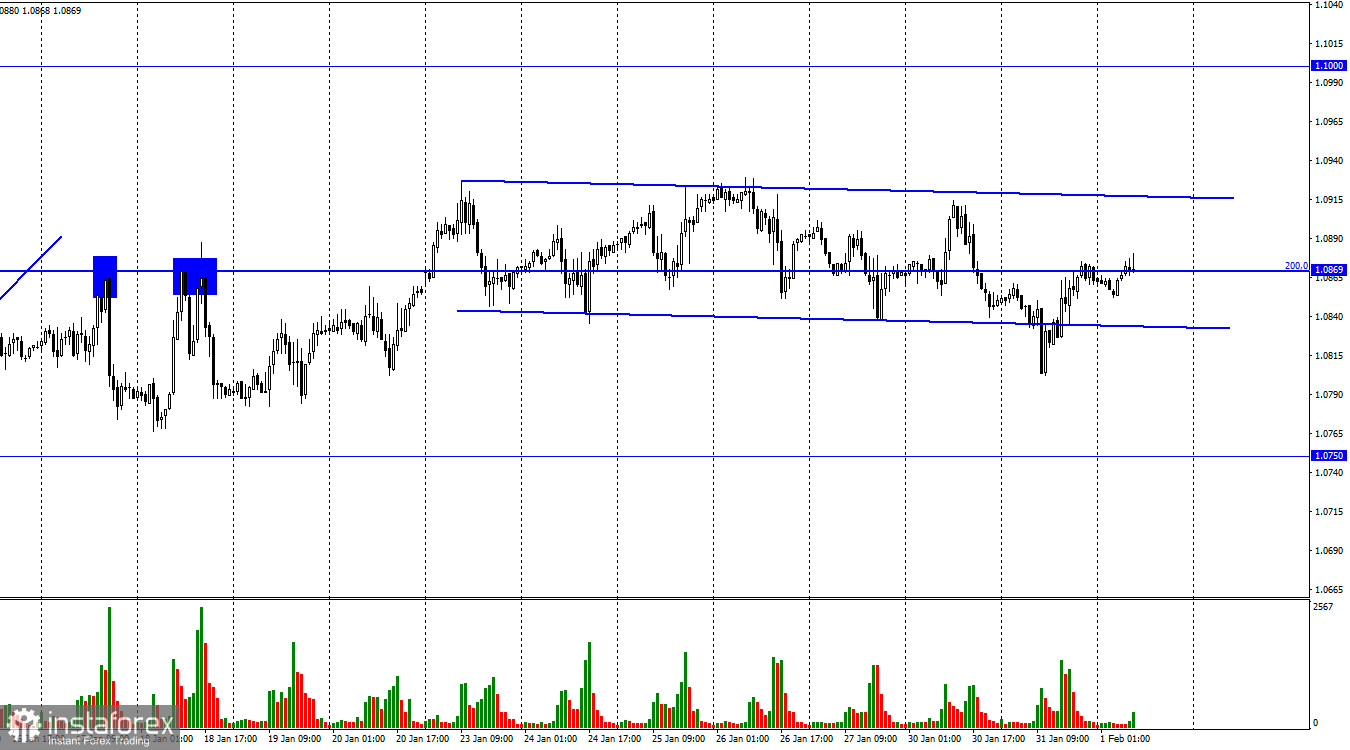

Hi everyone! The EUR/USD pair dipped below the sideways corridor on Wednesday. However, later, it managed to return to its previous level. The pair is still moving sideways as traders are cautious ahead of the ECB and the Fed meetings.

Today, the Fed will finally announce its key rate decision. This is the first meeting in 2023. Traders are betting on a 25 basis point rate hike. They do not even consider other scenarios. Expectations of a less aggressive rate hike were fueled by a slowdown in inflation in December. It was the sixth decline in a row. Fed policymakers stated in January that inflation is dropping at a good pace. However, they remained adamant when it comes to further monetary tightening. Investors took those remarks with a pinch of salt. They are confident that the Fed may stick to a dovish stance in the near future. For instance, it could happen in March.

Thus, investors are more focused on Jerome Powell's speech at the Press Conference rather than the rate decision itself. Powell is likely to touch upon such topics as inflation, economic growth, the labor market, and the prospects of monetary policy. The trajectory of the US dollar will mainly depend on Powell's speech. In my opinion, Jerome Powell will not make strong statements. He has always been careful with his comments. He will surely stress a steady fall in consumer prices as well as a strong labor market and low unemployment. Yet, such remarks may undermine the upward movement of the US currency as the ECB rhetoric is likely to be more hawkish. The softer Powell's statements are, the more likely the US dollar will decrease again. However, I believe that the US currency could climb today and tomorrow.

