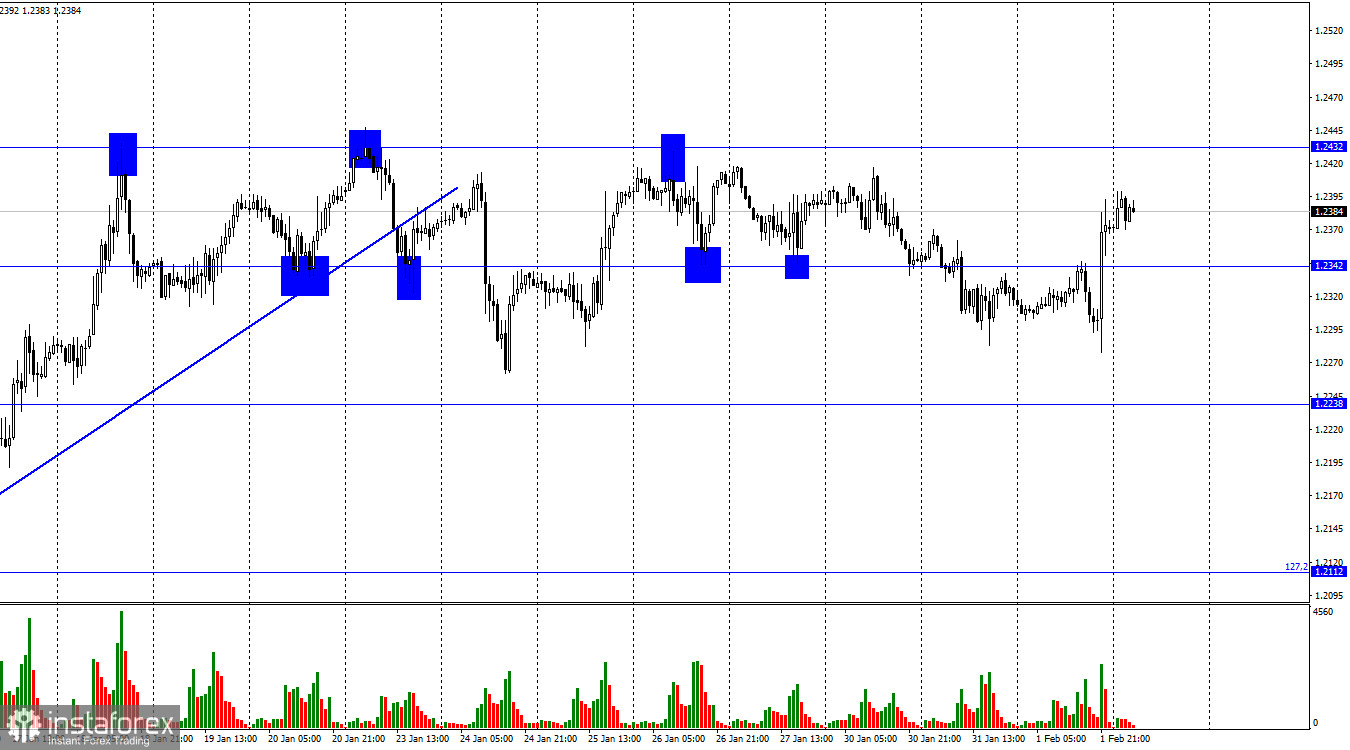

The hourly chart shows that the GBP/USD pair reversed in favor of the British currency and then consolidated above the price level of 1.2342. The pair maintained their horizontal movement because the growth of quotes was not too strong. The price is still fluctuating between 1.2238 and 1.2432. I don't anticipate significant British or American growth until it exits this area.

In the euro/dollar review, I've previously discussed the Fed meeting and Jerome Powell's remarks. I shall discuss today's Bank of England meeting in this essay. Similar to yesterday, other meeting-related activities will be more significant than the regulator's decision on the rate itself. The distribution of votes in favor of and against the rate hike will be crucial. Two members of the PEPP committee voted against tightening the policy at the last meeting. Regardless of the Bank of England's rate decision, if there are more of them today, the British dollar may decline. Traders are certain that the rate will increase by 0.50%, but what will President Andrew Bailey say following the meeting? Yesterday, his colleague Jerome Powell spoke persuasively and extensively about monetary policy and potential future changes. Today, Bailey is anticipated to act similarly. The market needs to know how much higher the rate can go and what steps the regulator is prepared to take to get inflation down to 2%. It is also crucial to consider the anticipated timeframe of a return to 2% and the speed that the Bank of England is prepared to follow. On Thursday, it's more likely that the British pound will increase if the answers to these questions are challenging.

