The EUR/USD pair rose by 10 pips yesterday, moving in a narrow range.

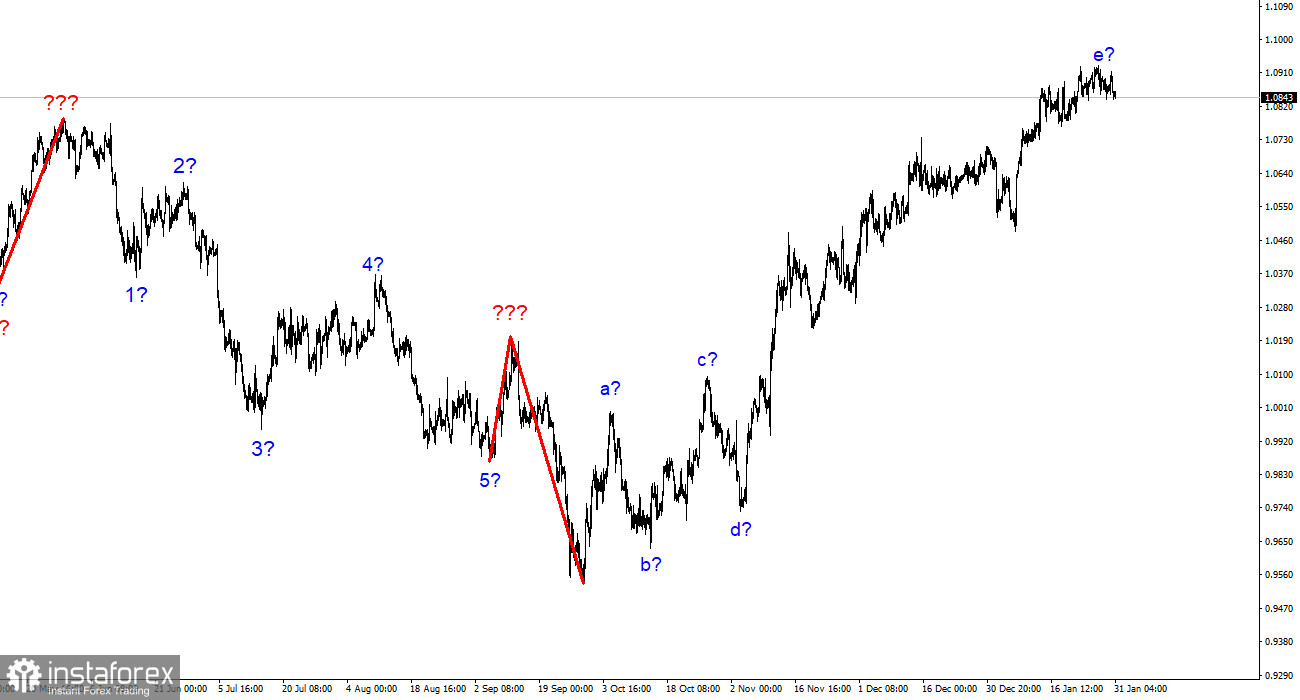

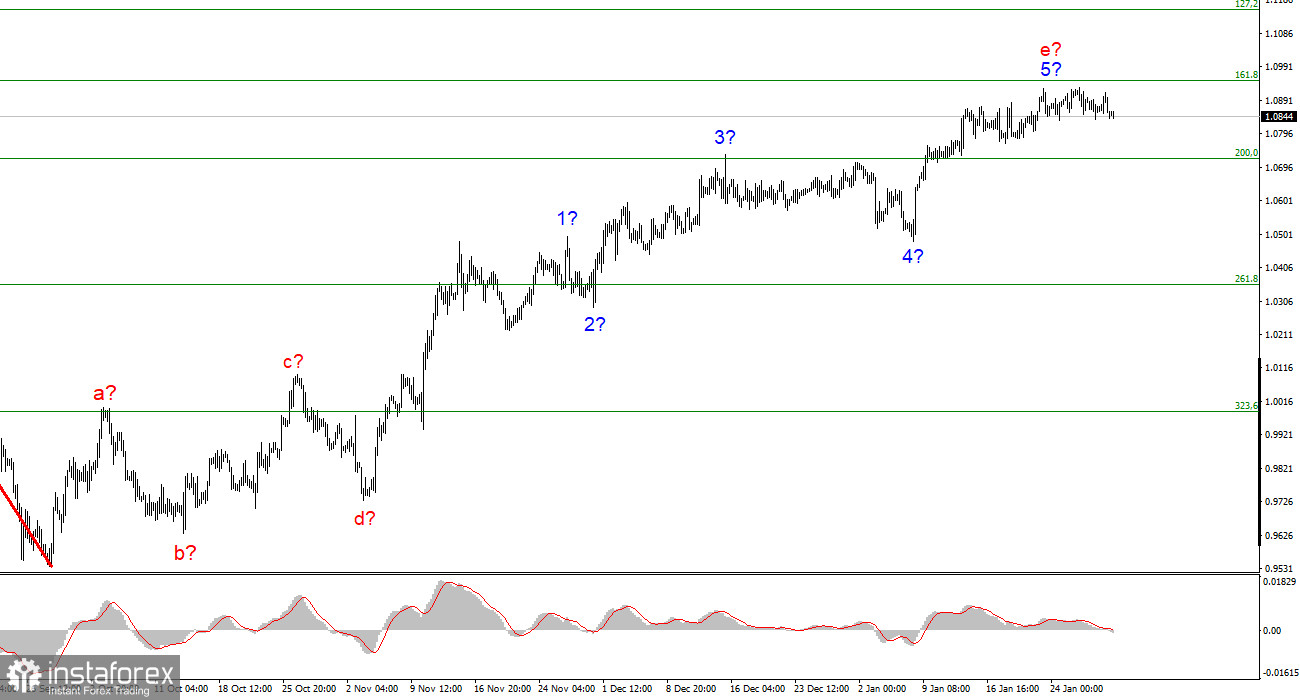

The wave layout of the 4-hour chart for the euro/dollar pair has not changed recently and remains complex. The uptrend line has taken a corrective and extended form although its size is more suitable for an impulse wave pattern. Now we see the wave structure a-b-c-d-e where the wave e has a much more complex form than the first four waves. If the current wave layout is correct, the construction of this structure may be nearing completion. The peak of wave e is much higher than the peak of wave C. In this case, there might be at least three waves down. Hence, I believe the pair could decline. In the first weeks of 2023, demand for the euro grew constantly or was high. During that period, the instrument managed once only to move down a little from previously reached highs. An unsuccessful attempt to break through the 1.0953 level, which corresponds to the Fibonacci level of 161.8%, will indicate a drop in demand. Unfortunately, the construction of the correction section of the trend is still delayed.

Eurozone GDP for fourth quarter rises

The euro/dollar pair climbed by 10 pips on Tuesday, moving in a narrow range. I have already said that the current price changes after each trading day are small as the instrument has been moving in a narrow range for several weeks. Thus, some changes may occur but it is better not to pay too much attention to them. Yesterday, the EU revealed GDP data for the fourth quarter. The EU economy expanded by 0.1% on a quarterly basis and by 1.9% on an annual basis. These readings are higher than expected. This report is positive for the euro. However, there was no increase in demand. It means that the market reaction was muted.

