Global markets were shocked once again as Friday's employment data in the US came markedly better than expected. The report said there is an increase of about 517,000 new jobs in January, while the December data was revised to 260,000. This strengthened the fears that the Fed will continue its aggressive rate hike cycle as consumers may resort to spending more, which might cause not only the slowdown of inflation, but also its rise again. If that happens, the Fed will have no choice but to continue to raise rates, perhaps more strongly, pushing it to above 5%.

Unsurprisingly, dollar demand grew because of the news, while equities fell almost unanimously. The fall was recovered afterwards, but it already halted the rally and threatened the bull market.

Investors are now in a very tricky situation because on one hand, the Fed has acknowledged a decrease in inflation after more than 6 months, but on the other hand, the strong labor market data could stimulate inflation.

Most likely, the rally on the stock markets will pause, while dollar will continue to grow at least until the next release of US inflation data. If that shows that there is a halt or even a slight increase in inflation, the rally in stock indices will resume, while dollar will fall. As for the market situation before the release of the data, volatility will be high as uncertainty will prevail. That could also be a catalyst for consolidation in the world markets.

Forecasts for today:

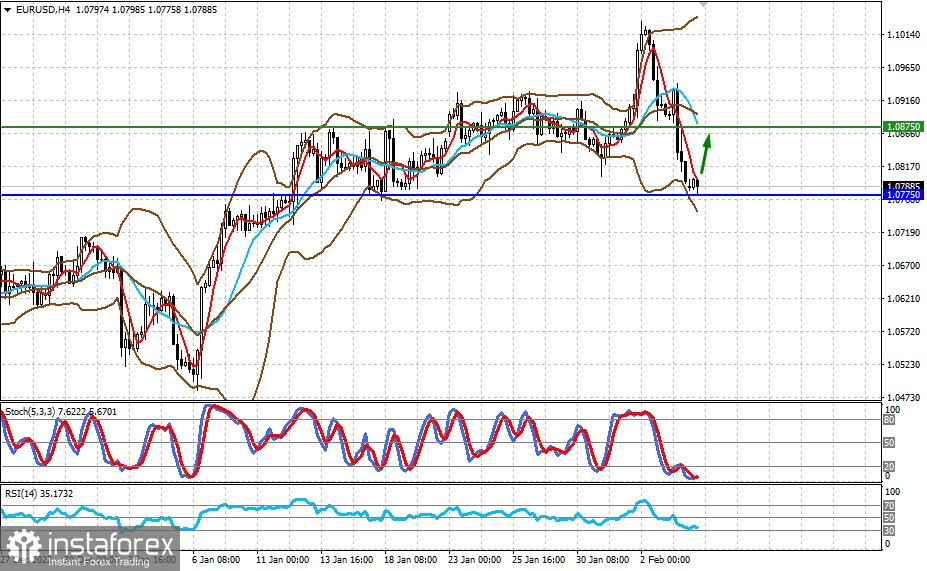

EUR/USD

The pair is trading above 1.0775. If this level holds, a rise to 1.0875 is possible.

USD/CAD

A renewed rise in crude oil prices may prevent the pair to rise further. If the quote stays below 1.3425, the pair will continue heading towards 1.3300.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română