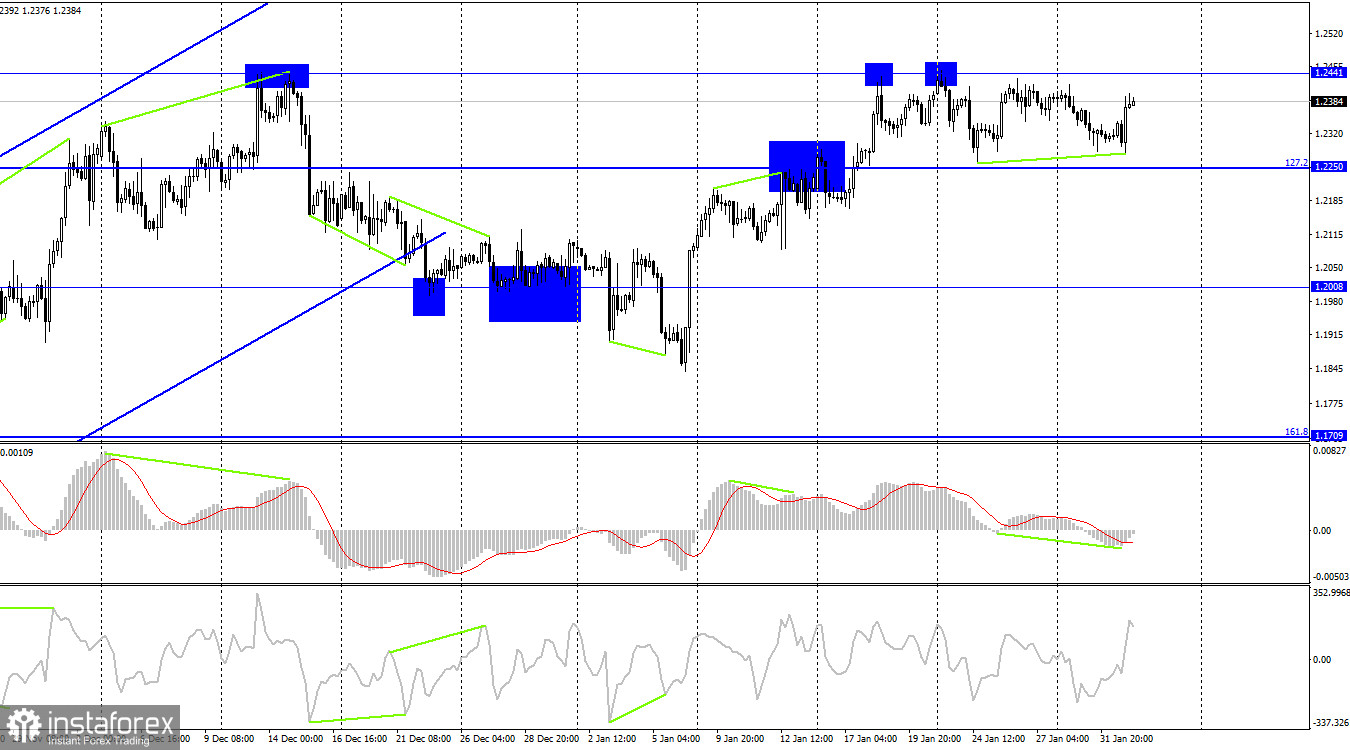

I do not rule out the potential of an increase in trading activity, following which the pair will continue to trade in a side corridor. Now that it is not far from its center, leaving it will be very challenging. Following the emergence of a "bullish" divergence at the MACD indicator, the pair on the 4-hour chart reversed in favor of the British. The increase in quotes could continue in the direction of 1.2441. The US dollar will benefit from a rebound from this level and the continuation of the decline in the direction of 1.2250. The pair is still moving horizontally in general. Closing above 1.2441 will increase the likelihood of more growth to the following level.

