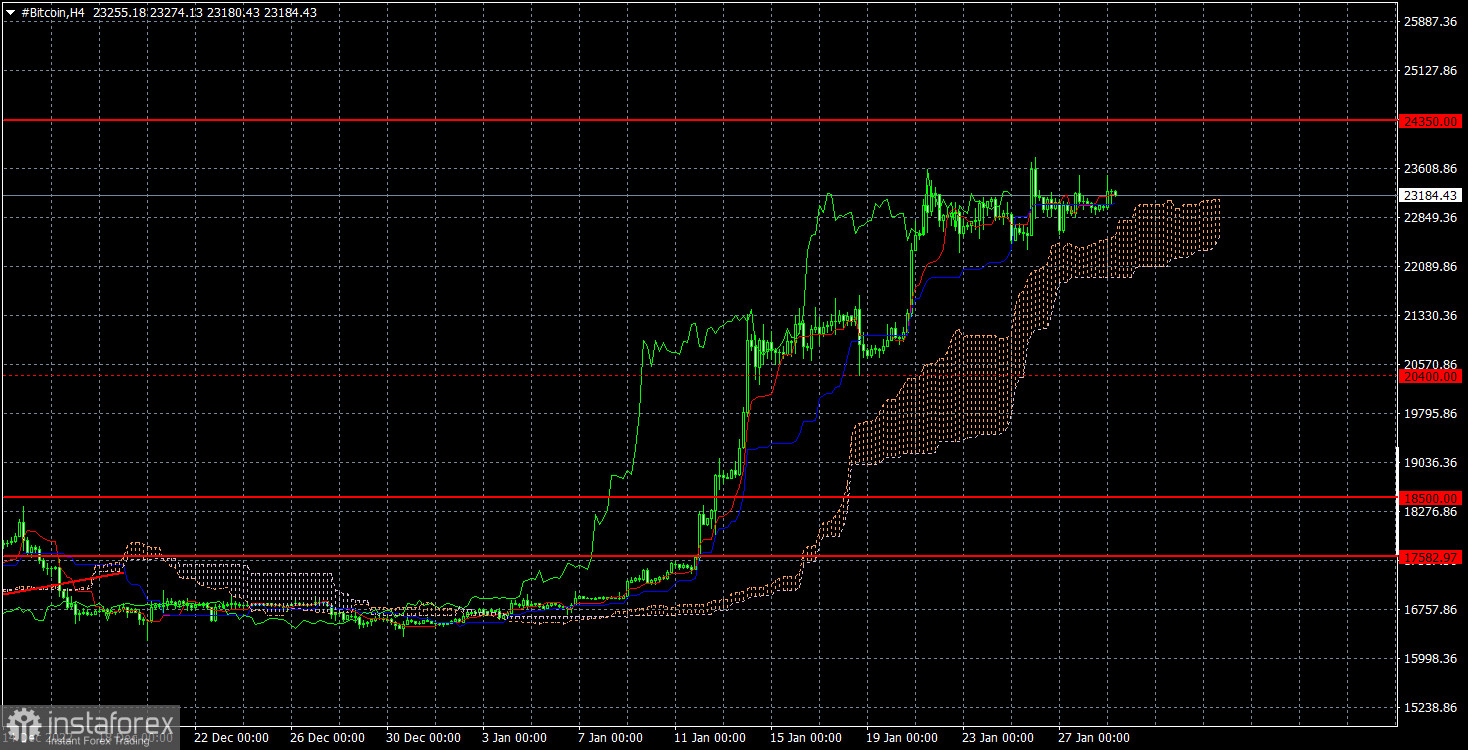

Bitcoin is confidently moving to a level of $24,350 on the 4-hour TF. Despite our skepticism over bitcoin's continued growth, it is important to note that recently things have changed for the better. However, there are persistent allegations that institutional traders are not in a rush to repurchase the "bitcoin" and that miners are eager to sell their coins because of a shortage of liquidity. The level of $24,350 can therefore be thought of as both a level and the upper border of a side channel, the lower boundary of which extends to approximately $15,500. This is only important to remember. There is no reason to assume the end of a "bearish" trend or a sideways movement because the price has been in this range for more than six months.

In the meantime, renowned investor and cryptocurrency skeptic Peter Schiff repeated his belief that bitcoin will not increase in value in 2023. According to the president of Euro Pacific Capital, even after falling to $15,500, bitcoin has not yet reached its "bottom." Even if bitcoin's price falls to $5,000, the market may not have reached its "bottom" at that point due to the way FTX's collapse may continue to harm quotes. According to Peter Schiff, the most recent expansion phase was a consolidation period before a new, significant crash. We do, however, think that a decline is conceivable, and thus we advise beginning the following week at the level of $24,350.

It's also important to keep in mind that the "moment of truth" for bitcoin could coincide with a Fed meeting or the release of Nonfarm. The most recent period of expansion started precisely when a significant report on American inflation was released in January. If the Fed keeps raising interest rates for another two or three sessions, it is unclear to us how bitcoin can continue to increase in value. The news that the likelihood of a pause in the rate increase has increased has caused Bitcoin to soar by $7,000 in value. It can't consistently display such developments on the news, which in theory shouldn't provide a lot of backing. In general, we should be ready for emotional outbursts just in case, but until the Fed slows down the pace of tightening below 0.25%, bitcoin won't rise and the dollar won't fall.

The first cryptocurrency's rise continues with a target price of $24,350 over a 4-hour period. From our perspective, a rebound from the level of $24,350 will serve as a signal to close any long positions and begin new short positions with targets of $18,500 and $17,582. Although there is a chance that Bitcoin may enter a new short-term "bullish" trend, the underlying background should ideally gradually improve. And just now, we are not noticing this.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română