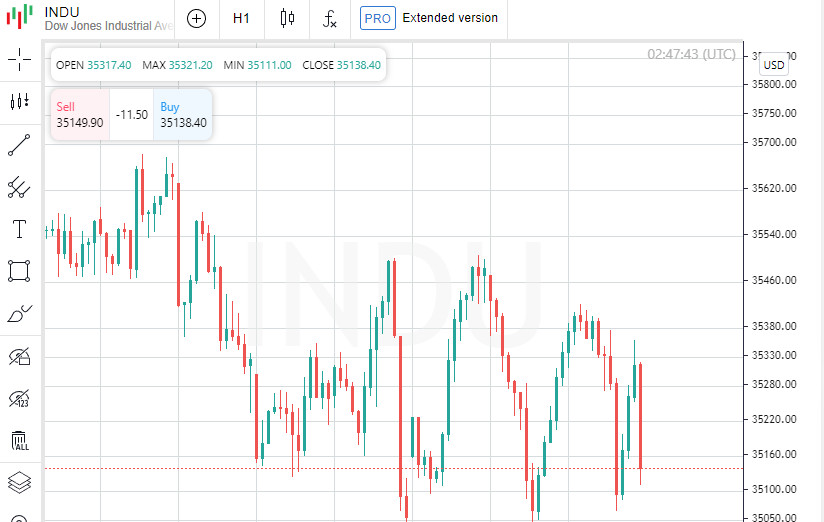

Nvidia, a technology company, found itself at the epicenter of the negative dynamics on Wall Street. However, several other giants from the "Magnificent Seven" also played a role in pressuring the market, leading to a decline in major indices. The global MSCI stock index decreased by 0.30%. U.S. stock indices also showed negative dynamics: the Dow Jones index lost 0.54%, the S&P 500 went down by 0.70%, and the Nasdaq Composite dropped by 1.17%. Meanwhile, the European market displayed more optimistic results. The STOXX 600 index increased by 0.43%, partially due to Italy's announcement that the new tax on banking profits would be within 0.1% of a bank's assets, which was lower than many investors had anticipated.

Nevertheless, a heated debate continues among global investors regarding the potential taxation of extraordinary banking revenues. Jim Reid, a strategist from Deutsche Bank, expressed the opinion that the question of how to distribute the burden of high rates among various market participants is likely to become political. European banking stocks rose by 1.01%, with the Italian FTSE MIB index showing a growth of 1.31%. The situation in China raises many questions on the global economic stage. The ongoing decline in consumer and producer prices confirms the fears of many experts about a potential slowdown in China's economic growth post-pandemic. Both domestic and foreign demand for Chinese goods is weakening, suggesting that the country might be transitioning into a period of stagnation.

The inflation data, as well as weak foreign trade indicators, have led to comparisons with Japan's "lost decades," a period when the country's economy stagnated for many years. The currency market also reacted to the news from China. According to dealers, the alleged interventions of China's state banks to support the national currency led to the strengthening of the yuan. The dollar declined against the yuan and major currencies, which was reflected in the dollar index. There were fluctuations in the US government bond market. The Treasury issued 10-year bonds, and the market closely monitored demand, especially after the recent sharp increase in yields. Instability in this sector reflects investor uncertainty regarding future economic growth and monetary policy. The global oil market continues to show positive dynamics. Reduction in US reserves, as well as decreased supplies from major exporting countries, including Saudi Arabia and Russia, led to price increases. Despite concerns about declining demand from China, the oil market maintains its position. Overall, global financial markets remain influenced by the economic situation in China and the response of key players to these changes.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română