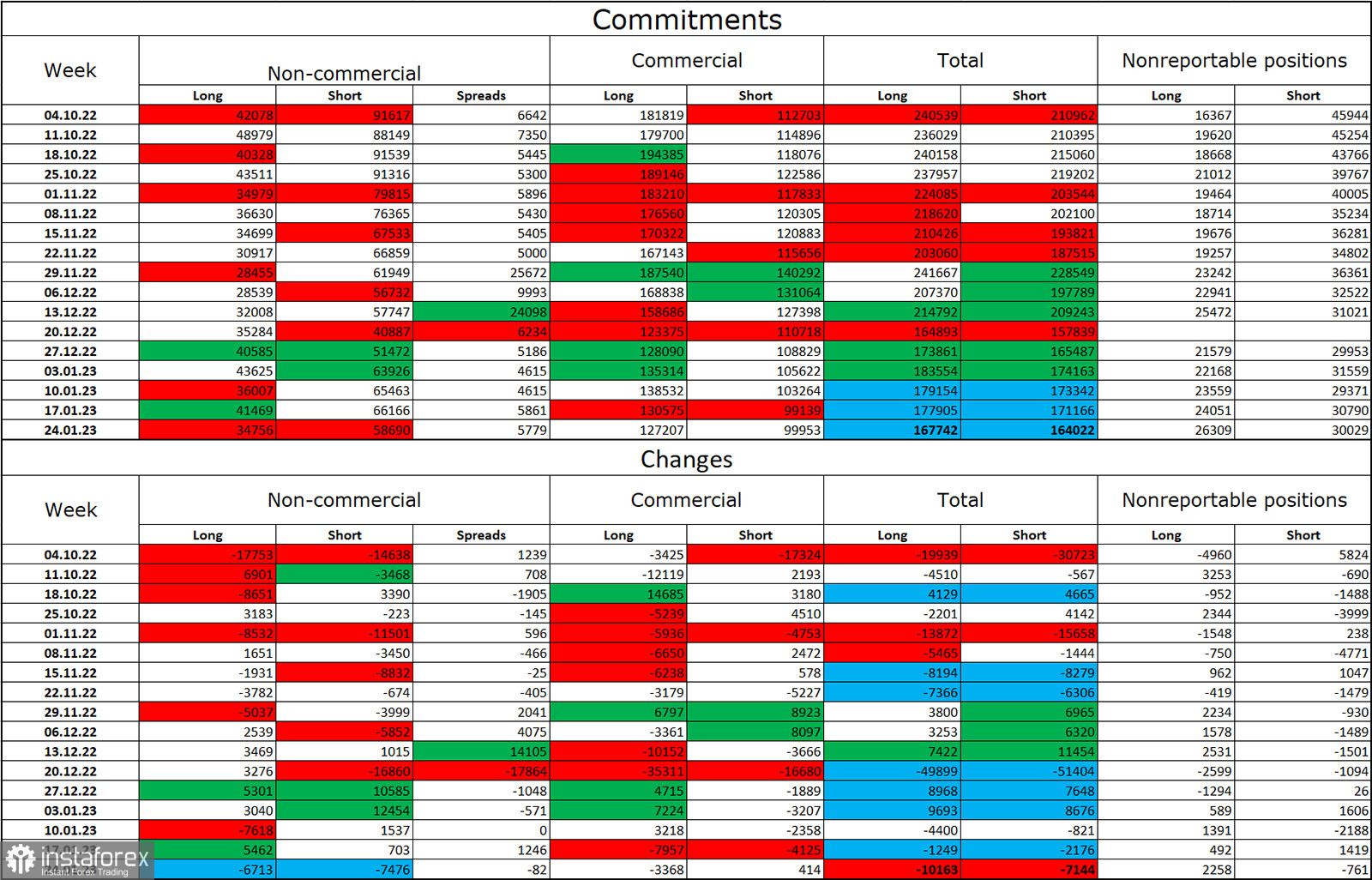

Report on Commitments of Traders (COT):

The "Non-commercial" group of traders has been trading in a less "bearish" manner than they were a week ago. The number of long contracts held by investors dropped by 6,713 units, while the number of short contracts dropped by 7,476. The major players' overall outlook is still "bearish," and there are still more short-term contracts than long-term contracts. The situation has shifted in favor of the British over the last few months, but today the number of Long and Short in the hands of speculators is nearly doubled once more. As a result, the outlook for the pound has once again declined, but it is not eager to decline and is instead concentrating on the euro. There was an escape beyond the three-month ascending corridor on the 4-hour chart, and this development may prevent the pound from rising further.

News calendar for the USA and the UK:

UK – Bank of England interest rate decision (12:00 UTC).

UK – minutes of the Monetary Policy Committee meeting (12:00 UTC).

US – number of initial applications for unemployment benefits (13:30 UTC).

US – speech by the head of the Bank of England Bailey (14:15 UTC).

The US economic calendar is almost empty on Thursday, but the British calendar is filled with significant events. The information backdrop might have a significant impact on how traders feel today.

Forecast for GBP/USD and trading advice:

If prices on the hourly chart rebound from the level of 1.2432 with targets of 1.2342 and 1.1.2238, sales of the pound may be conceivable. When the pair is fixed above the 1.2441 level on the 4-hour chart with a target price above 1.2500, purchases of the pair are probable.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română