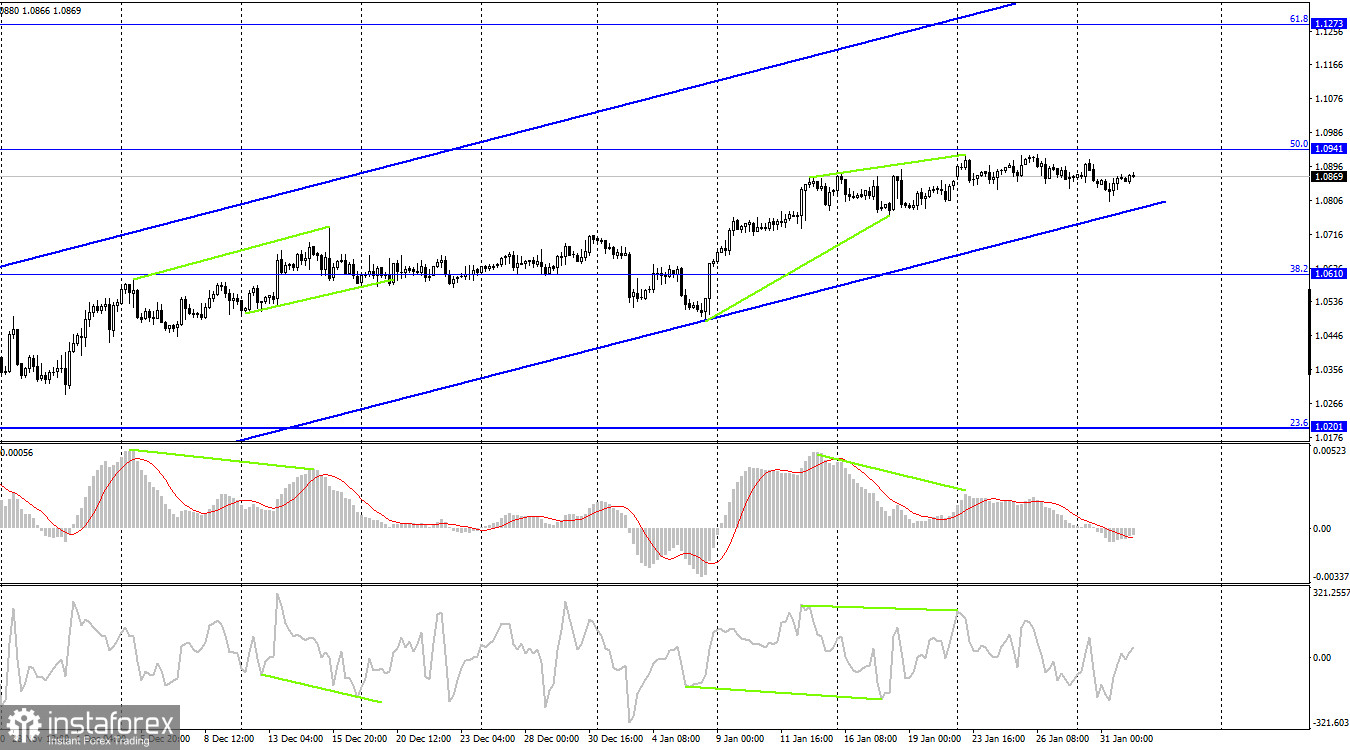

On the 4H chart, the pair keep rising to 1.0941, the Fibonacci correction level of 50.0%. If the pair declines from this level, it could tumble to 1.0610, the Fibo level of 38,2%. The uptrend corridor indicates that the market sentiment is bullish. I don't expect a strong fall in the pair before closing below the corridor. There are no divergences of any indicators.

