Federal Reserve Chairman Jerome Powell said policymakers expect a couple more interest rate hikes before suspending their aggressive tightening campaign, even as they slowed their efforts to rein in inflation.

Policymakers lifted the Fed's target for its benchmark rate by a quarter percentage point to a range of 4.5% to 4.75%. The smaller move followed a half-point increase in December and four giant hikes of 75 basis points before that.

Nevertheless, investors were receptive to the chair acknowledging that price pressures had begun to ease, even as he emphasized the Fed's outlook for further rate hikes. The S&P 500 closed more than 1% higher after his speech, and two-year yields fell sharply.

"We have covered a lot of ground," Powell told reporters after the meeting. "Even so, we have more work to do."

The Federal Open Market Committee's vote was unanimous.

"The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time." the Fed said in a statement issued after the two-day decision.

In a sign that the end of the rate hike cycle may be near, the Committee said that the "extent of future increases" would depend on a number of factors, including cumulative tightening of monetary policy. It had previously linked the "pace" of future hikes to these factors.

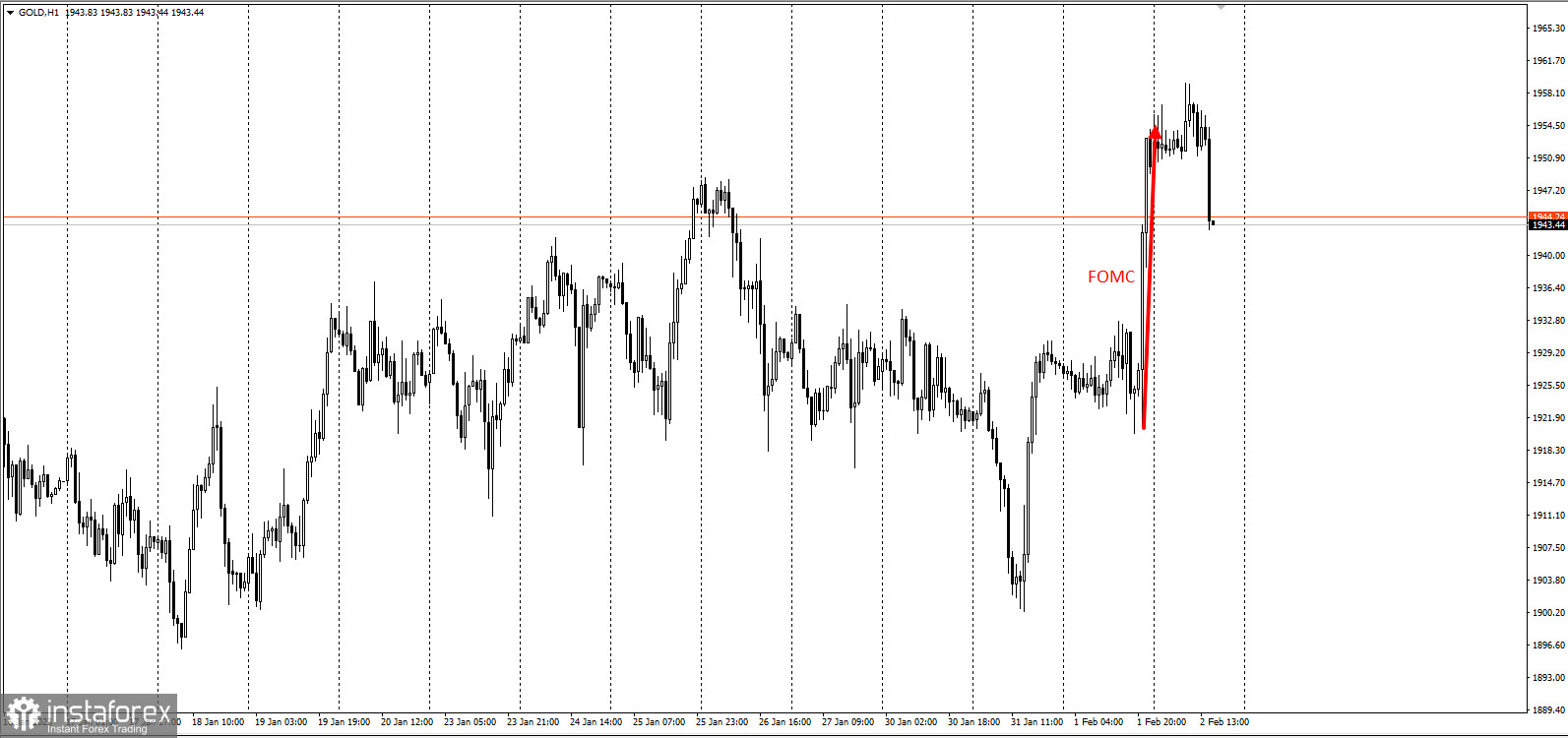

Gold rose 3000p during the session:

Powell added during his press conference:

"We've raised rates four and a half percentage points, and we're talking about a couple of more rate hikes to get to that level we think is appropriately restrictive," he said.

In another departure from its last statement, the Fed noted that inflation has "eased somewhat but remains elevated," indicating that policymakers are becoming more confident that price pressures have peaked.

That compares with previous language when officials simply said price increases were "elevated."

"The heavy lifting is done, but it doesn't mean the job is finished," said Derek Tang, an economist at LH Meyer in Washington. "He'll err on the side of hiking a bit more and staying there a bit longer. He stuck to his risk management story of not wanting to test if they can get away with doing fewer hikes."

EURUSD added 1,500p in the session, rewriting the top of the month:

The Fed did not release new forecasts on Wednesday, but Powell referred to those forecasts as a benchmark for how much higher officials expect rates to rise.

Initially dismissing price increases as temporary, Fed policymakers have struggled to get rampant inflation under control before it takes root in the economy, raising rates sharply from near-zero levels as recently as a year ago.

They are also shrinking the Fed's balance sheet at a record pace, taking hundreds of billions of dollars out of the financial system.

"It is gratifying to see the disinflationary process underway, with continued strong labor market," Powell said. Still, the chairman said officials will need "much more evidence" that inflation is on a steady downward trajectory.

Powell focused on the labor market as a source of potential inflationary pressure, arguing that "demand for workers far exceeds the supply of available workers, and nominal wages have been growing at a pace well above what would be consistent with 2 percent inflation over time."

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română