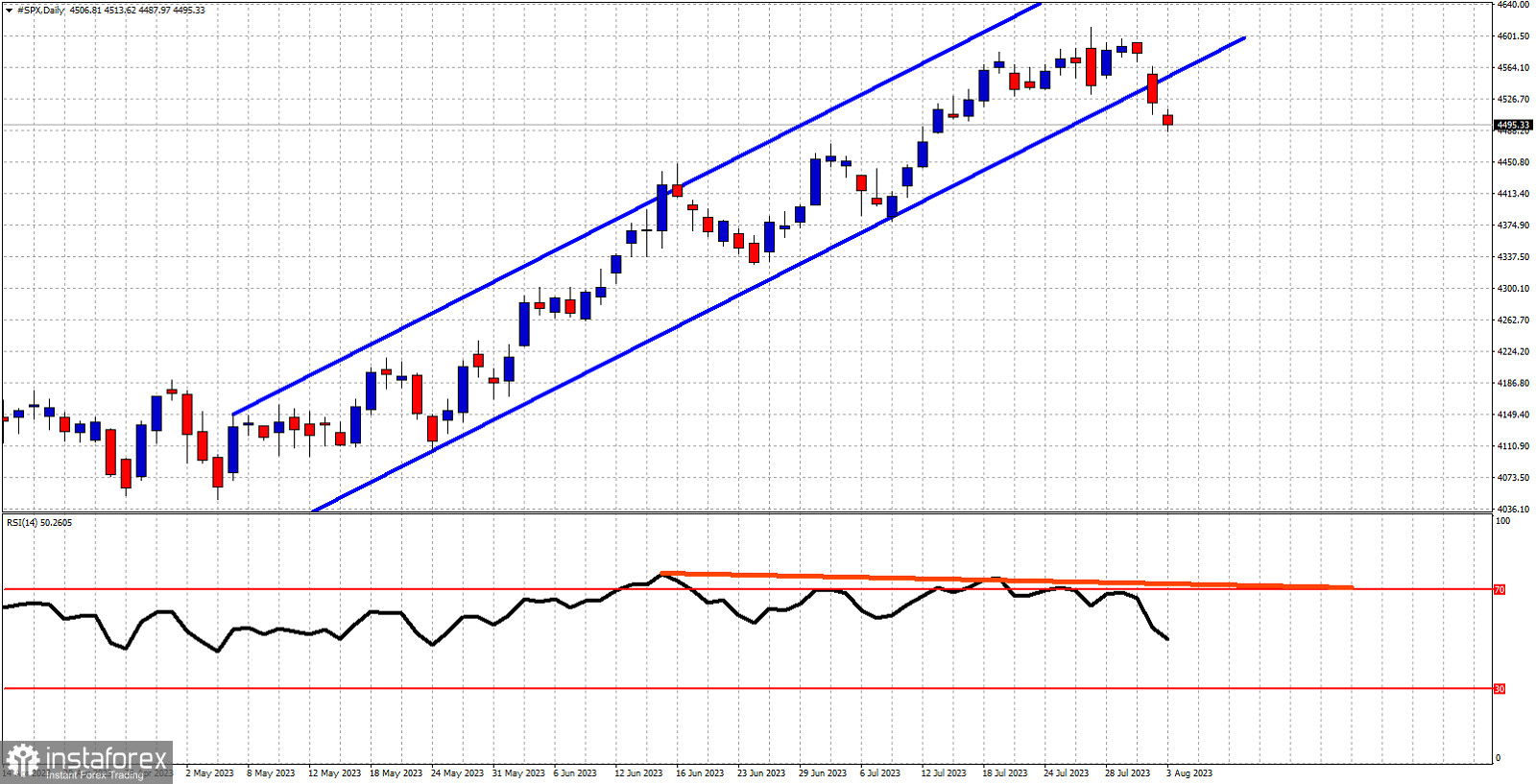

Blue lines- bullish channel (broken)

Red line -bearish RSI divergence

SPX is under pressure for a third day in a row. In previous posts we warned traders that a reversal was very possible. The bearish RSI divergence has warned us that the up trend was weakening. Yesterday we saw price break out of the bullish channel providing a bearish reversal signal. SPX is now in a corrective phase and with the RSI turning to new lower lows, we expect to see a pull back in the index towards at least the 4,480 area. There is an open gap at 4,580. I do not expect to see the gap filled if price is in the process of a corrective phase now. Second downside target is at 4,400.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română