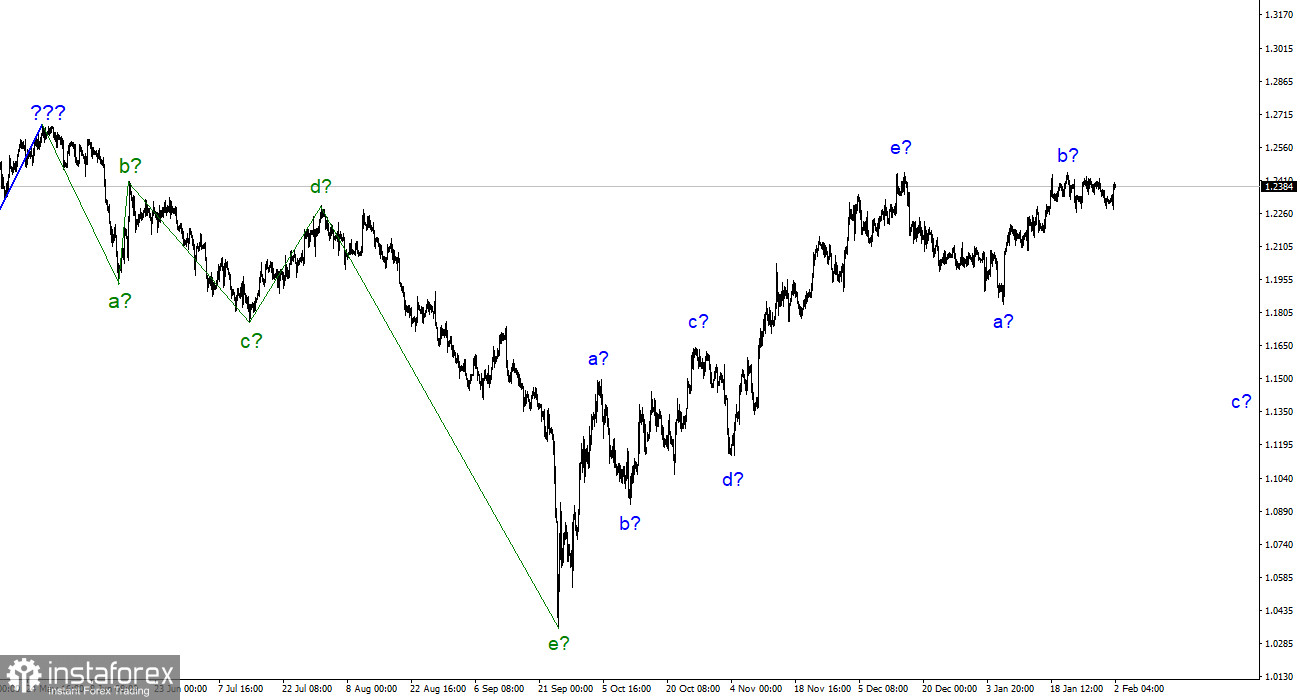

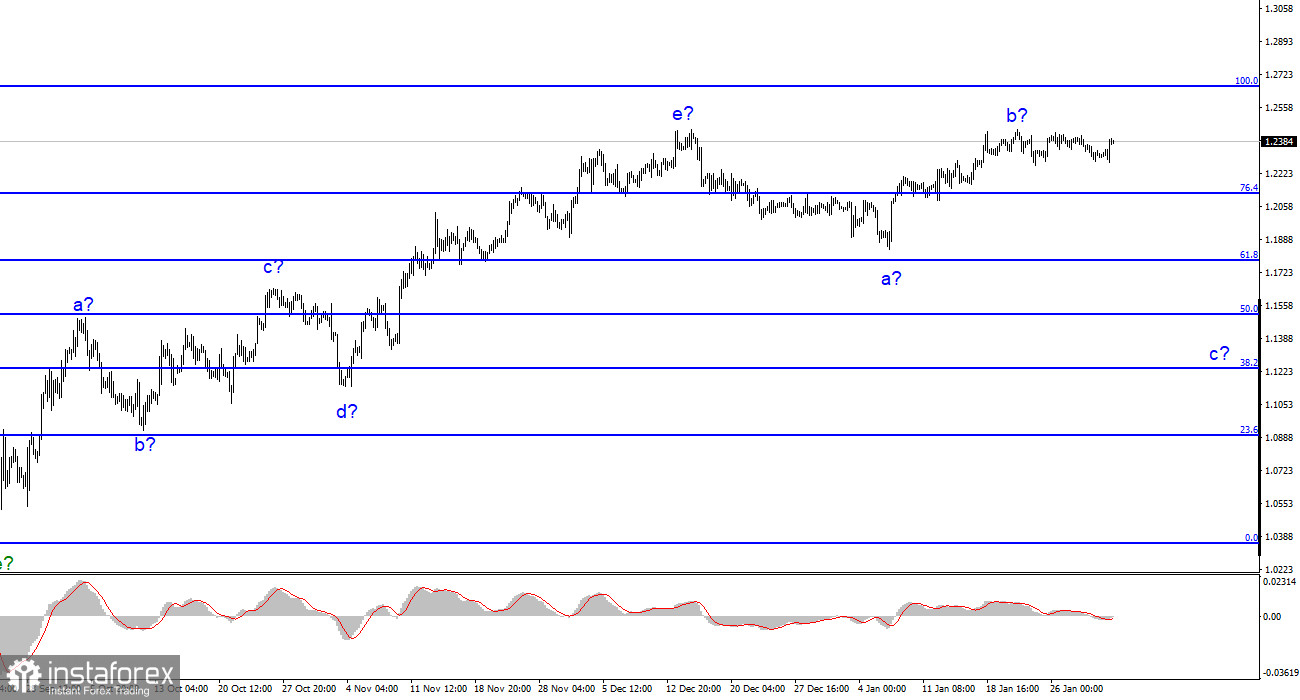

The wave layout of GBP/USD looks rather complex and does not require any adjustments. However, its structure starts to differ when compared to the layout of the euro/dollar pair. So, we have an ascending wave pattern consisting of a-b-c-d-e parts and this trend section seems to be completed. I assume that the descending section of the trend began to form a three-wave structure. However, wave b has become too extended and is about to be canceled. If the quotes continue to rise, the current ascending wave can no longer be considered wave b, and the entire wave layout will need to be readjusted. Yet, I still expect to see the development of the descending c wave. If the current wave structure is correct, the instrument has potential to decline by 500-600 pips to the level of 1.1508, which corresponds to the 50.0% Fibonacci level. The high of wave b has not yet exceeded the high of wave e, which maintains the integrity of the current wave layout. A moderate retreat from recent highs suggests that the descending c wave may start to form soon. At the same time, yesterday's uptrend and today's policy meeting of the Bank of England may change the wave structure.

GBP still hangs on but stays shaky

The pound/dollar pair went up by 55 pips on Wednesday, which is a very modest result compared to what the euro showed. Traders turned their sights to the pound after the end of the FOMC meeting although a sell-off was also very likely. But as we can see, the market stays bullish on both the euro and the pound. Today, the Bank of England will announce its decision on interest rates. The regulator is expected to hike the rate by another 50 basis points. The market has long been waiting for this decision. Therefore, I believe that