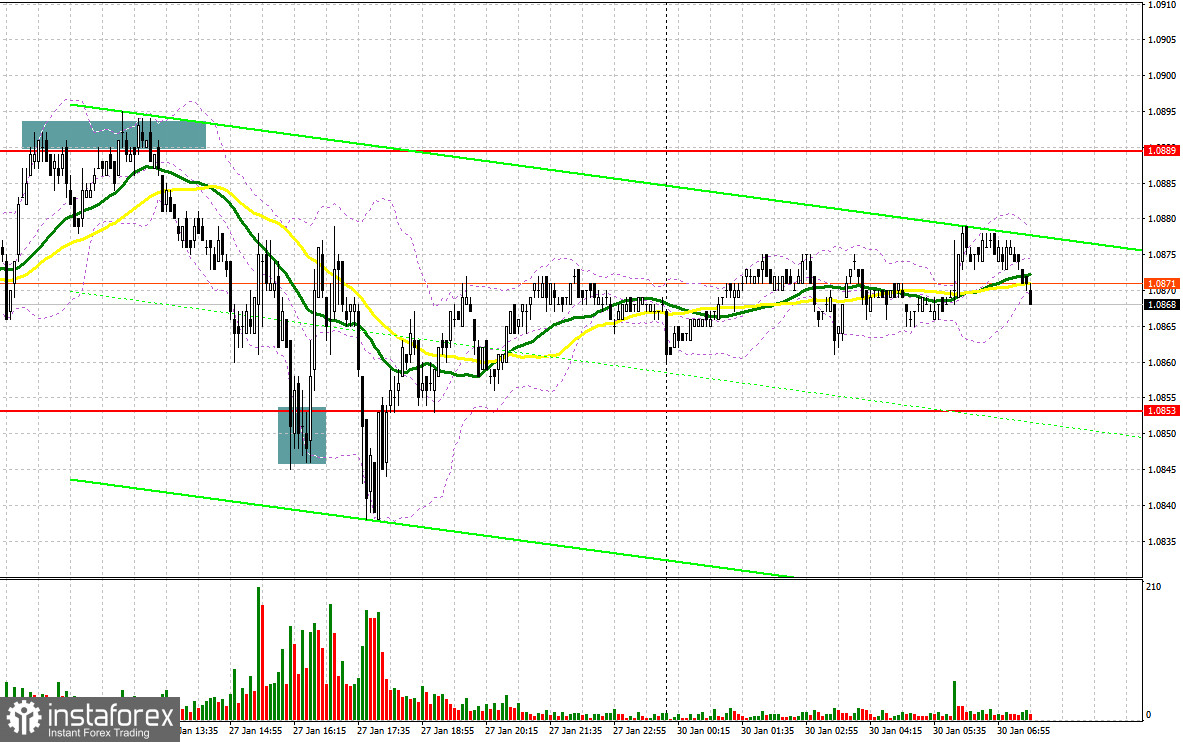

On Friday, traders received several perfect signals to enter the market. Let us take a look at the 5-minute chart to figure out what happened. Earlier, I asked you to focus on the level of 1.0889 to decide when to enter the market. The euro increased to 1.0889 amid the absence of fundamental data. After that, the pair formed a false breakout, which led to a decline of more than 30 pips. Buy orders from 1.0853, which was protected by bulls in the second part of the day, allowed the price to recover by 20 pips.

Conditions for opening long positions on EUR/USD:

