Trading on the last day of January ended on an optimistic note as market players seem to be convinced that the Fed will raise interest rates by 0.25% at its upcoming meeting and then announce a pause in the cycle. This is after the Q4 labor cost data showed the steepest decline of the year, indicating that the continuing deterioration in the US economy could prompt the central bank to stop raising rates in the coming months.

Any signal of a pause is likely to lead to massive buying pressure in stock markets, accompanied by a decline in dollar demand. Then, ADP data on new jobs could strengthen the momentum, especially if the figures are in line with or below the forecast. Sentiment will also remain positive if the December JOLTS data show a reading of 10.250 million or lower.

As for the average hourly earnings and average working week values that will be released on Friday, they could be another reason for a surge in risk appetite if the figures come out higher or in line with the forecasts. This is because the income and expenses of the working population are directly related to employment, and will mean that inflationary pressures will have trouble growing, continuing to decline. Employment data from the US Department of Labor will give a similar effect.

All in all, markets will rally if everything that is mentioned above comes true. It could also trigger huge amounts of cash going into US Treasury shares and government bonds, putting pressure on dollar.

Forecasts for today:

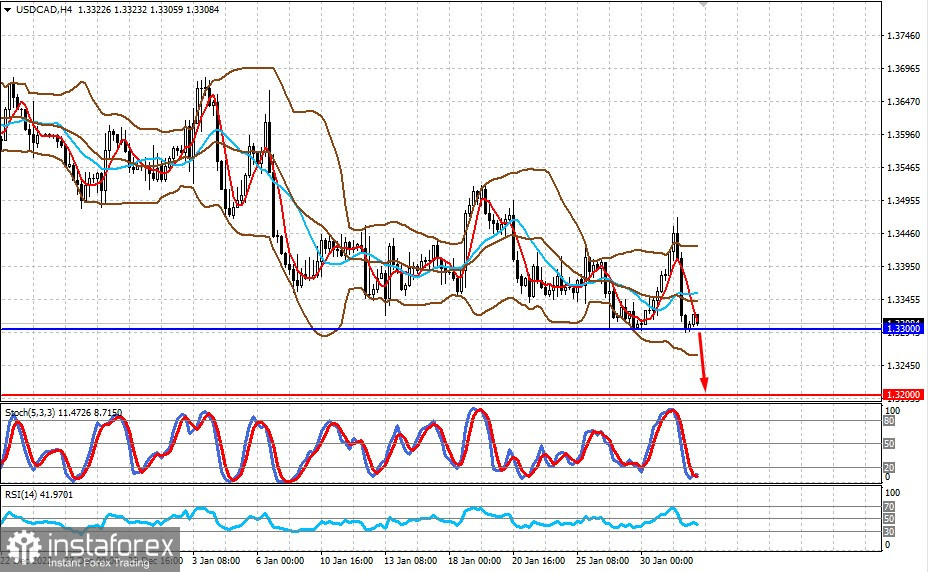

USD/CAD

The pair has fallen to the level of 1.3300. A further increase in oil prices could result in another decline to 1.3200.

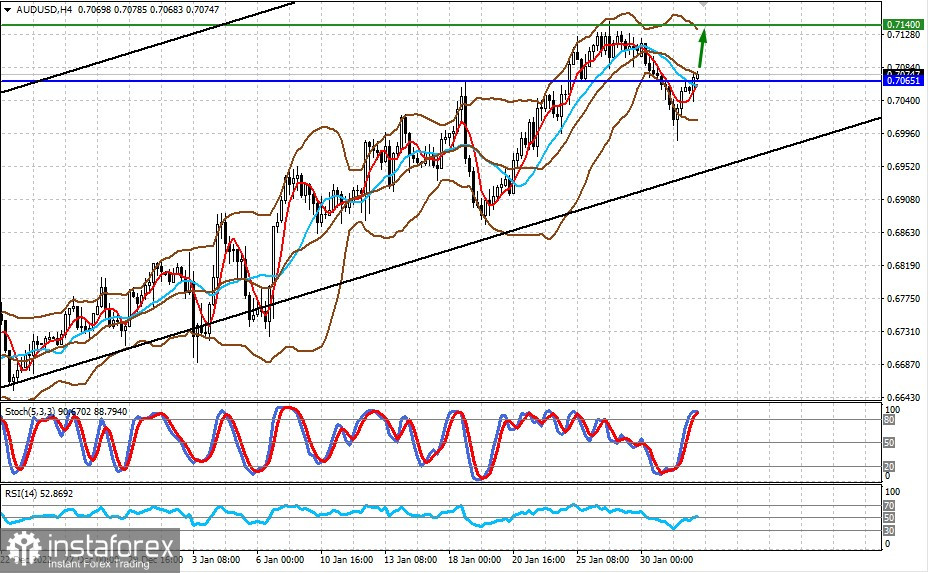

AUD/USD

The pair is trading above the level of 0.7065. A price consolidation above it could lead the pair towards 0.7140.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română