this event has already been priced in by traders. At the same time, we could see yesterday that the market was ready to add more long positions on the pound. So, it is very possible that today GBP will advance further which may break the structure of wave b and change the whole wave layout.

I would like to point out that wave layouts for the euro and the pound are different now which is not common for these instruments. I still hope to see a new descending wave on the pound. This can be possible only if the BoE mutes its hawkish rhetoric and raises the rate by just 25 basis points. This scenario cannot be ruled out as the decision on interest rates was not unanimous at the last meeting. In my view, a decline in the instrument would be more justified. A new ascending section of the trend could well begin after the three-wave descending structure is completed. Everything will depend on Andrew Bailey's statement and the market reaction.

Conclusion

The wave layout of the pound/dollar pair suggests the formation of a new descending section of the trend. You may consider selling the pair with the targets near 1.1508, which corresponds to the 50.0% Fibonacci level. A stop-loss order can be set above the highs of waves e and b. The ascending section of the trend may become even more extended, just as it is happening with the euro. Selling can be risky now as the pound is poised to rise further.

On higher time frames, the wave structure is similar to the one of the euro/dollar pair. Yet, some slight differences can already be seen. At the moment, the upward correction is nearing its completion (or has already been completed). If this assumption is right, we will see at least three descending waves that will extend the downtrend up to the 1.15 area.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română