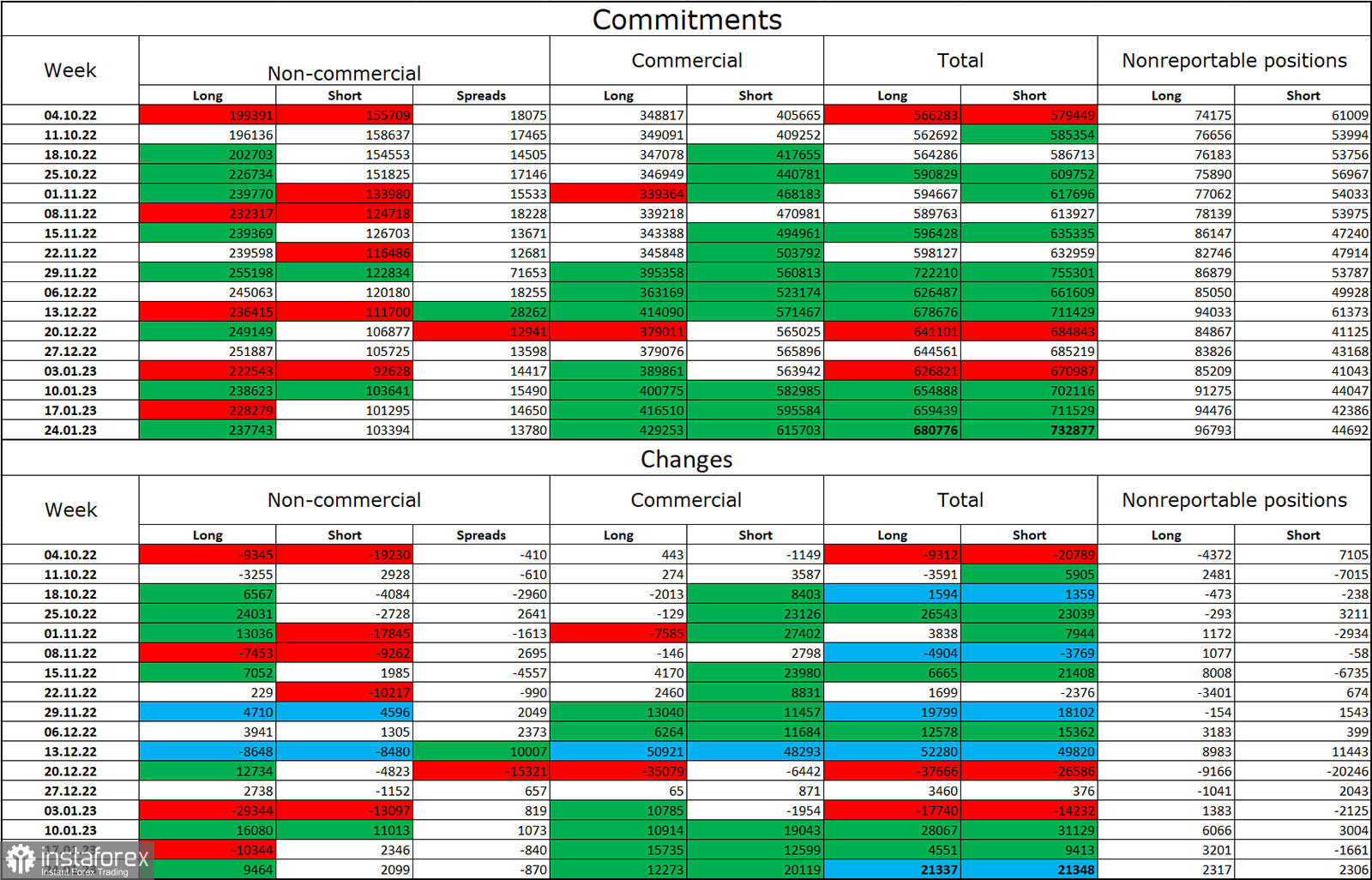

Commitments of Traders (COT):

Commitments of Traders (COT):

Last week, speculators opened 9,464 long positions and 2,099 short ones. The mood of large traders remains bullish. It has slightly strengthened. The total number of long positions amounts to 238,000 and the number of short ones totals 103,000. The euro keeps climbing at the moment, which is in line with the COT reports. However, the number of long positions is almost two and a half times higher than the number of short ones. Over the past few months, the bullish sentiment has been constantly growing as well as the euro. However, sometimes it lacked drivers. The market situation is favoring the euro after a prolonged downtrend. So, its prospects remain positive at least as long as the ECB raises the interest rate in steps by 0.50%.

Economic calendar for US and EU:

EU– PMI Manufacturing Index, 09:00 UTC.

EU – CPI, 10:00 UTC.

EU – Unemployment report, 10:00 UTC.

US – ISM PMI Manufacturing Index, 15:00 UTC.

US – Fed's key rate decision, 19:00 UTC.

US –FOMC Press Conference, 19:30 UTC.

On February 1, the economic calendars for the EU and the US include many crucial macroeconomic reports. However, traders will mainly pay attention to Jerome Powell's speech at the press conference and EU inflation data. The impact of fundamental factors on market sentiment may be quite strong today.

Outlook for EUR/USD and trading recommendations:

It is better to open short positions if the pair declines from 1.0941 on the 4-hour chart with target levels of 1.0869 and 1.0750. It is recommended to open long positions If the quotes close above 1.0941 on the 4-hour chart with target levels of 1.1000 and 1.1150. You might go long if it continues to move in the sideways channel with the target level of 1.1000.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română