Markets came under strong pressure on Monday due to the closing of many long positions ahead of the Fed monetary policy meeting. This is to be expected as investors usually hedge before central banks announce their decision on interest rates.

Earlier, markets had a strong opinion that slowing inflation and the still-strong US economy will influence the Fed to raise the key interest rate by 0.25%. They also expected the central bank to take a pause in the rate hikes, while some even believe that is where the cycle will end. Of course, in spite of such widespread conviction, there is still the possibility that the opposite will happen.

Nevertheless, it is likely that the declines that began on Monday will end without exception, and it is even possible that risk appette will surge again. This will put pressure on the dollar, slowing down its local increase. The signal will be the rebound in stock indices, not only in the US but also in Europe.

Forecasts for today:

USD/CAD

The pair bounced up, thanks to the decrease in risk appetite and crude oil prices ahead of the Fed's monetary policy meeting. If market sentiment changes today and traders fail to hold the quote above 1.3445, the pair will fall to 1.3300.

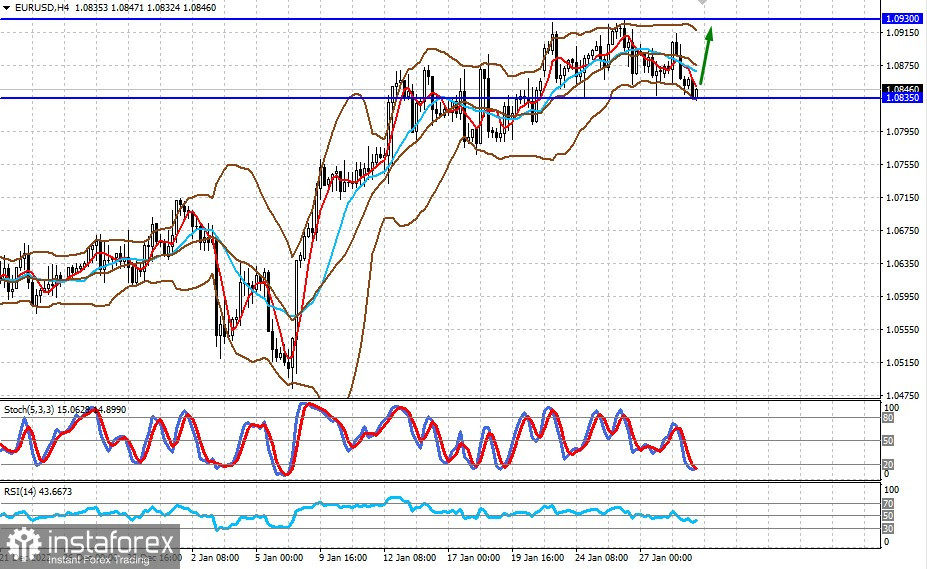

EUR/USD

The pair is trading above 1.0835. If the negative sentiment eases today, the pair may advance to 1.0835-1.0930.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română