This report is rather contradictory. On the one hand, the European economy has not entered a recession yet, which is bullish for the euro. The ECB has the opportunity to stick to monetary tightening. On the other hand, economic growth is slowing down. An increase in indicators was rather small. This is why analysts predict a contraction in the first quarter of 2023. Nevertheless, I consider this report positive since the recession could have already started in winter. Besides, it confirms that the EU economy is more resilient despite gloomy forecasts. Christine Lagarde also talked about this in Davos. She noted that the summer and autumn forecasts did not come true and the European economy went through the energy crisis well. A decline in oil and gas prices helped the economy significantly. Yet, inflation is still high. The ECB will continue to raise the interest rate. At the same time, the current wave layout indicates the construction of a downward set of waves and does not imply a new increase in the euro.

Conclusion

Given the analysis, the construction of the upward trend section is nearing its completion. Thus, now it is possible to consider short positions with targets located near 1.0350, which corresponds to the Fibonacci level of 261.8%. It is better to place a Stop Loss order above 1.0953. There is a possibility of complicating the upward section of the trend. It may become more extended. This scenario looks quite likely. An unsuccessful attempt to break through the 1.0953 level will indicate the market's readiness to complete the e-wave.

On the higher timeframes, the wave layout of the downtrend section has become noticeably more complicated and extended. We saw five upward waves, which are most likely the a-b-c-d-e structure. The construction of a downward trend section may begin after the completion of this section.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română