Overview :

The GBP/USD pair is moving higher amid profit-taking around the area of 1.2709 and 1.2847.The US Dollar kept grinding higher on Tuesday as the market mood soured on fears that Chinese economic growth has lost momentum.

The focus now shifts to Federal Reserve Chairman Jerome Powell's testimony before Congress. U.S. Dollar Index is moving higher despite the pullback in Treasury yields. Traders react to the encouraging Housing Starts and Building Permits reports, which beat analyst estimates by a wide margin.

From the technical point of view, DXY is moving towards the 1.2847 resistance, but the pace of this move is slow. The GBP/USD pair fell 0.1% to 1.2783, but remains near 14-month highs with traders fully expecting the Bank of England to raise its benchmark interest rate to 4.75% from 4.5% on Thursday, the highest rate since 2008. Wednesday sees the release of the CPI number for August, and this is expected to confirm that inflation in the U.K. remains the highest in the G7, more than four times the central bank's 2% medium-term target.

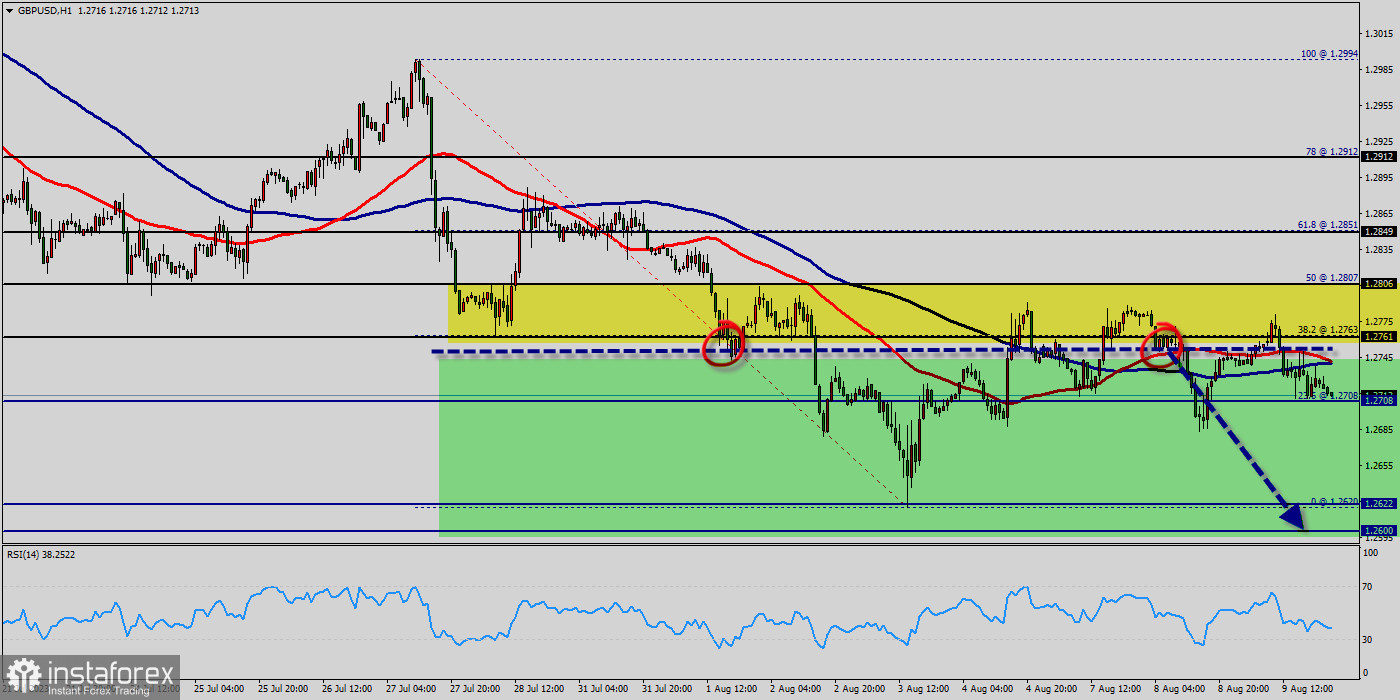

Today, the GBP/USD pair has broken resistance at the level of 1.2709 which acts as support now. Thus, the pair has already formed minor support at 1.2709. The strong support is seen at the level of 1.2624 because it represents the weekly support 1.

Equally important, the RSI and the moving average (100) are still calling for an uptrend. Therefore, the market indicates a bullish opportunity at the level of 1.2709 in the H1 chart. Also, if the trend is buoyant, then the currency pair strength will be defined as following: GBP is in an uptrend and USD is in a downtrend.

Buy above the minor support of 1.2709 with the first target at 1.2709 (this price is coinciding with the ratio of 61.8% Fibonacci), and continue towards 1.2847 (the weekly resistance 1). Further close above the high end may cause a rally towards 1.2847. Nonetheless, the weekly resistance level and zone should be considered.

On the other hand, if the price closes below the minor support, the best location for the stop loss order is seen below 1.2624; hence, the price will fall into the bearish market in order to go further towards the strong support at 1.2571 to test it again.

Furthermore, the level of 1.2486 will form a double bottom - last bearish wave on the hourly chart. The GBP/USD pair broke resistance at 1.2709 which turned into strong support yesterday. This level coincides with 61.8% of Fibonacci retracement which is expected to act as major support today. The GBP/USD pair increased within an up channel.

Closing above the Pivot Point (1.2709 ) could assure that the GBP/USD pair will move higher towards cooling new highs. the bulls must break through 1.2768 in order to resume the up trend. Equally important, the RSI is still signaling that the trend is upward, while the moving average (100) is headed to the upside.

Accordingly, the bullish outlook remains the same as long as the EMA 100 is pointing to the uptrend. This suggests that the pair will probably go above the daily pivot point (1.2709) in the coming hours. The GBP/USD pair will demonstrate strength following a breakout of the high at 1.2768. Consequently, the market is likely to show signs of a bullish trend.

In other words, buy orders are recommended above 1.2709 with the first target at 1.2847. Then, the pair is likely to begin an ascending movement to 1.2934 mark and further to 1.2966 levels. The level of 1.2966 will act as strong resistance, and the double top is already set at 1.2847.

The daily strong support is seen at 1.2624. If the GBP/USD pair is able to break out the level of 1.2624, the market will decline further to 1.2486 (daily support 2). The trend is still bullish as long as the price of 1.2709 is not broken. Thereupon, it would be wise to buy above the price of at 1.2709 with the primary target at 1.2847.

Then, the GBP/USD pair will continue towards the second target at 1.2934 (a new target is around 1.2966). Alternative scenario : The breakdown of 1.2624 will allow the pair to go further down to the prices of 1.2486.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română