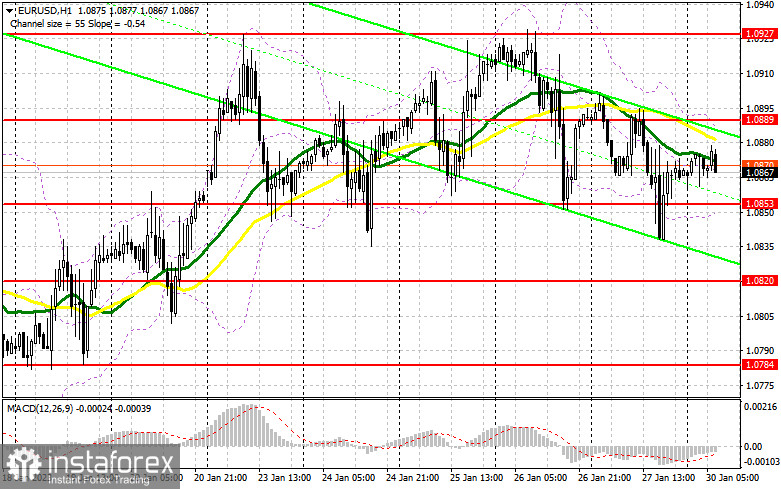

Today, there is nothing that could help the euro to recover against the US dollar. Germany's GDP data and the consumer confidence report will hardly affect the market situation, especially before the meetings of the global central banks, which will take place this week. From the technical point of view, after a surge in volatility recorded on Friday, the situation did not change. It is obvious that the euro will not be able to climb above 1.0927 without additional support from big traders. However, they remain cautious ahead of central banks' meetings. On Friday, the US published its income and spending reports, which almost met the forecasts. This may allow the Fed to remain stuck to its monetary policy stance, thus supporting the greenback. Strong data from the eurozone may help the euro to return to 1.0889, a resistance level that the pair failed to exceed last week. I will bet on the pair's drop to 1.0853 and open long positions from this level after a false breakout. The target is located at 1.0889. Slightly below this level, there are sellers' MAs. A breakout of this level and a downward test will give an additional long signal with the target at 1.0927. A breakout of this level will affect bears' stop orders and give an additional buy signal with the target at 1.0970, where it is better to lock in profits. If the euro/dollar pair declines and buyers fail to protect 1.0853 in the first part of the day, the euro may show a deeper correction. The fact is that a return below this level will violate the formation of a new bullish trend. That is why traders will focus on 1.0820. Only a false breakout of this level will lead to a buy signal. It is also possible to go long just after a bounce off the low of 1.0784 or even lower – from 1.0735, expecting an upward correction of 30-35 pips within the day.

Conditions for opening short positions on EUR/USD:

The fact that bears managed to protect 1.0889 and tried to push the price to 1.0853 points to a high possibility of the pair's hovering within the sideways channel or a deep decline. Sellers should return control over the level of 1.0853, which was numerously tested. Only this will allow the pair to form a new sideways channel and settle inside it until the first meetings of central banks take place. However, the key aim is to protect the intermediate resistance level of 1.0889, which is the middle line of the channel. If the euro/dollar pair jumps during the European session, an unsuccessful settlement above this level will lead to a sell signal with the target at 1.0853. A breakout and a reverse test of 1.0853 will give an additional sell signal with the target at 1.0820. A settlement below this area will cause a deeper drop to 1.0784. The farthest target is located at 1.0735. A test of this level will point to a bearish market. It is better to lock in profits at this level. If the euro/dollar pair increases during the European session and bears fail to protect 1.0889, traders should not panic. It is better to avoid short orders until the price hits 1.0927, where it is possible to sell after an unsuccessful settlement. Traders may go short just after a rebound from the high of 1.0970, expecting a decrease of 30-35 pips.

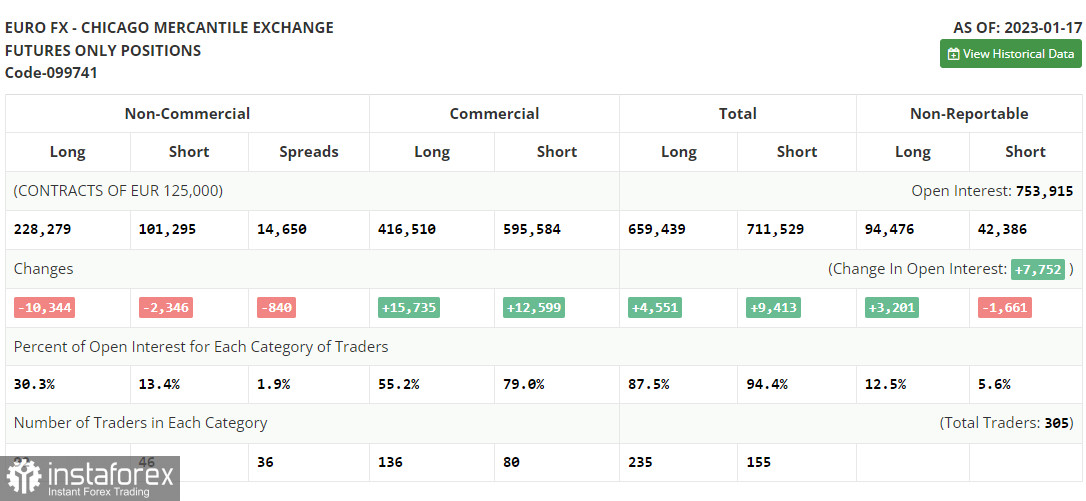

COT report

First of all, let us focus on the futures market and changes in the COT report. According to the COT report from January 17, the number of both long and short positions dropped. Traders took the wait-and-see approach after a rapid rise in the euro ahead of the Fed meeting that is scheduled for the next week. Quite weak fundamental data on the US economy, especially a decline in retail sales in December, pointed to the worsening of the overall situation in the country. It means that further monetary policy tightening may lead to even more negative results. On the other hand, inflation continues to slacken, thus allowing the Fed officials to revise the key interest rate hike. Meanwhile, the euro is supported by the ECB's officials who insist on a further key rate hike to combat inflation. Against the backdrop, the euro/dollar pair is reaching new local highs. The COT report unveiled that the number of long non-commercial positions declined by 10,344 to 228,279, while the number of short non-commercial positions slid by 2,346 to 101,295. At the end of the week, the total non-commercial net position decreased to 126,984 from 134,982. All this suggests that investors believe in further growth in the euro but they are still waiting for a clearer picture from central banks on future interest rates. The weekly closing price rose to 1.0833 against 1.0787.

Signals of indicators:

Moving Averages

Trading is performed below the 30- and 50-day moving averages, which points to bears' attempt to gain control over the market.

Note: The author considers the period and prices of moving averages on the one-hour chart which differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

If the pair increases, the resistance level will be formed by the upper limit of the indicator located at 1.0889. In case of a decline, the lower limit of the indicator located at 1.0850 will act as support.

Description of indicators

- Moving average (a moving average determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (a moving average determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total number of long positions opened by non-commercial traders.

- Short non-commercial positions are the total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română